2023, an Epic Year of Performance Chasing

This year is a great example of performance chasing.

Flows into money markets are at record highs; meanwhile, despite massive Fed rate increases, the economy seems ok despite inflation spiking to 9%, and we are in spitting range of stock market highs, and just about everything else is working well too (aside from bonds).

Let’s look at flows into money market funds in 2023 and the Callen Table and see why 2023 is an epic year of performance chasing.

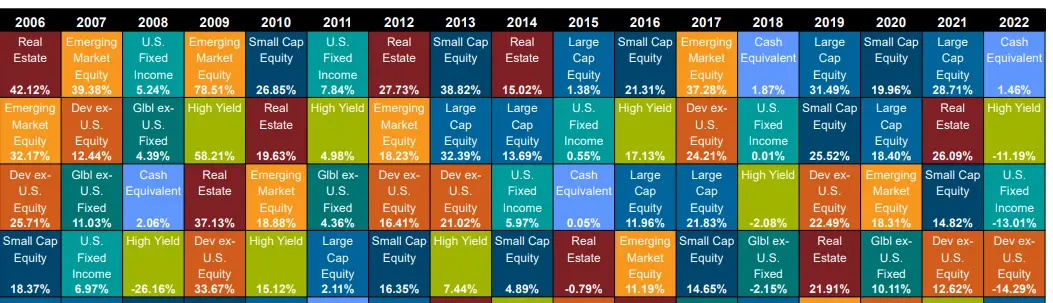

Callen Table 2023

In 2022, cash equivalents were on top of the Callen Table, earning 1.46%. In 2021 (just like in 2023) large-cap blew up. Look above and see that US Large Cap (read it as S&P500 or QQQ or mag 7) has been top quartile of the market for 8 of the last 12 years.

But what really hurt in 2022 is that US Fixed Income was down 13%. Looking back at 2018, it kept par; in 2008, it was up 5%.

In summary, bonds have been beaten up. Cash equivalents rule the Callan chart for two of the last six years. Despite the stock market being at near all-time highs, there is too much cash on the sidelines.

Since Money Markets did the best in 2022, let’s look at their cash flows.

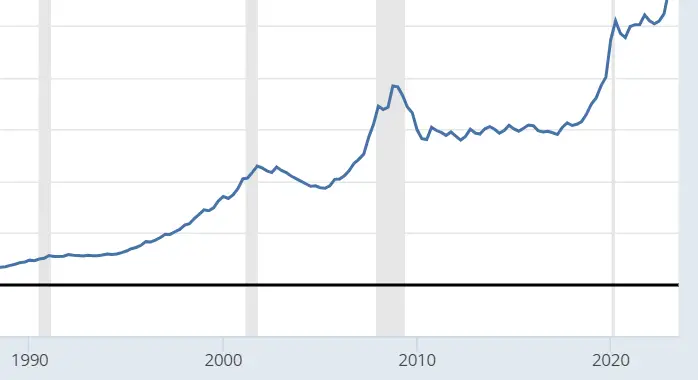

Cash Flows into Money Market Accounts

Above, you can see the inflows to money market funds. After all, cash is king when you earn 5% on cash! It seems like a safe investment, but it is seductive and sticky.

The amount of money in money market funds reached one trillion around 1990 and is currently 6 trillion. It is interesting to note the cash drag through the recent zero-interest rate decade. Cash earned zero yet it was at 3 trillion.

And now it has doubled? Why? Because cash did well recently.

And because it did well recently, we see money flowing in, and the chance that it tops the Callen Chart next year or two is very low.

2023 is an Epic Year of Performance Chasing

Cash is a guarantee that you are going to lose out to inflation over time. It is a sucker’s bet and just because it is paying well in 2 of the last six years doesn’t mean that you shouldn’t diversify away.

Tell me the last 30-year retirement where cash won in the end. It never does, especially in the face of inflation.

Why talk about cash drag unless it is important? In early retirement, is it fine to have 2-3 years’ worth of expenses in cash or short-term bonds. Beyond that, in 2023, where cash is king, you can think of better things to do with cash.