Disability Insurance- When Should I Stop

Once you are Financially Independent (FI), you no longer require income to pay bills. If you don’t need your income to pay bills, you don’t need disability insurance! So, when should you drop disability insurance once you are financially independent?

Let’s look at the numbers! FI is about optimization. You optimize disability insurance when purchased. Let’s optimize when you should stop disability insurance as well.

For physicians, LeverageRx is a digital lending and insurance marketplace exclusively for doctors. This is an affiliate link if you need disability insurance.

Expectancy and Stopping Disability Insurance

Expectancy is an important consideration. When do you expect that disability insurance is no longer a good deal?

Well, remember, insurance will always have a negative expectancy. After all, that’s how insurance companies make money! If consumers expected to make money off insurance, well, then we wouldn’t have insurance to cover rare, catastrophic events, would we?

What is expectancy? Expectancy is important to understand: it is the payout times the chance something will happen.

We often think probabilistically. However, it is more powerful when multiplying probabilities times payouts to get expected future results.

Expectancy for the payout of disability insurance is the probability of disability times the expected payout.

We will discuss the probability of disability in a minute, but what is the payout for disability insurance? The younger you are, the higher the expected payout for disability. This is because disability insurance generally stops paying out at 65.

Determining the probability you will be disabled is the next consideration.

Probability of Disability during Your Career

There are some oft-quoted statistics about disability. Look around the internet, and you will see that you are seven times more likely to be disabled than to die. Ok. I also see 10-20% get disabled at some time between 25-65.

Let’s see if we can narrow that down a little more.

The SSA published probability statistics for disability if you were born in 1997. So, for a 20-year-old born in 1997, 26% of males and 24.7% of females have a disability before they are 65.

As an aside, it’s also interesting to note that the expected death rate is 7.4% for males and 3.7% for females. No surprise there!

Also, of note, the average disability claim lasts 2.5 years. One in eight lasts more than five years. We can use that data.

Disability Later in Your Career

Let’s look at the probability of disability by age.

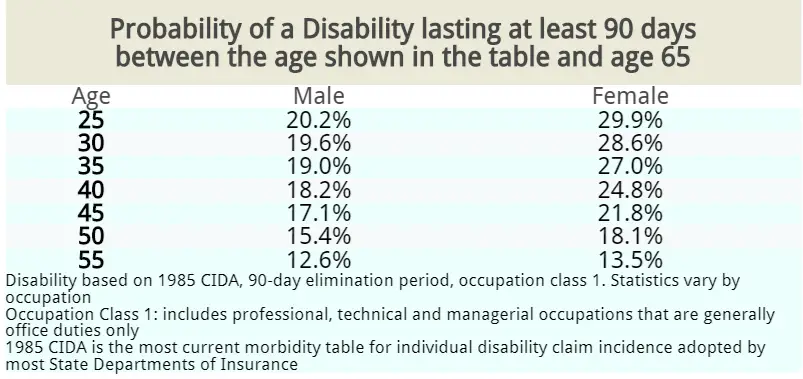

Figure 1 (Probability of a disability between the age shown and age 65) Source

Above, find the age-based probability of being disabled for at least 90 days before turning 65. The data in Figure 1 is from 1985 for professional and managerial occupations with office duty. Take it with a grain of salt, it is old data, but at least it is a good starting point.

Probability of Life-long Disability

We see above that 1/8 of disabilities result in long-term disabilities. Can we get a better number than that?

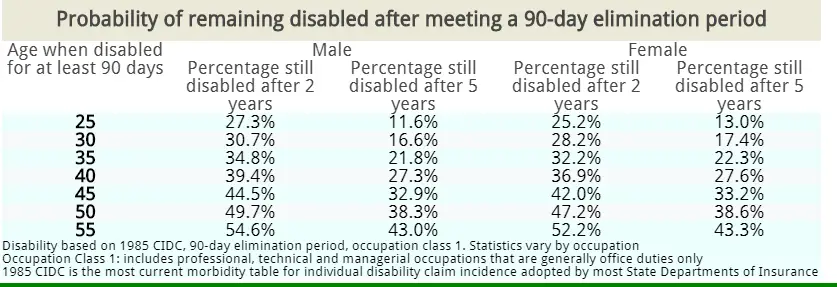

Figure 2 (Probability still disabled after 2 and 5 years) Same Source

From the same data set, we can see what percentage of males and females are still disabled after 2 and 5 years, depending on age.

Putting figures one and two together, as you age, you are less likely to become disabled between now and 65, but if you are disabled, the older you are, the greater chance you will remain disabled. Intuitively, this makes sense.

