Social Security Bridge Strategy

This comprehensive guide helps you Bridge the Gap to optimize social security: a Social Security Bridge Strategy.

Optimizing Social Security is an important component of retirement financial security. Frequently, it pays to wait to claim your social security. If you have retired (and no longer have income), you need a bridge strategy to delay social security.

Let’s look at different ways you can afford to delay social security.

But first, is it worth it to delay social security?

Is it Worth it to Delay Social Security?

Delaying social security increases your income for life. Not only are the checks larger, but so are the cost of living adjustments.

Full retirement age is 67 for those born after 1960.

*If you claim at 62, you lose 30% of your Primary Insurance Amount (PIA—the amount you get from social security at full retirement age).

*If you claim at age 70, you get 24% more than your PIA!

So, you can get anywhere between 70% and 124% of your PIA, depending on when you claim.

Assume your PIA is $1000: you can get $700 a month or $1,240 a month, depending on when you claim. That is a 77% increase by delaying! And, cost of living adjustments are proportionally larger as well.

It can really make sense to delay, thereby increasing your total net worth! Let’s look at an example of that now.

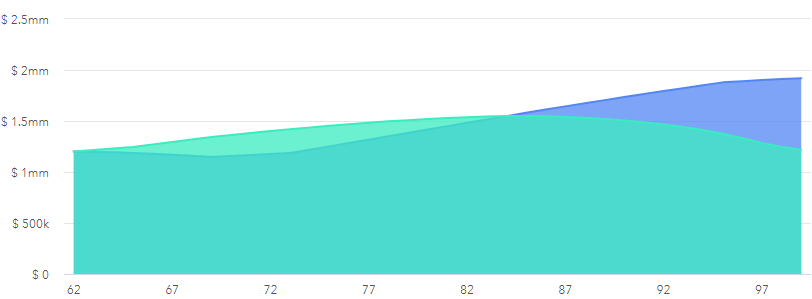

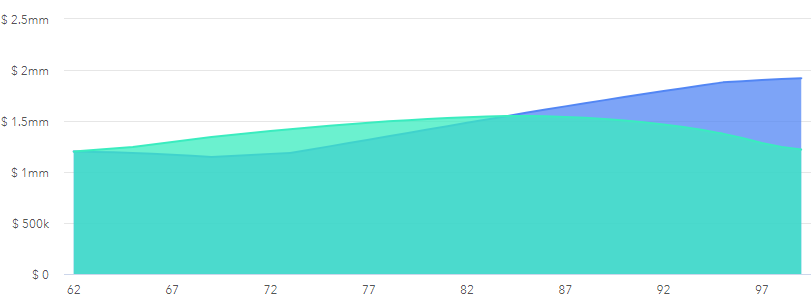

Example of Total Net Worth with and without Bridge Strategy

Above, there are two strategies for social security clamming. In light green, you start claiming at age 62. There’s a slow asset increase until about two decades later when inflation catches up with income.

Conversely, in dark green, delaying claiming until 70 causes an initial decrease in net worth. You can see, with time, that net worth increases given the larger social security income.

Note that the cross-over point (when you have more net worth due to delayed claiming) is about age 86. This is a full 24 years after the earliest you can claim (age 62), and 16 years after the latest you can claim (age 70).

So, obviously, it is not right for everyone to delay claiming social security. So, who should?

Who Should Delay Social Security?

If you might live beyond 85, consider delaying social security! There is no better longevity insurance than a delay in social security. Other annuities don’t come close to the power of delayed social security.

It is especially important for the high-income earner of a couple to delay as long as possible. This is due to the Widow’s Tax Penalty, where the lesser of the two social security checks stops at the first spouse’s death.

Also, getting at least to your second bend point in social security is very important!

Finally, if you want a Tax Planning Window and have unfettered access to your 10 and 12% tax brackets to do partial Roth conversions (or capital gain harvesting), delay claiming as long as possible.

Social Security Bridge Strategy: “Bridge Assets”

How do you bridge the time after income stops and before social security begins most effectively?

Let’s look at some “Bridge Assets:” resources used to pay the bills while you delay claiming social security.

What are Bridge Assets?

Bridge Assets are resources, investments, and strategies that allow you to live an active retirement until claiming social security at 70.

- Flexible Cashflow—Expenses drive income needs in retirement. You can control expenses or earn money; neither is much fun in retirement!

- Expense Modification: One can spend conservatively

- Income Generation: Using human capital (a part-time job or side gig)

- Additional Income: Income from rentals, patents, or other passive income streams

- Investment Strategies—this is the mainstay of Bridge Assets.

- Ladders: “Ladders” of CDs, Bonds, or MYGAs. Depending on interest rates, consider laddering a combination of 2 or 3 of these assets.

