Tax Planning Window to Save in Lifetime Taxes

What is the optimal time to do tax management for retirement? The tax planning window!

Not infrequently, that tax strategy is a yearly series of partial Roth conversions. These pre-pay future taxes, which lock in a tax rate and are insurance against future tax increases.

This is your best chance to save in lifetime taxes during retirement.

The Tax Planning Window

The Tax Planning Window opens after you stop earning income and before you are required to start social security or required minimum distributions (RMDs). This is the optimal time for tax planning for retirement.

For the tax-savvy individual, The Tax Planning Window is a glorious time! There is no other window in time where you have such control over how and when you recognize income. During your tax planning window, you decide exactly how much you will pay in taxes!

Do not ignore your tax planning window for retirement: the goal is to pay the least in taxes over your lifetime. A dollar less you spend in taxes is a dollar more you can enjoy in retirement or leave as a legacy.

A Window is a good analogy because it opens and closes.

Open Window For Retirement Tax Planning

The window opens when you can access your 10 and 12% tax brackets (or sometimes 22 or 24%). This is usually due to retirement, but you can earn less later in your career and take advantage of this retirement tax strategy.

Even better, below the standard deduction, you can access income-tax-free!

Use this Tax Planning Window wisely because it closes when you are forced to take income again.

Close Window for the Best Retirement Tax Strategy

There are several ways your tax planning window closes.

First, when you take social security. Depending on your “provisional income,” you will pay taxes on up to 50 or even 85% of social security. Of course, half the money you get from social security counts for provisional income, so most high earners should assume they must include 85% of their social security as fully taxable. Regardless, at least the high earner in a couple should plan on delaying social security for the longevity benefit, especially if you want a more significant tax planning window.

Second, you must take the required minimum distributions (RMDs) from your pre-tax accounts. The RMD age went from 70 to 75 (for many) but is 73 for some.

Finally, other sources of income can be recognized as ordinary. For example, pensions and annuities are familiar sources of partially (say, annuities from your brokerage account) and fully taxable income (pensions and annuities from tax-deferred accounts). Remember, there are good annuities that are very worthwhile to consider.

But wait, there’s more! Of course, more sources of income can fill up your brackets!

Alimony (before 2018-after that it stops being a tax deduction), business income (Schedule C), Schedule E income, Schedule F income, Form 4797… even Capital Gains!

Capital Gains Stack on Top of Ordinary Income but can negatively affect your Tax Planning Window.

I know this is a lot to take in, but the Tax Planning Window is very important! Let me tell you why.

The Tax Planning Window: the Best Tax Strategies for Retirement

Why?

Control. Yes, you can control how much you pay in taxes.

For a traditional retiree who retires at 65, you have less than five years to access your low tax brackets.

For Financial Independence, the glory of being FI is prolonged access to your Tax Planning Window. But, of course, this leads to a whole host of other issues (like what income is most tax-advantaged to live on) that are the bread and butter of FIRE.

Beyond control– flexibility. You get to decide when to do partial Roth conversions.

Partial Roth Conversions: Best Tax Strategies for Retirement

The next best tax strategy for retirement: partial Roth Conversions.

Some people get confused and think there is an income limitation on Roth conversions. There is not. There are limitations on contributions, but not conversions.

If you have money in your pre-tax account, you can (usually) press a button and convert that money to Roth money, paying taxes now in the year of conversion.

These partial Roth conversions are amazingly powerful! They are among the best tax strategies for retirement.

Having some money in Roth accounts is essential for good tax diversification. It gives you control of future income. Remember the question: to Roth or not to Roth depends on tax rate arbitrage.

Some folks only use their brokerage account during this time, allowing their tax-deferred accounts to grow. This is usually a bad idea, as you will increase the taxes you pay later via RMDs. But, again, the goal is to pay the least taxes over your lifetime. Use the standard deduction and the 10 and 12% tax brackets to pay some tax now to pay fewer taxes in the future.

During the tax planning window, partial Roth conversions can shift this money into tax-free Roth accounts.

An Example of Partial Roth Conversions

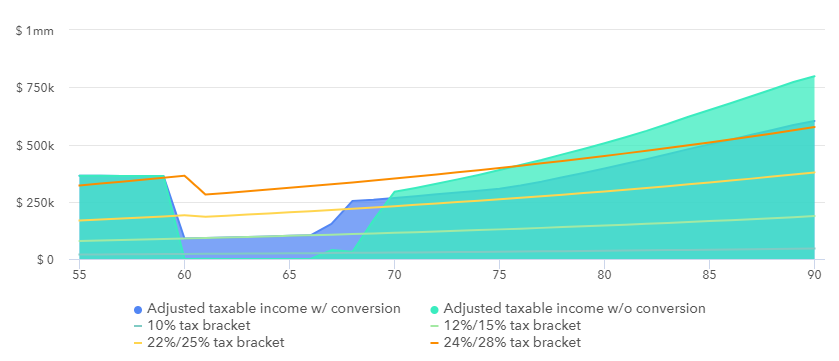

(An example of partial Roth conversions best tax strategies for retirement)

Note that a dark blue shape is now filling the 10 and 12% tax brackets during the tax planning window. These are the partial Roth conversions!

Also, note that this decreases RMDs and keeps them out of the 24% tax bracket in the future (which is the 28% bracket once TCJA expires after 2025).

You might think this isn’t a big deal, going down two percent from 24 to 22. But you would be wrong! And don’t forget, 22 becomes 25, and 24 becomes 28 when Tax Cut and Jobs Act expires in 2026.

Remember, you are paying taxes at very low effective rates during your tax planning window. When you are forced to take RMDs, all of the money comes out “on top” of everything else, at your highest marginal tax bracket. Keep your effective tax rate low over your life by decreasing the income included at your highest marginal tax brackets.

Other Retirement Tax Strategies During the Tax Planning Window

What do the best retirement tax strategies offer you? Tax Control and Flexibility!

Reduce future RMDs. Accumulate Roth money (so you can pull the money out without any implications for your taxes). Efficient tax planning for your Heirs.

What about health care? Controlling your income can get your premium ACA tax credits for Obama Care plans. And when you get to Medicare age, IRMAA is a huge deal. Medicare plans B and D are subject to hefty surcharges if you make too much money. Don’t forget about form 8606 if you have non-deductible IRA basis.

In the end, it is all about control. Who knows what the future will hold, especially regarding tax rates set by Congress? Do you think taxes will be higher or lower in the future?

Tax Planning for Retirement is your best chance to keep the money you earned rather than paying through the nose in taxes.

Remember that the ordinary taxes are not affected by dividends and long term capital gains. K1, W2 and 1099 (and some other types of income) will fill up the lower brackets.

Some people, if they have enough pre-tax money, will easily be pushed into 32%/35/37+% tax brackets by RMDs and doing Roth conversions in the 32/35% tax brackets can make sense. It just depends on the amount of pre-tax money you have and your sources of on-going income in retirement. You need to project what your RMDs are into your 80’s. Don’t just do a tax projection at age 72, do one for the next 20-30 years!

You would need to plan a large cash/ cash equivalent in order to live on during the multiple years of Roth conversion.

Correct! Cash, or stocks in a brokerage account, or some other source of after-tax money (rents from RE, HECM, cash-value life insurance…). It is expensive to keep your ordinary income tax low and then pay all those taxes, but it can save a ton in taxes over your (and your heir’s) lifetime.