What is worth wanting in life and the Iron Triangle of Trade-offs

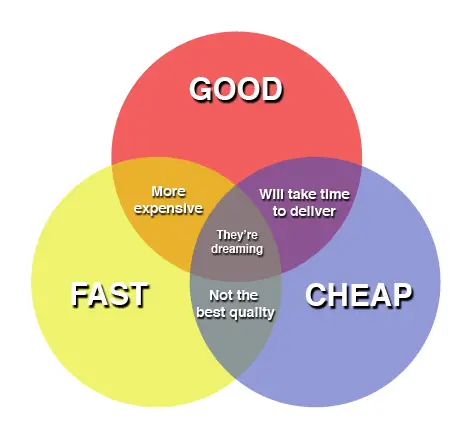

When we ask what is worth wanting in life, it might be a combination of happy and healthy. The villain in happily ever after are the tradeoffs you face when you go for both. Actually, doing well, doing good, and feeling good is where the tradeoffs exist, for they are a bit of an iron triangle.

What is worth wanting in life means you can have two but not all three (that’s an iron triangle!). That is a trade-off and a significant cost because you always are rationing decisions.

And it also needs to be long! What is better than being happy is being happy for a long time. Same with healthy. You need all sides of the triangle.

“Long, happy, healthy: it’s the slogan for a peculiarly modern vision of a life worth living.”

Long Happy Healthy – The Iron Triangle

Long, happy, and healthy is also an iron triangle. You must decide which two you want. This is not what you hear from glossy magazines and the wellness industry with the airbrushing and magic bullets.

But that is impulse living, and we know the good life requires discipline. You don’t get all three.

In investing, this is called the illiquidity risk premium. I want to detour the illiquidity risk premium to demonstrate an iron triangle for you.

Illiquidity Risk Premium

The Illiquidity Risk Premium is paid to those who allow others long-term access to capital. While the goal is to earn higher returns with this money than your liquid reserves, you might not have access to these funds for years.

Wait, why do I want my money tied up for years?

Illiquidity earns a risk premium.

But when investing, you can’t have it all. It is a trade-off between illiquidity, returns, and safety.

Illiquidity Risk Premium as an Iron Triangle

Illiquidity risk premium implies a risk/reward trade-off. More specifically, you have to choose two out of the three when investing: liquid/profitable/safe.

Let’s look at the combinations.

- Safe and Liquid (with poor Returns)

- Safe and Profitable (and Illiquid)

- Liquid and Profitable (and Risky!)

LIQUID, PROFITABLE, SAFE

Above, you can see the implications when you have to choose two.

- Fast: Liquid

- Cheap: Returns (Profitable)

- Good: Safe

Let’s talk about examples of each.

Safe & Liquid

Safe and liquid is pretty easy; you see above it is more expensive (it has poor returns). Examples include your bank account, savings account, high-yield savings account, and the like. Here, you can have access to your money at any time, and it is frequently insured by the government (safe). It will not lose principle. The downside of good and fast: it is expensive! That is, you get poor future expected returns because of the liquidity and safety.

This is a prime example of the liquidity premium. You “pay” in order to hold cash.

Safe & Profitable

What is Safe and Profitable? Well, above in our figure, it “will take time to deliver.” This means, in investing terms, it is illiquid. You don’t have access to the money, hence the liquidity premium. Examples are provided in detail below.

Liquid & Profitable

This is the true holy grail of investing. What has good returns and is liquid: equities!

Wait! But at what cost? Above, you see it is “not the best quality.” In investing equivalents, that means there must be risk. Yes, we know the equity premium is all about volatility risk. Volatility, or risk of your assets being worth less than what you paid for them (in the short term), is the price of entry to get the returns associated with equities.

What I want you to consider: if you are going for liquidity and returns (via the stock market), you ARE giving something else up. Safety. You must not sell low!

Liquidity Premium and Stocks

Are stocks really liquid? Well, yes, you can sell them anytime the market is open. But do you want to sell them anytime the market is open?

That is, if the market has tanked and your stocks are down, are they really liquid? Well, yes, you could sell them and lock in a loss. So, during a down market, stocks aren’t really liquid at all!

Next, what about your stocks invested for future purpose? Say they are there to pay for your long-term care needs in 20-30 years. Are your stocks really liquid? Well, yes, you could sell them and use them for something else, but that defeats the point of planning! You plan to have that money available in 20-30 years. If you consider it liquid and you can sell it at any moment, is it really there to pay for future goals?

With equities, you have technical liquidity but not true liquidity. Technically, you can sell that stock anytime you want, even if it was supposed to pay for long-term care expenses in the future. But truly, that stock is liquid if you have adequate long-term care insurance.

100% liquidity is merely a mirage. It is not real. If you were 100% liquid all the time, then you wouldn’t get the equity premium.