And now we have some numbers to work with!

Example of Expectancy

So, how long should you keep your disability insurance? Since most disability insurance stops paying out at 65 and you need to be disabled for six months before getting paid, you should stop paying at 64.5 years of age. Likely, the answer is even sooner than that, especially if you are Financially Independent and no longer “need” the insurance.

Using expectancy, can we figure out the ideal time to stop disability insurance? After all, risk management is not just about the risk something terrible happens but also about the potential payout. You have paid for disability insurance for a long time. Is disability insurance a waste of money?

What if You are only going to Work for 5 More Years?

We are running out of data here. With that in mind, I present this:

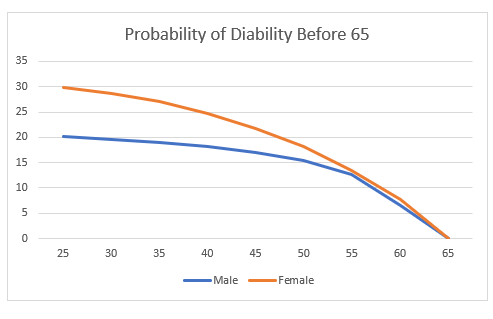

Figure 3 (probability of disability by age until the age of 65)

As you get closer to 65, the chance of becoming disabled by 65 decreases, as seen above in Figure 3. This is interesting to contemplate because we know that the older you get, the higher the likelihood of becoming disabled. If you are disabled after 65 in this setting, it doesn’t “count” since you would receive no disability payments after 65.

The data presented in Figure 1 stopped at age 55. However, we also know that at age 65, the number of people who will be disabled before 65 is zero. So, we can insert a trend line and discover that 6.5% of 60-year-old males become disabled, and 7.8% of females become disabled before they are 65.

Summary Table: When Should I Stop Disability Insurance?

Figure 4 (summary of expectancy for disability insurance)

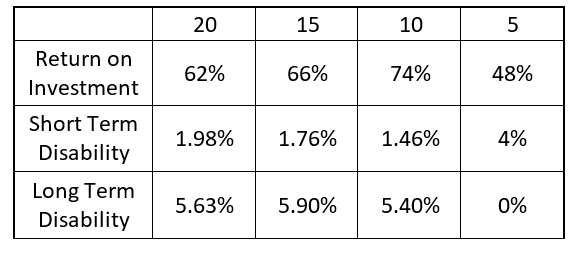

In Figure 4, see the summary table. On the top are the years left until retirement. On the left, find the percent of return on investment and percentage of short-term (2-5 years) and long-term (>5 years) disability.

Return on investment, in essence, means the chance that you get your money back. It is expected to payout over premium payment.

Insurance is risk mitigation or risk transfer for catastrophic problems. There is an expectancy for a negative result, as obviously, insurance would go out of business if they paid out more than they took in.

What makes disability insurance fascinating: the older you get, the more likely you are to become disabled, but the less payout you receive.

The return on investment, then, increases until you are about ten years out from retirement. The chance of having a long-term disability also increases as you get older but goes to 0% once you are 60.

So, when should you stop your disability insurance when you are Financially Independent? It is a personal choice and one that can take your health into account. If you have conditions that increase the risk for short or long-term disability, it may pay to keep the insurance around. On the other hand, if you are healthy and financially independent, stop it ten years before retiring.

Nevertheless, once you can self-insure for disaster, the odds are ever in favor of insurance companies.

When should I cancel my disability insurance?

Previously, we used expectancy to calculate if disability insurance is a waste of money for someone who is financially independent and going for traditional retirement. After torturing a data set from 1985, I conclude that if you were going to work more than ten years (but not less than 5), you were better off keeping your disability insurance.

Now, let’s torture the data again and see when you should cancel disability insurance if you expect to retire early.

Sunk Cost Fallacy and Disability Insurance

Now might be a good time to mention the sunk cost fallacy. Like the entrepreneur, they can’t worry about past failures, just future success.

So it is true with disability insurance. You don’t look at what you have spent on insurance in the past; instead, what is the expectation it may pay out for you?

If you are financially independent, you don’t need disability insurance. But by using expectancy, you can determine if it is a waste of money and when you can cancel disability insurance.

The past doesn’t matter if you learn from it and grow. Sunk costs from past insurance payments don’t matter if you have a high expectancy to benefit from it now or in the immediate future.

Look back again at Figure 1.

