Which generation is better off?

Are millennials worse off than their baby boomer parents were at their age? Both generations have had economic adversity, but what does that data say?

Which generation is better off at age 35?

Who is Better Off?

Who is better off, the millennials or the baby boomers? In a study (Life Course Trajectories and Wealth Accumulation in the United States: Comparing Late Baby Boomers and Early Millennials) (source), two age cohorts were examined to see what effect career and family choices have on net worth.

These cohorts are followed longitudinally. Their career and family paths and net worth are studied from ages 18 to 35. Late baby boomers (from 1957 to 64) are compared to early millennials (from 1980 to 84).

What do you think? How do high-income jobs affect wealth distribution? What about divorce, the declining rate of marriage, later family formation and childbirth, and other career and family decisions?

Deciles are used in the paper because of the effect of large outliers on mean wealth (a few billionaires massively skew the mean).

The result? The top two deciles of millennials are better off than the baby boomers, but the bottom eight deciles are worse off.

Wealth at Age 35

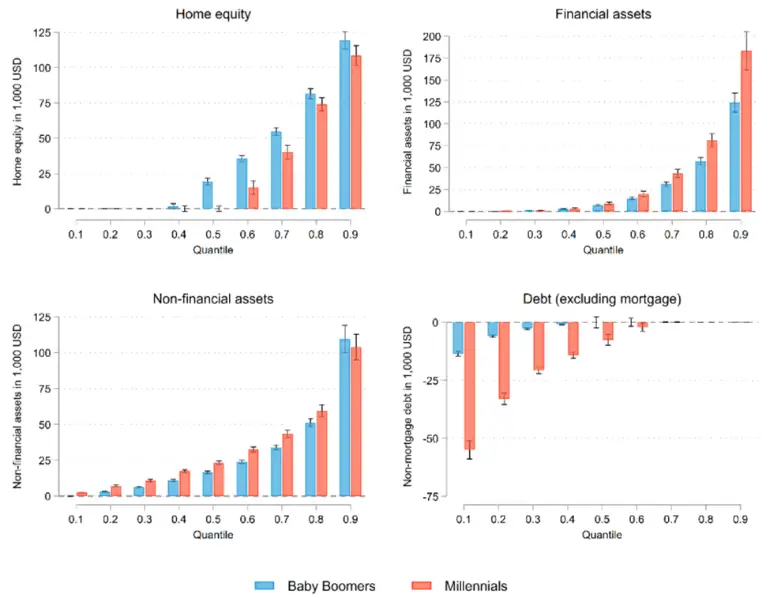

Above, you can see baby boomers in blue and millennials in red. This data breaks down wealth deciles and allows us to compare the generations when they are 35.

Home equity is shown on the top left. Note that baby boomers had more home equity throughout the deciles and owned more homes in the middle deciles. This speaks to millennials’ difficulty purchasing homes (and slower family formation).

On the bottom left, non-financial assets are similar in all deciles. Perhaps the millennials have a few more toys in the driveway than their parents, but interestingly, not by much.

On the top right are financial assets. Note that the top decile of millennials owns more stocks and bonds than the baby boomers did. This may be a result of automatic enrolment in 401k retirement plans. As a FIRE enthusiast, I’d like to think that good savings habits and regular investment have led to this notable improvement in net worth.

Finally, on the bottom right, debt. Millennials in the bottom decile are much more in debt than their baby boomer peers. This speaks to college debt and credit card debt.

In summary, the top decile of millennials are better off than baby boomers because they own equities. The bottom deciles are doing worse off largely because of debt.

A Tale of Two Deciles

Let’s examine the effect of career and family choices in the top and bottom deciles of the generations.

Bottom Decile

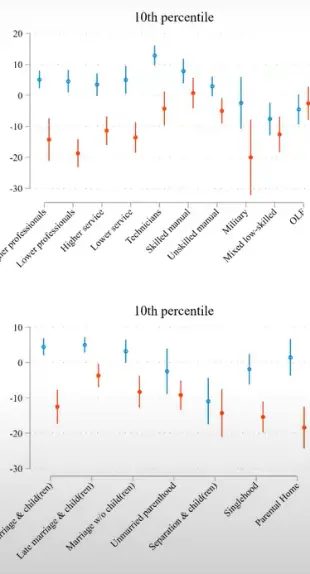

Above, you can see the bottom decile of millennials (red) vs. baby boomers (blue). In the 10th decile, millennials were less represented in all job types (except for OLF (out of the labor force)).

On the bottom, we can see that regardless of family type, the bottom decile of millennials has less net worth than baby boomers at age 35. So, no career or family type is responsible for the lowest decile of millennials having less net worth than baby boomers.

At the 10th percentile, millennials were less well-off regardless of career or family path.

The data show that the generations are similar at the 50th percentile (data not shown), except millennials have less home ownership.

What about the 90th percentile?

Top Decile

The story from the highest decile tells a different tale. High-net-worth millennials are likelier to be both high- and low-income professionals and hold high-service jobs and technology positions.

At the bottom, we see that later marriages with children and singles do better among millennials than among baby boomers.

In the 90%ile, millennials did better if they had late marriages with children or were single. They have more professional work trajectories (and invest in equities).

Conclusion

Comparing millennials and baby boomers, who are better off when they are 35?

It is a tale of two deciles.

Despite the different financial challenges the generations face, the top two deciles of millennials have more wealth at age 35 than baby boomers. This is largely driven by equity ownership, later marriages, and single families.

The bottom eight deciles of millennials are doing worse, largely driven by debt.

Who is better off, millennials or baby boomers? It depends on whether you are wealthy or not. Wealthy millennials own more equities and are doing better than the baby boomers. Other millennials have some catching up to do.