Roth Conversions are Longevity Insurance

Roth conversions are a little like longevity insurance!

Longevity insurance pays you more the longer you live. It protects against living too long a life.

Social security is longevity insurance, too. Interested?

Let’s talk about how Roth conversions are like longevity insurance.

What is Longevity Insurance?

For a detailed summary of longevity insurance, see my definitive guide to longevity insurance.

In short, longevity insurance pays you more the longer you live. You usually set aside some money now and get paid later. You can use time as leverage if you live too long a life.

A good example of longevity insurance is a DIA. Let’s start there.

What is a DIA?

A DIA is a type of annuity. Specifically, it is a deferred income annuity. They are simple and inexpensive, making them a “good annuity.”

DIAs might become more interesting now that interest rates are higher. A specific type of DIA (QLACs) is very useful if you have a large amount in your pre-tax retirement accounts.

Social security is another example.

Social Security as Longevity Insurance

Social security is also a bit like longevity insurance.

When you build a bridge to defer social security, you buy a DIA with the money you spend instead of security after age 62. Between your full retirement age, you buy a DIA from social security at 6% every year you delay. Then, after your full retirement age, the government rewards you with an 8% DIA by waiting until 70.

With Social Security, the lump sum payment is the money you spend instead of taking it each year. The future income stream is delayed retirement credits to your Social Security primary insurance amount.

Roth Conversions as Longevity Insurance

With Roth conversions, the lump sum payments are the taxes you pre-pay, and the future income stream is the expected future tax reduction for you and your heirs.

Roth conversions are one of the best ways to leave your children money.

Let’s dive in. How is a Roth conversion similar to longevity insurance?

How is a Roth Conversion Similar to Longevity Insurance?

How is a Roth conversion similar to longevity insurance?

With a Roth conversion, you opt to pay taxes now. It is like insurance in case tax rates go up in the future. You pay taxes now at a known rate, so you might pay less in taxes in the future when RMDs begin.

Instead of giving an insurance company a lump-sum payment, you are paying the government taxes you don’t need to. And that is important to understand. You (or your heir) will eventually owe taxes on this money. This money is called IRD—Income in Respect to the Decedent. You are dead, and taxes will be paid.

Instead of a future income stream, you will pay less in taxes once RMDs start. Instead of taking a percentage every year once you are 72 or 75 (as Required Minimum Distributions force you to do), you are taking the same percentage out of a smaller pot. Your IRA has been shifted to the tax-free Roth. More Roth and less pre-tax IRA when 72 means you pay less taxes.

Not only do you pay less in taxes, but you also pay less at your marginal rate.

Think about this: with a Roth conversion, you make a lump sum payment now (taxes this year) to reduce future RMDs. This reduces the amount of money you must pull out each year from your retirement accounts and thus limits the “top” of your income, which is exposed to the higher tax brackets.

With Roth conversions, you pay with after-tax dollars, but you are saving at the marginal rate in the future, not the effective rate (which is what you pay your tax dollar at now).

How Much Do You Get Paid to Do a Roth Conversion?

So, if a Roth conversion is a little like longevity insurance, what is the payout? How much do you get paid by doing a Roth conversion?

Let’s find out!

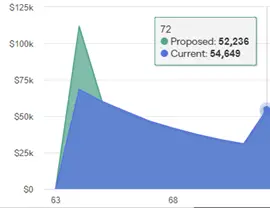

Above, you can see a large one-time Roth conversion as the green tax spike.

We are considering how much you are expected to pay in future federal and state taxes with and without Roth conversion. With a Roth conversion in green, you pay about $43k more in taxes once on your conversion of $100k.

In blue, note what you pay without the Roth conversions.

Without the Roth conversion, you are expected to pay more in taxes once RMDs start at 72. You can see that reflected in the difference between the two lines above, which slowly increase over time (reflecting the increase in taxes you save over time as the withdrawal percentage rises with age.

Let’s look at RMD age more closely.

How Much Do Roth Conversions Save in RMDs?

So, how much do Roth conversions save in RMDs?

Above, you can see the expected taxes at 72, RMD age. You might save $2.4 k the first year that RMDs are due.

So, that is essentially a 2.4% return of your 100k Roth conversion.

However, a more accurate way to look at this is to consider taxes specifically.

For example, we paid about $43k ten years before this “savings” of taxes.

Remember, money saved is the same as money not spent, which is income essentially.

If you pay now for future savings, that’s like an annuity!

Roth conversions are like a deferred income annuity. We paid $43k to get a $2.4k “payment” 10 years later. This is a 5.6% return on our principal! Take that SPIA! Or, more accurately, take that DIA. And most accurately, take that 4% SWR.

Roth Conversions are like Insurance that Gets Better with Age

Roth conversions are like insurance that gets better with age.

Let’s consider age 80. The expected tax savings then (above) are $4.4k. This is a 10% return at 18 years out.

As I said, it gets better and better the older you get.

And don’t forget, it is good for the kids, too!

Roth Conversion is like Insurance for Your Kids

If your kids are in high tax brackets, Roth conversions are a great idea. Often, you can convert them at lower rates than they will pay over their 10-year inheritance.

If your kids are likely to take the whole IRA out the year you die, Roth conversions are also a grand idea.

Only if you have charitable intent or a lot of heirs (you can spread it out to many different inherited IRAs with many different beneficiaries) or a low-income heir (who can essentially pay less in taxes over ten years than you would during a Roth conversion).

Summary – How Roth Conversions are Like Longevity Insurance

So there you have it! You pay cash now (in extra taxes) for a Roth conversion.

This is insurance – you are pre-paying your taxes so you never have to pay them again.

This is good because you expect your liability to grow over time (your investments get larger) and you are expected to take more and more out every year (via increasing RMDs). And don’t forget the big whammy.

The big whammy is that you don’t have to guess what future tax rates will be once you pay taxes. The only thing we know about Congress is that they will play around with the tax code and make it more convoluted than it already is.

With Roth conversions, you might get better returns than traditional longevity insurance!