- Goal Segmentation Strategies: Guaranteed fixed income “floor” provided through pensions, annuities, or TIPS ladder

- Annuity Strategies: Income from immediate annuities, longevity insurance from deferred annuities, or period certain annuities during the delay years

- Income Portfolio: Preferred stock, dividend stocks, utility stocks, REITs, convertible bonds, and MLPs are not infrequently used by investors for “bond-like” exposure and income.

- Retirement Accounts: Traditional or Roth IRAs are tapped for income

- Income Replacement Funds: Also known as Managed Payout Funds

- Uncorrelated Assets

- Cash Reserve Strategies: Having a large cash reserve will bog down overall portfolio returns

- Classic Buffer Assets: Cash value life insurance and HECM (reverse mortgages) have low correlation to market returns and tax-free “income”.

- Other Assets: Businesses, hobby collections, rental properties, or other assets can be sold for income

Now that we have those ideas to test let’s meet our fictional couple.

Case Presentation- Social Security Bridge Strategy

Consider a couple 62 and 58 years of age. They have a net worth of $1.2M and want to see what social security will add to their retirement. They both hope to live to 95.

Currently, $100,000 is in cash, $200,000 in a Roth, $300,000 in a brokerage account, and $600,000 in a traditional IRA. They have a 60/40 portfolio; stocks return 7%, and bonds 3.5%.

They will spend $ 5,000 monthly in retirement (about 4% withdrawal rate). Inflation is 2%, and healthcare starts at $ 5,000 annually with 5% inflation.

Their PIA is $2000 and $1000 a month (so if they both claim at their full retirement age, they will get $3000 a month in social security). The older partner was born in 1957, so his full retirement age is 66 years and 6M. The younger partner is born after 1960, so her full retirement age is 67.

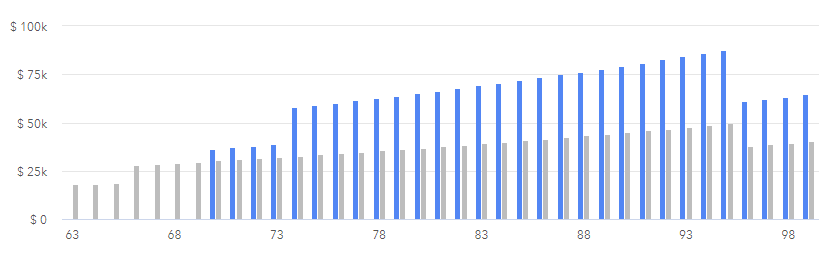

Effect of Social Security Bridge

If they both claim as early as possible (age 62), they will start with $18,000 a year, which increases to $28,000 a year when the younger partner turns 62. This increases by 2% a year in this model.

On the other hand, if they wait until 70 to claim, they will make $36,000 a year after eight additional years, which increases to $58,000 a year four years later.

See these numbers above. In grey, they each claim at 62. In blue, 70. You can see how much more you get yearly by delaying in Blue!

Above, you can see the different claiming strategies. Gray is early, and blue is delayed.

The cross-over point where they make more by delaying is at age 79 (15 years after retirement). If the younger partner lives until 90, they will earn $632,000 more over their lives with the delayed claiming strategy.

On Monte Carlo, early claiming has a 61% chance of success, and delayed claiming 82%.

Let’s look at the portfolio total overtime next.

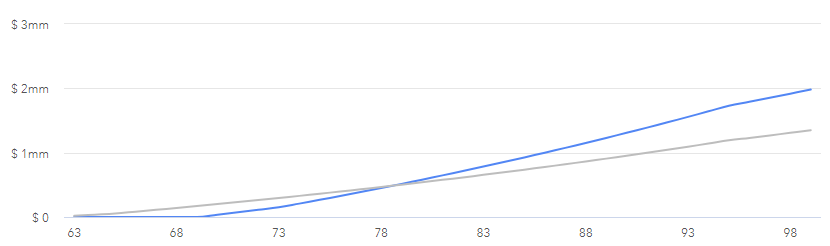

Comparison of Portfolio Total with Social Security Bridge Strategy

Above, light green demonstrates early claiming. The total amount increases for about 20 years and then gradually decreases. In blue, they bridge to social security at 70. Initially, there is a drawdown in the portfolio total. When the portfolio total slowly increases when they start claiming social security at age 70, the cross-over point, where the delayed portfolio has more than the early, is at age 85, 13 years after retirement.

Good and dandy. So, with $60,000 in expenses, they can do pretty well to delay claiming social security until age 70.

Social Security Bridge Strategy: Optimize Social Security

In general, social security is the best longevity insurance out there.

If the higher earner defers taking social security, you get cost of living adjustments on the guaranteed delayed retirement credits. As you may know, the surviving spouse keeps the higher of the two social security payments. So, in a couple, the odds of one spouse surviving into their 90s are pretty good. Especially if you are rich and intelligent, you would not be reading this if you weren’t!

What is your bridge strategy to optimize social security?