What is an investor to do? Well, what is your allocation to illiquid investments? Do you actually need all that liquidity in your life? Would you like to participate in the illiquidity risk premium?

Illiquidity Risk Premium

Let’s talk about the illiquidity risk premium.

Do you actually need 100% liquidity all the time? But, if you cannot access your money easily, there should be a reward. That is, there is a premium due when someone can use your money for a longer period of time while you cannot access it.

Investment Returns Increase with Illiquidity

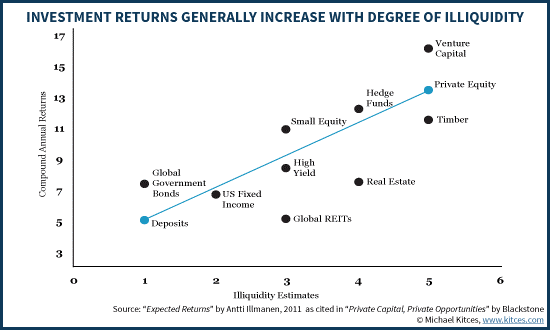

Above, you can see a simplified version of a pretty classic paper on illiquidity.

Note you have compound annual returns compared to an estimate of liquidity.

A deposit is the most liquid (on the bottom left) but has lower returns than government bonds. On the top right, you have private equity investments, which are the most illiquid but have (had?) the best returns. Below that, you see timber, which is clearly an illiquid investment as you need decades for the trees to grow.

Note, below the blue line (which represents poor liquidity/return premium), is real estate, and non-traded REITs. Above the line (good liquidity/return premium), find small equity (the small cap factor) and hedge funds.

I’m not suggesting you invest in hedge funds or private equity deals, as these may have had their time in the sun already. “Come for the complexity, and stay for the high costs!” But the idea is that these investments take five or more years to start paying off, so they should have higher returns because your investment is illiquid.

Ultimately, there is a risk premium for illiquid investments. A simple example is your own home. You don’t see daily fluctuations in the price of your home, so you are never tempted to sell it after its value drops by 10 or 20%. You have to hold on to it for a while. Thus, for most, home ownership is a good deal, because it forces illiquidity in part of your portfolio, with decent future expected returns.

You can get the illiquidity risk premium, but only if the underlying investment is sound.

Whew, back to what is worth wanting in life!

Long Happy Healthy – As an Iron Triangle

So, using the framework above, let’s add long, happy, and healthy to the safe, to the good, fast, cheep iron tringle framework.

Fast: Liquid: LONG

Cheap: Returns (Profitable): HAPPY

Good: Safe: HEALTHY

Safe and Liquid (with poor Returns): Healthy and Long (and unhappy)

Safe and Profitable (and Illiquid): Healthy and Happy (and short)

Liquid and Profitable (and Risky!): Happy and Long (and unhealthy)

There are the three tradeoffs for the what is worth wanting in life iron triangle. Let’s go over each one.

Healthy, Long, and Unhappy

If you have a healthy and long life, that sounds like a pretty good deal! We all know that what you need to be healthy and live long takes eating well, sleeping well, meditating, and getting a lot of physical exercises. If we aren’t doing that, then we don’t really have all three.

Unhappiness in this regard is giving into impulses in an aspect or two of life and not living to our fullest potential. That’s ok, we are perfectly imperfect and don’t need to excel at everything; just recognize the discipline it takes to be happy AND healthy, and immortal.

Healthy, Happy, and Short

Here is another tradeoff. You can be healthy and happy yet die young. I’m going to suggest Peter Attia’s book on the topic: Outlife: the science and art of longevity [there are two affiliate links in this blog that go to Amazon]

Happy, Long, and Unhealthy

Finally, we are to a long, happy, and unhealthy life! This is the dream. This is impulse living!

Advertising and our impulses are force-fed and lead to numbing. Also, watch out for possible positive feedback loops of desires.

Look, are you doing as well as you want to in all aspects of your life? It is your decision to do so. But it is time to get our money back and stop paying attention to advertising. At least as much. Break free in some part of your life, and don’t give the advertisers your eyeballs.

Let go of some part of your life that is making you unhealthy. Move on!

What is Worth Wanting in Life?

As a thought experiment, tell me two people whom you admire. Could be anyone but make sure you think they have flourishing lives. See which characteristics they have that are long, happy, and healthy.

Just like you can’t have fast, cheap, and good, you can’t have long, happy, and healthy. There will always be tradeoffs on the way to wanting what is worth wanting.

Doing well, doing good, and feeling good is the iron triangle. Where do you want to spend your time?

Well, what do you think, can you have long, happy, and healthy in your life? Is there anything that might be lacking if you already had that life? If you think of your honest self, what might you value more than the iron triangle?