Mitigation of Retirement-Specific Risks

For those approaching or already in retirement, “risk” is complicated.

Risk usually means market risk or volatility, the fact that the stock market goes up and down. This is especially true for the most vocal majority of folks in accumulation. Risk as market volatility is sold as a headline Dow Jones Average on the nightly news. Occasionally, ill-advised souls cash out their 401k at the market bottom and never return to stocks again.

But Retirement-Specific Risks are different. Once withdrawing from the portfolio rather than adding, the very nature of the risk changes.

In retirement, risk is sequence of returns risk, long-term care risk, and inflation. Believe it or not, longevity is a great multiplier of all other retirement risks. There is the risk that you won’t spend your money after decades of building. Inflation. Taxation. Divorce. Disability. Dementia.

Some Retirement-Specific Risks are mitigatable, and some are not. Mitigation means you have options or plans to enhance future opportunities and reduce future threats to meet your retirement goals.

Let’s look at the difference between mitigatable and non-mitigatable risks. What are some obvious examples of Mitigatable Retirement-Specific Risks?

Mitigatable Retirement-Specific Risks

To the degree that you can predict the likelihood of a risk occurring, you can attempt to mitigate it.

Some risks are easily mitigated, and some aren’t. And superficial treatment may lead to conflicting thoughts. For example:

Long-Term Care Insurance

Long-Term Care Insurance seems easily mitigatable with insurance specifically for this condition. However, obtaining traditional Long-Term Care Insurance is increasingly difficult, and the hybrid policies might not cover long stays. Or, say you set aside $1M in your IRA that will go to the kids if you don’t spend it in a nursing home… That seems pretty mitigated to me!

My thoughts on long-term care insurance are pretty clearly stated. Though currently, they are in a bit of evolution. Regardless, Long-Term Care planning is an essential part of retirement planning. Your options depend on the fundedness of your retirement.

Inflation

Inflation is surprisingly mitigatable. All you need to do is asset-liability match your future expenses with individual TIPS. Done. Complicated, but done.

There are other ways to floor your fixed expenses that might take inflation into account. But what, do you need Bitcoin and gold in the impossible scenario of true cataclysmic hyperinflation in the US? Or real estate? A private island? I can imagine scenarios where inflation is unmitigable for most.

A superficial glance at any retirement-specific risk may lead to conflicting advice on what to do. It depends on your goals, how likely and impactful you think the risk is, and, most importantly, how well-funded your retirement is.

Consider your resources and priorities to determine if a risk is mitigatable.

No, you cannot mitigate against every scenario, but you can have a plan against the more common retirement-specific risks you might encounter.

You must consider every risk and decide whether to mitigate it.

And that depends on how mitigatable that retirement-specific risk is.

How Mitigatable is that Retirement-Specific Risk?

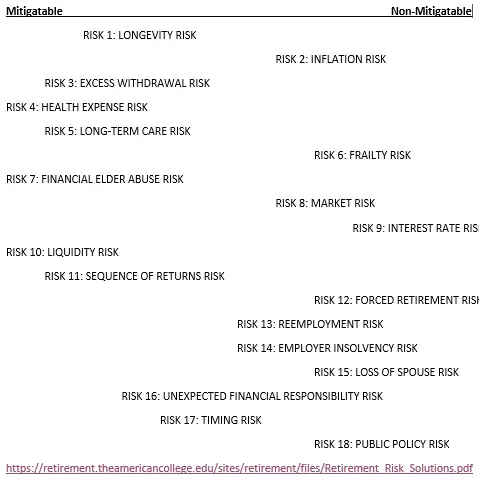

Let’s look at 18 different retirement-specific risks and see how mitigatable they are.

Above is my attempt to rate retirement-specific risks along a “mitigatable vs. non-mitigatable” spectrum.

There are the relatively more mitigatable risks on the left, and as you go further to the right of the graph, the less mitigatable.

So, the most mitigatable:

- Health Expense Risk is mitigated by universal insurance for those over 65. But of course, up to 20% of the bill might slip through the cracks, but there is insurance for that, too.

- Financial Elder Abuse Risk is mitigatable by having multiple concerned people involved in care.

- Liquidity Risk is easily mitigated. Even if your only asset is your home, there are reverse mortgages. Not having liquidity is a basic failure to plan.

Conversely, for the least mitigatable, I have:

- Interest Rate Risk

- Forced Retirement Risk

- Loss of Spouse Risk

- Public Policy Risk

You cannot control public policy, and only very infrequently do you control when you lose a spouse. Though these are not mitigatable events, you can have a plan when it happens. Consider if you have a disabling accident or the like for forced retirement risk. Ok, to plan for; hard to mitigate.

Finally, I discussed interest rate risk above. Along with prolonged deflation, devastation, and government confiscation are Bill Bernstein’s “Deep Risks” that cannot be mitigated. Of course, Bill refers to out-of-control hyperinflation rather than expected inflation.

Inflation is expected, and you must grow your assets faster than inflation. That, or risk losing the game of compounding interest.

Considerations for Mitigation of Retirement-Specific Risks

There are 11 additional risks identified in the graph above that are more or less mitigatable, depending on your circumstances.

As is said in the courtroom: “facts and circumstances.”

As for considerations when mitigating retirement-specific risks, the facts are how you view the risk, and the circumstances are your fundedness.

Let’s look again at Long-Term Care Insurance. Some folks have seen their parents in nursing homes and, as a result, purchase LTCI regardless of the cost. Some folks have seen their parents in nursing homes and say they will never go in one of those and never think about the subject again.

Your thinking a certain way dictates how risky you think needing long-term care is. To you, it either is or isn’t, or it is somewhere in between, and only you can know that. There is a spectrum from “this must be addressed” to “I will never think about that topic again.”

And circumstances: If you have a $3M IRA you will leave to charity as your backup fund in case you need extra care at the end of your life. Or, on the other side of the spectrum, if you have undersaved for retirement, plan to spend down to have Medicaid cover your or your spouse’s long-term care expenses.

As a result of facts and circumstances, each of us places the retirement-specific risks at different spots along the mitigatable vs. non-mitigatable spectrum.

Conclusion- Retirement-Specific Risks and Considerations for Mitigation

Some retirement-specific risks are easily mitigatable, and others are less so.

I suggest a retirement checklist where you address each risk separately.

Consider mitigations of each risk. How do you mitigate each retirement-specific risk?

Is there a way to enhance future opportunities or reduce threats? A chance to make it better now or in the future, or reduce how harmful it will be now or in the future?

Lest we let this get away from us, of course, before you use any insurance product, make sure you understand them and the indication for use. Easier said than done.

There are plenty of options for mitigation of retirement-specific risks. Start learning about them before retirement.