Should You Get a 15 year Mortgage or Invest?

15 year mortgage or invest? What if you could get a 15 year mortgage but chose to invest instead? Let’s look at a 15-year mortgage vs. investing!

We can use professional financial planning software and see what the numbers over time. Let’s look and see how much you nest egg grows after a 15-year mortgage vs using extra cash to invest.

15-Year Mortgage vs Investing

Assume a 33-year-old couple has two children. They have a $400,000 home mortgage. Salary is $200,000 a year, and they spend $100,000 a year.

As for investing, they fund a backdoor Roth IRAs every year ($12,000). If they have additional cash flow, it flows into a brokerage account. They also save 6% in a 401k with 100% match. Wage and general inflation is 2% a year. Assume stocks pay 7% a year and bonds 3.5%. Asset allocation, since they are young, is 90/10 stocks/bonds.

15-year Mortgage Option

They can get a 15-year mortgage with a 3.5% interest rate and pay $2860 a month. This is tempting, as on paper they save $150,000 in interest payments over the 30 years. Cash will be tight with the 15-year mortgage, and they won’t be able to meet all their investment goals.

30-year Mortgage Option

Or, they can get a 30-year mortgage with a 4% interest rate and pay $1910 a month. This will fully fund the backdoor Roth every year, but with not a lot left over for the brokerage account.

Which would you choose? A 15-year mortgage or investing?

Pay-Off Schedule Comparison 15- vs 30-

Above, you can see debt pay-off schedule

On the left is a 15-year mortgage which pays off in 2034. Note the slope is mostly linear, reflecting a straight-line payoff of the debt.

On the right, in blue, is the 30-year mortgage which pays off in 2049. Take note of the shape of the slope, which results from the prolonged period of time in which the interest rate affects the payoff of debt. This reflects the fact that most of the initial mortgage payments go to interest rather than to debt!

Also, on the right in green, is a 30-year mortgage paid with the same payments for a 15-year. Given the slightly higher interest rate, it takes one more year to pay off (16 years).

Let’s see how your account balances grow over time between the two

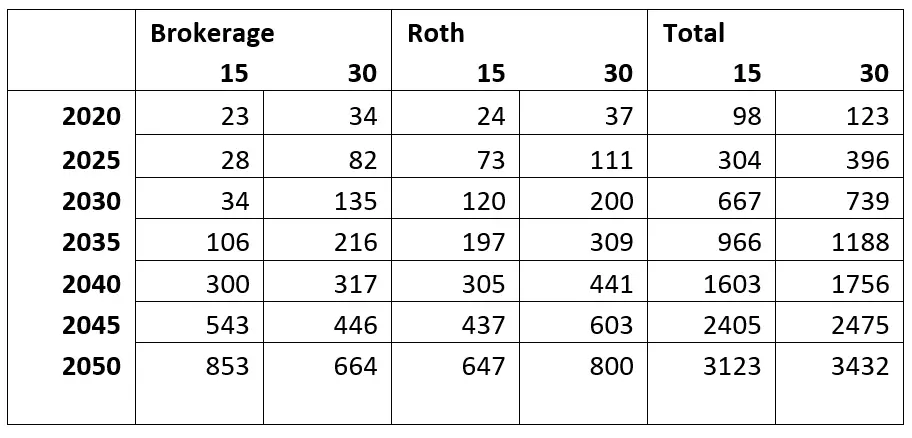

Net Worth 15-year Mortgage vs Investing

(in 1000 of dollars)

Above, you can see the actual account balances. If you don’t like number then note the following:

For the year 2030 (when the home is paid off in the 15-year mortgage), the value of each plan is:

- Brokerage 34k vs 135k (15 vs 30 year)

- Roth 120k vs 200k

- Total net worth 667k vs 739k

For the year 2050 (when the 30-year mortgage is paid off)

- Brokerage 853k vs 664k

- Roth 647k vs 800k

- Total net worth $3.1M vs 3.4M

Note that after 30 years, 30-year mortgage has a larger Roth account and 10% more investment assets.

But what about the debt?

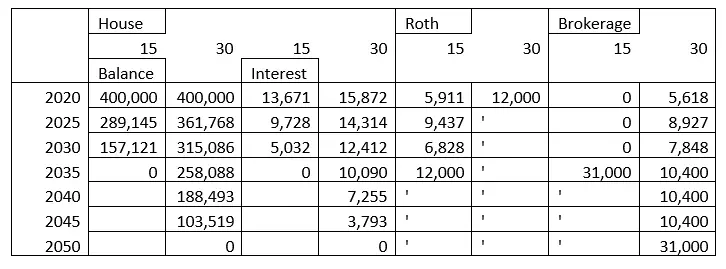

All the Important Numbers: 15-year mortgage vs investing

Let’s look at all the numbers!