The difficulty in using this data for early retirement is that it assumes you will work until you are 65. So, say you are 50 and going to retire at 60. Well, there is a 15.4% chance you will be disabled if you work until 65, but what is it if you only work until 60?

Using Expectancy to Decide When to Cancel Disability Insurance in Early Retirement

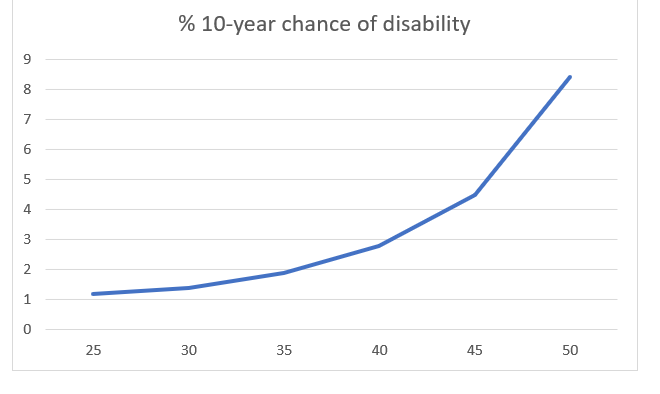

To be clear, I previously assumed you were going to work until you were 65. Now, let’s see when you should cancel your disability insurance if you quit work early. Let’s start with your 10-year chance of disability, depending on your present age.

Chance by Age You Will be Disabled if Working 10 More Years

Figure 5 (Chance by Age You Will be Disabled if Only Working 10 More Years)

Above, see the chance by age you will be disabled if you are only going to work for ten more years. When you are younger, you have a lower possibility of disability in any ten years. As you age, it increases.

Note that your cumulative chance of disability would be higher when you are younger because that includes all the periods when you are older as well. But above, we are just focusing on any ten years. Younger people are, in general, healthier and suffer less from disability.

Let’s look at expectancy now.

Results of Expectancy for Early Retirement

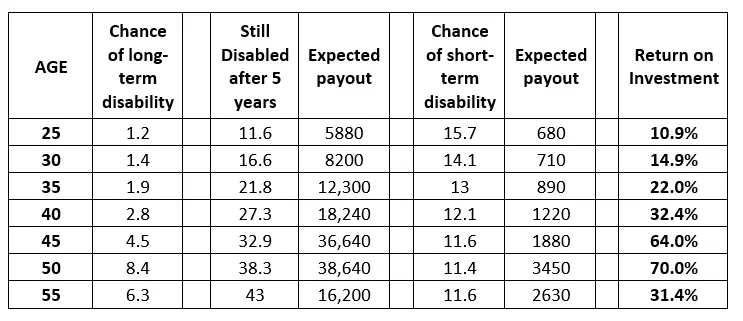

Here, find the results using expectancy.

Figure 6 (Chance of Long- and Short-Term Disability with Expected Payout and Return on Investment)

Above, see the chance of disability of more than 90 days on the left. Then, of those, see the percentage still disabled after five years and the expected payout.

After that, take the chance of long-term disability and subtract out the >5 years of disability to get the chance of short-term disability. Then, multiply that by the 3-year payout and get an expected payout.

Finally, payouts are added together and divided by costs ($60,000), and you get a return on investment. Note that return on investment increases rapidly between 40 and 45 and then goes away at 55.

Thus, as far as return on investment goes, you are best to keep your disability in your 40s and drop it when you are 55. But remember, the above assumes you plan to quit in the next ten years, regardless of your age. So, the natural conclusion is that the older you are, the more likely you will need disability insurance. That makes sense. If you can get over the sunk costs, disability insurance has a higher potential return the older you get and the longer you work.

Conclusion – When should I cancel disability insurance?

In Part 1, we see that the return on investment for a traditional retirement plan increases until you are about ten years from retirement (age 55) and then rapidly falls off.

If you consider early retirement, the return on investment increases until you are about 50 and then rapidly falls off. Your best chance of using disability and getting a payout from it is between 40 and 55.

You get insurance because you hope you will never need it. However, if you have been paying for disability insurance for decades, you may want to plug in your numbers and see your expectancy. If you have low premiums and high payouts, you may not want to cancel your insurance, as you have a 70% chance of getting your money back between 50 and 55 years of age.

Again, you will lose money on average. Otherwise, the insurance company will go out of business.

With disability insurance, as you get older, you are more likely to use it but get less of a benefit as payouts stop at age 65.

Using expectancy and your numbers, you can calculate your return on investment for the next 5-10 years and see if it is time to cancel disability insurance and self-insure.