Do I need more Large Cap Value?

Most people are underweight Large Cap Value in their portfolio.

I dived deep into my US equity holdings but am underweighting large value. Is there a large value premium that should have me reconsider how I slice and dice my equities?

Do I need more?

Do I Need More Large Cap Value?

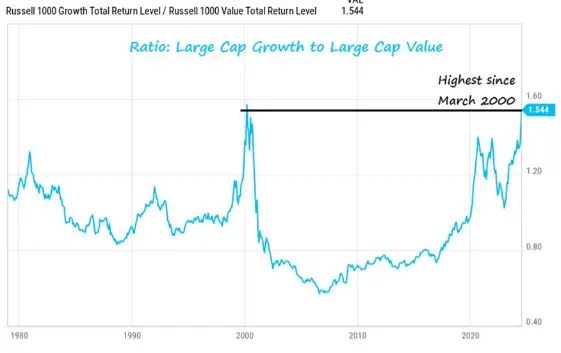

Growth has killed Value in the last 15 years.

Above, you can see that large growth is at its highest valuation compared to large value since the peak of the dot-com bubble in March 2020. What happened over the next seven years?

Over the next 7 years, large value destroyed large growth.

About 15% of my portfolio is invested in small-cap value. Yes, I believe in the value risk premium.

But most of what you hear regarding value has the word “small” in front of it. What about Large Cap Value?

What is the advantage of large value? Should I have it in my portfolio?

Should I have Large Value in my Portfolio?

You already have large value in your portfolio.

But you likely don’t “tilt” toward it or, that is, have it overvalued in your portfolio unless you are focused on doing so. So, for example, if you buy the S&P500 or the total stock market index, you already own all of the large value stocks in proportion to their capitalization.

Large-cap value stocks are large-cap stocks, which means they are concentrated in index funds focusing on market capitalization. The larger the company, the more you own as a percentage of the index.

But what does a focus, concentration, or “tilt” to large value add? Or does it add something to your entire portfolio (including your bonds and other assets) beyond just the diversification it adds to your stocks?

Let’s define large value.

What is Large Value?

Large Cap(italicization) means it is a big company. Value means less expensive than a growth company compared to its earning potential. Therefore, value companies are “cheap” and often pay dividends. As they pay more in dividends, if you want to maximize your earnings and minimize tax drag, these funds might go best in a tax-protected space.

You might consider putting your value in your tax-sheltered accounts and your growth in the taxable brokerage account. Still, you don’t need to do this as part of your routine tax optimization and optimal asset location.

As for dividend yield, well, it changes over time. But currently, some large value ETFs yield about 2.5%, compared to 0.6 for large growth and 1.64% for large blend. So, you can save some taxes by putting value in tax-protected compared to growth. See my blog on the yield-split asset location strategy.

What sectors are you invested in with large value? Financials and health care lead the sector weightings, followed by industrials and information technology. Of note, energy is much more represented compared to large blend.

So, why invest in large value?

Why Invest in Large Value?

We invest in large-value investments because they diversify our portfolio and increase risk-adjusted returns over long periods.

All of those components are important. First off, long periods.

Large Value outperforms over long periods. However, as with small cap value, this may take decades.

It provides diversification both to your equities and to your portfolio in general. Diversification has been called the only free lunch in investing.

Finally, increased risk-adjusted returns. Understand, you don’t get increased returns; you get increased risk-adjusted returns with large value in addition to your total market funds. Over the years, sometimes growth and sometimes value does better, leading to changes to decrease your volatility and increase the returns of your portfolio. Let’s look at this now.

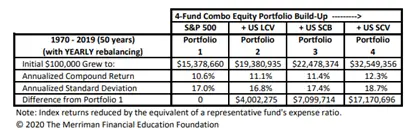

Above, this is a bit busy, but hang in there with me for a second. You can see an initial 100k investment invested in 4 different portfolios on the top left. Over 50 years, the reference portfolio (number 1, invested in the S&P500) grew at 10.6%, with a standard deviation (to represent volatility in the case) of 17%. In portfolio number two, they add US large value to the portfolio. This improves compound return rates and lowers the volatility!

Next, Portfolio Three adds a small cap blend, and Portfolio 4 adds a small US cap value. So again, you can see both increased volatility and compound returns.

You can see that adding small cap value made the largest difference, but adding large value was better than adding just small cap blend to the S&P500.

In summary, you are better to go value than you are size (cap). If you add large value to your basic funds, you are better off than if you add small caps!

Disadvantages of Large Value

There are, of course, disadvantages to large value tilts.

The main one is profit chasing. Hopping in and out of tilts is a sure way to time the market and lose out on the risk premium you get from these factors.

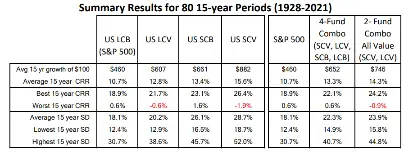

Above is more great work from Merriman’s archives.

You can see along the top US large-cap blend, the large value, the small-cap blend, then the small-cap value.

These are 15-year periods that compare the results for different portfolios.

Note that with the S&P500, your $100 grows to $460 compared to $607 with large value.

Then compare large value with small cap blend and small cap value.

That is the main disadvantage of large value.

Summary: Do You Need More Large Value in Your Portfolio?

So, do you need more large value in your portfolio?

There may be a size premium. There is a value premium. There probably is an additional small value premium if you go small and value-e enough. Is there a large value premium?

Yes. If you can invest for decades rather than years,

I need more large value. I believe in factor investing. Buy and hold.

I buy great ETFs when I have the money, and I sell them if I need the money in the future. Or leave them for the kids to get a step up in basis. I have no fear that a low-cost, broadly diversified large value ETF will be around in 40-50 years. It will probably be worth more than a total stock market ETF. But only because I took more risk.

I’m happy to risk my money in a large value tilt. Are you?