Above, you can see the house on the left. The first two rows are the balance (amount owed) on the home mortgage. Note that when the home is paid off in 2035 for the 30-year mortgage, there is still over $258,000 owed on the 30-year mortgage!

In addition, the next two rows are the yearly interest payments between the 15-year vs 30-year mortgages. In 2020, you are paying more than $2000 a year in interest. For 2025, it is $4000 a year more. In 2030, it is $7000 more a year. Finally, in 2035, see there are no more interest payments for the 15-year and the 30-year continues to pay out interest.

Additions to the Roth account are next. It takes 15 years for the 15-year plan to max this out where as the 30-year maxes out from year one.

Finally, the brokerage account is at least partially funded in the 30-year mortgage over time. The 15-year mortgage cannot afford additions to the brokerage account until the mortgage is paid off, and then it maxes out at about $31,000 a year from then on.

Considerations for Investing vs 15 Year Mortgage

In this scenario, this couple invests in 90/10 stocks/bonds which pay out a continuous 7% and 3.5%. This is 6.65% a year continuous growth.

Of course, the world doesn’t work that way. Stocks to invariable go up over time, but certainly not every year nor even every decade!

In addition, most people only own their home for 6-10 years, let alone 15-30 years.

The bottom line, if you earn more on your investments than you do on your mortgage payments, you make more money.

So, What Should YOU DO? 15 Year Mortgage vs Investing

Roth money is precious. Try to at least have the cash flow every year to fully fund Roth or backdoor Roth accounts. At least get the match on any employee sponsored plan.

Beyond that, 15-year mortgage vs investing?

If everything goes right, If EVERYTHING goes right, you make more over time paying less monthly to the mortgage and investing the difference.

This interest rate spread, or arbitrage, is how banks make their money. Are you a bank? If so, go 30-years and invest the rest.

If you are more conservative but have the cash flow, go 15-years.

Remember, debt is like a negative bond. Debt INCREASES your risk, so it more often than not increases returns.

If you have enough income, the obvious answer is pay off debt AND invest, it doesn’t matter which you prioritize.

Whatever you decide to do, a 15-year mortgage vs investing, at least get your yearly Roth and your employer match!

Nice post! Appreciate the detailed analysis. This question always seems to generate endless controversy and opinions. As you point out, there are so many assumptions that must be made to predict the outcomes. The future is uncertain! For this reason, we have always chosen the 30 year mortgage for its flexibility. You can always pay more on it when you have the means, but if circumstances change or if a great investing opportunity arises, you don’t have to pay more and you can put the money elsewhere. Over the long term flexibility is key.

Thanks for what you do!

I appreciate the in-depth analysis. One other factor to consider is your employer’s matching contribution to a 401(k) or other employer retirement plan. That would tend to tilt the advantage to the 30 year option, I would think. You are leaving money on the table if you don’t or can’t take advantage of the matching dollars.

Good point! I have both scenarios getting a 6% match on a 6% contribution to a 401k but I think I neglected to say that in the post!

Great article, although now I’m wondering about this situation . . .

I retire from my military career with enough pension and investments for financial independence, BUT we have no home or equity due to lots of moves and rental homes. I also wouldn’t expect to be contributing new dollars to investments b/c I’d have no income, and would live off the pension (and investments if needed).

If I desire to buy a home after I retire, which plan is wisest — pay in full with no mortgage, or do a 15-yr, or do a 30-yr mortgage? The money would all be coming out of the same pot, i.e., my taxable brokerage account (b/c I’d only be 49yo).

This situation seems different from your article b/c there wouldn’t be any more Roth contributions in the math.

Thoughts? Thanks!

Interesting. I assume your pension would easily cover the mortgage payment, so you have a guaranteed source of income paying for it. You say your brokerage account is paying for it, but since money is fungible, it is all the same thing. Having a large expense like that in retirement might set you up for sequence risk, so be careful there. Otherwise if it is just a cost out of your pension, you might as well take the smallest payment possible and live it up… and then consider a reverse mortgage when you are 62.

I like your angles on this. I’m always looking for different viewpoints and everyone seems to view this scenario a little differently. I really like your emphasis on the Roth money. But what about tax efficiency? Do you think you could do a follow-up post on the tax-efficiency of each strategy? I’m not suggesting purely “letting the tax-tail wag the dog” but rather after various tax deductions of homeownership vs. taxes paid on Roth contributions, etc. I would love to see how that plays out! Thanks for the great article!

Since most people are taking the standard deduction, there really isn’t a tax deduction with home ownership any more… and Roth is after tax money, it is the most efficient way you can put away money for retirement after you have your match from your employer plan. But you are right, with the 30 year mortgage presumably you are having more tax drag from the larger brokerage account. So, my head is starting to hurt like it does when I think about after-tax returns over decades… theoretically it is the best thing to calculate but in reality it sucks to try and do so!