Optimize Inheritance to Kids

Inheritance. A goal for some is to leave behind money for their kids. What is the most tax-efficient way to leave money to your kids?

If your goal is your kid’s inheritance, consider which accounts you should leave behind, gifting during life, and the tax implications of leaving money to your kids.

Which Accounts Should You Leave to Your Children?

There are three different types of assets from a tax perspective.

These asset buckets are: Never Taxable, Sometimes Taxable, and Always Taxable. Some are more tax-efficient to leave to your kids than others.

Never Taxable

An example of a “Never Taxable” account is a Roth IRA.

Roth IRAs are the best accounts to leave your children as they will never pay taxes since you already did! In addition, these accounts continue to grow tax-free after inheritance.

Since the SECURE Act, these Roth IRAs must be closed before the end of year 10. Therefore, the optimal way to receive this inheritance is to leave it in the Roth for ten years and then pull it out at the end.

Sometimes Taxable

“Sometimes Taxable” accounts are brokerage and savings accounts.

When invested, these accounts get a “step-up” in basis when you die. So, for example, say you bought an ETF at $10, and when you die, it is worth $200.

If you sold the fund before death, you pay capital gains tax on the $190 of profit. However, when gifted during life, the basis transfers with the gift resulting in capital gains taxes.

But your heirs get a full step-up of $200 at your death. Then, they can sell at $200 without paying capital gains.

If you have appreciated assets in brokerage accounts, leave them until your death rather than giving them away. Then, your kids get a full step-up in basis! No Required Minimum Distributions exist on brokerage accounts, but any future growth is taxable.

Always Taxable

Always Taxable accounts require the most attention.

These “qualified accounts” are pre-tax retirement accounts. Therefore, whenever distributions are taken from these accounts–by you or your heirs–taxes are due.

I’ve included a few advanced strategies to deal with these accounts at the end of this blog.

Gifting During Life

It is best to give with warm hands.

Under current law, each spouse can give a maximum of $17,000 a year to a person without filing a gift tax return. If you give more than that, you won’t pay gift taxes until you reach the $11+ million estate tax exclusion limit ($22+ million for a couple), but you must file the return with your taxes. If you gift split—a married couple can give up to $34,000 a year to any individual—a gift tax return must also be filled out. If you are concerned about the decrease in the estate tax exclusion limit in 2026, understand SLATs and how they are used to get the full limit now.

You can give an unlimited amount to a university or hospital to pay for anyone’s educational or medical expenses. Just make the check directly out to the institution.

Also, think about a super-annual gift into a 529 for grandchildren. If married, put five years’ worth of gift tax exclusions into a 529. This is $34,000 x 5 = $170,000 per grandchild. Remember, if grandparents own the 529, don’t use the account until the second semester of sophomore year. This keeps it from counting as income for the student for financial aid purposes.

Considerations for your Always Taxable Accounts

If you are a 401k Millionaire, then you have a problem. The IRS will crack open these accounts and tax their deferred income. See my previous blog on The Tax Planning Window as a reference, but partial Roth Conversions are an excellent strategy for gifting to your children.

What if you have a starving artist child in the zero-tax bracket? Or is your child a high-income doctor practicing in a high-income tax state? Depending on your heir, there are different considerations for partial Roth conversions during your lifetime. The goal is to pay the least in taxes over your and your heir’s lifetime.

Child in the Zero Tax Bracket

If your child has low income, why pay a lot of taxes now to convert to a Roth? Then, when they inherit your IRA, hopefully, they will “stretch” it over ten years to pay the least amount in tax possible.

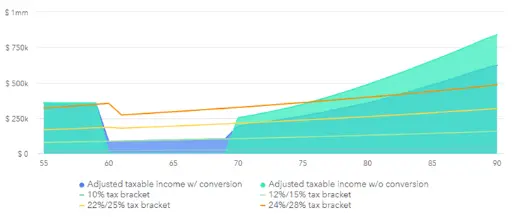

Above is an example of a partial Roth conversion strategy for a couple with a kid in a low tax bracket. In green, they retire at age 60, and income drops from the 24% tax bracket to zero.

Note that the tax brackets have two values. The Tax Cut and Jobs Act (TCJA) expires in 2025. Tax rates will go back up from 12% to 15%, from 22% to 25%, and from 24% to 28%. Most people think the TCJA will not be renewed, and taxes are “on sale” currently.

Two overlapping scenarios are demonstrated above; first, without partial Roth conversions, seen in green, RMDs start once they turn 70. These RMDs kick them up into the 22%/25% tax bracket, and once they are 75 years of age, they pay at the 24%/28% tax bracket.

Let’s optimize this scenario for a zero-percent tax bracket kid. You heir has access to the standard deduction and the 10% and 12% tax bracket to absorb income from the inherited IRA.

It is not cost-effective to convert too much into a Roth IRA and pay significant taxes now when your heir pays less in taxes later.

You can see that they do partial Roth conversions up into the 12%/15% tax bracket in blue. This optimizes their taxes from RMDs but doesn’t convert too much as the heir can inherit what is left and pay taxes at a lower rate.

Remember, your goal is to pay Uncle Sam as little as possible over your and your heir’s lifetime.

If you have two heirs in very different tax brackets, consider leaving them accounts accordingly. Your high-income heir can get the Roth and brokerage accounts. Your low-income heir can get qualified accounts (pre-tax IRAs).

Child in a High Tax Bracket

On the other hand, if your heir makes a lot of income, perhaps you are better off paying taxes now. On the other hand, as a retiree, you may have little income and thus access to your lower tax brackets.

Conversely, In the future, when your heir is forced to take RMDs from the inherited IRAs, they will pay tax at their marginal (highest) tax rate. Again, the goal: pay the least taxes over the combined lives of you and your heir.

Let’s think about a very successful child who will inherit an IRA. Assume they are paying taxes at a combined rate of 48%. If you want to leave them your IRA, YOU might plan on paying taxes at your lower rate with partial Roth conversions.

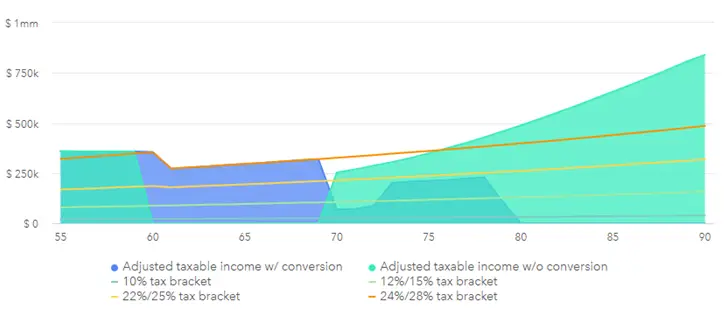

Again, this couple retires at 60. In green are future expected RMDs without doing partial Roth conversions.

In blue, they utilize the 24%/28% tax bracket to do partial Roth conversions before RMDs at age 70. In addition, despite the increased taxes on their social security (and other taxes like IRMAA), they continue to do partial Roth conversions into the 22%/25% tax bracket until the entire IRA is converted into a Roth IRA.

If their heir inherits a taxable IRA while in the 48% tax bracket, they pay taxes at the marginal rate of 48%. Meanwhile, this couple only pays taxes at less than 24%/28% during retirement.

What If Both You and Your Heir are in High Tax Brackets?

This gets complicated quickly.