Mitigations for Retirement-Specific Risks

How do you mitigate retirement-specific risks?

That is, what are your options to plan for future retirement risks?

Some retirement-specific risks are more mitigatable than others.

Let’s learn a little about your options for mitigation and how you mitigate retirement-specific risks.

First, what is risk mitigation?

What is Risk Mitigation?

Risk mitigation involves planning and developing methods and options to reduce threats to meet a specified goal. In retirement planning, you mitigate the known retirement-specific risks. The procedures and options you have to reduce the threat are also risk-specific.

The goal is usually the same: to have a wonderful and well-funded retirement.

So, how can you meet that goal by mitigating retirement-specific risks? You must create a strategy to identify and evaluate risks and consequences inherent to meeting your goal.

So, let’s discuss a strategy to identify and evaluate risks!

A Strategy to Identify and Evaluate Retirement-Specific Risks

Let’s start with the five ways to deal with retirement-specific risk.

The 5 Ways to Deal with Retirement-Specific Risk

The 5 Ways to Deal with Retirement-Specific Risk

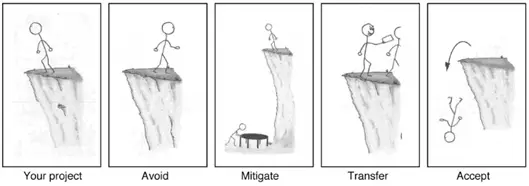

Above, you can see the five ways to deal with retirement-specific risks. These are your options. Since we are looking at our options to deal with these risks, we will assume we have chosen not to ignore them entirely.

Ignoring a risk is a perfectly valid option for retirement planning. It, in fact, may be the most common choice! Just don’t plan for Long-Term Care, longevity, or inflation. If they happen, well, I’ll worry about it then.

But if we have chosen not to ignore the retirement-specific risks, what are your five options for dealing with them?

The 5 Ways to Deal with Retirement-Specific Risk

Risk Avoidance

Usually, this is the most expensive option; avoid exposure at all costs. This can be a little like throwing the baby out with the bathwater, but it is on the spectrum from acceptance all the way to avoidance.

The avoidance strategy means you plan for risk and then actively take steps to avoid it.

By avoiding the risk, you are pretty certain of the results, but the timeline is still uncertain. And it is likely to be costly either financially or emotionally.

Risk Mitigation

This is the most common solution. You deal with part of the problem, part of the cost, or part of the risk. Then, you mitigate part of the risk so that you are not financially (or otherwise) devastated if the worst happens.

With the Risk Mitigation strategy, you break down the risk into parts. Cost and timing depend on the goal and the degree of mitigation.

Risk Transference

For retirement-specific risks, risk transference usually means risk pooling and insurance.

Fundamentally, you trade the risk off to a willing third party.

Transference of risk mitigates consequences through contractual guarantees.

With the risk transference strategy, results are contractually guaranteed for certain periods and usually for a defined cost.

Risk Acceptance

Ok, this is essentially ignoring the problem. Accepting the risk is a valid strategy if the avoidance of the risk might outweigh the cost of the risk itself.

Here, you assume the risk. The risk acceptance strategy means you identify and assume the risk’s vulnerabilities.

You are responsible for the cost, the time, and the results.

The 5th Way: Your Way

Finally, we deal with the first panel of the above cartoon. After all, you and YOUR PROJECT are why we are here. Your plan will differ from everyone else’s because it comes from your values, dreams, and goals.

How do you limit the damage of retirement-specific risks? What can you control? Is there a way to mitigate part of the damage?

Here, we come to the word “hedge.” As in hedging your bets rather than in some fancy investment that attempts specifically to address a financial downside based upon future predictions.

Most of us will plan to hedge our bets. This is your way, too.

Address some (ignore others), mitigate some, get insurance when needed, get contractual sources of income if you want it (and can afford it), and avoid what you want and accept what you must.

How you Mitigate/Limit/Control/Hedge your retirement-specific risks depends entirely on what you believe is important to your future goal of a happy retirement.

Risk Limitation to Address Parts of a Retirement-Specific Risk

Risk limitation is a common strategy, and I want to focus it on retirement-specific risks specifically.

This strategy addresses part of the risk rather than the whole risk. It can address certain aspects of the risk or perhaps set aside a certain dollar amount that might be considered a proportion of the total amount expected if the risk comes to fruition.

For example, maybe you are concerned about longevity and running out of money. You have a large IRA, so decide that a QLAC may just be what you need. A QLAC is a product that addresses part of the risk rather than the whole risk: if you live to 85 (or whenever you turn the income one), you have a nice (though taxable) source of income kick in late for the rest of your life. This might be right if your expenses increase later in life, but it doesn’t address the many risks raised by longevity and outliving your income specter.

After you list your retirement-specific risks of concern, you can use risk limitation to address any or all of your risks. The idea is to control your risk as best you can via mitigation.

Controlling Retirement-Specific Risks Via Mitigation

So, after we understand our goals and what retirement-specific risks we wish to mitigate, we can move to control those risks.

You use a control strategy when mitigating risks to your specific goals. Take actions to eliminate the impact of the risks by, for instance:

- Controlling risks to cost

- Controlling risk to timeline

- Controlling risk to results

After considering how to control the risk, you must consider how to monitor it over time. You need to monitor the risk, cost, timeline, and results for each control strategy you develop (for each retirement-specific risk).

How to Mitigate a Specific Retirement Risk

So, here is the checklist to mitigate retirement-specific risks.

First,

- List retirement-specific risks

- -ranked by risk based on likelihood (probability of the risk)

- -ranked by cost (chance of ruin)

Then, use a formula to combine risk and cost to develop a force-ranked list of the most likely and most costly retirement-specific risks.

-a combined rating for each risk based on probability and cost

For each risk:

- -an assessment of the current plan

- -a new plan of action

Next, prioritize the risks depending on:

- -High cost and highly likely to occur

- -High cost and less likely to occur

- -Low cost and highly likely to occur

- -Low cost and less likely to occur

Next, determine your options for mitigation. Again, these are:

- Avoid (stop risky activities or turn them over to a third party)

- Reduce (the likelihood of a negative event occurring)

- Accept (live with the risk, understanding the cost and probability of occurrence)

The final steps include creating the plan, testing it, and stress-testing it. At least imagine the worst that could happen or the best that could happen, and then what is halfway between the two.

Residual Risk and Retirement-Specific Risk Factors

Remember to consider residual risk.

You do not need to mitigate each risk fully. But if you do partition off a risk (either in part or in cost), then you can treat each risk as mitigated—part by risk reduction and part by acceptance. Maybe accept the things you cannot change and have the courage to change what you can.

The residual risk may be additionally dealt with in any of the five ways above.

Summary—Mitigation of Retirement-Specific Risks

A single risk will often not sink your plan. Instead, you need to be wary of multiple risks.

Once you understand some of the risks to watch out for, you can make a plan.

Remember, you have to start at the beginning: determine your goals!

Next, decide how likely and costly it will be to mitigate retirement-specific risks. And then learn, read, and ask questions.

What will you do?

It is always a good time to retire if you have a plan!