What are the Long-term REAL Returns?

Everyone is currently worried about inflation, especially those about to retire. A poor Sequence of inflation is a retirement risk and hyperinflation (and deflation) are economy killers. But let’s not be pessimistic! The question most want to know is: after accounting for inflation, how much will my stocks, bonds, and cash make in the next 10-30 years?

Let’s guess the real return of stocks, bonds, and cash over the long haul.

What is Real Return?

That ‘real’ part of the equation means after inflation, which is important for retirees. Once you stop working, you deeply care to ensure your portfolio keeps up with a standard of living.

De-accumulation inaugurates a negative cash flow sequence. With this sequence of negative cash flows, you need to know how much your portfolio might grow in the face of inflation-based pressure.

Inflation in retirement is less than CPI.

But, I want to focus on how much a dollar will buy in 10-30 years. Will the falling value of a de-accumulation portfolio keep pace with the decelerating value of the portfolio? What is the real return?

Real Return

Real return is what is earned on an investment after accounting for taxes and inflation. Real returns are lower than nominal returns, which do not subtract taxes and inflation. Investor.gov

Real Returns

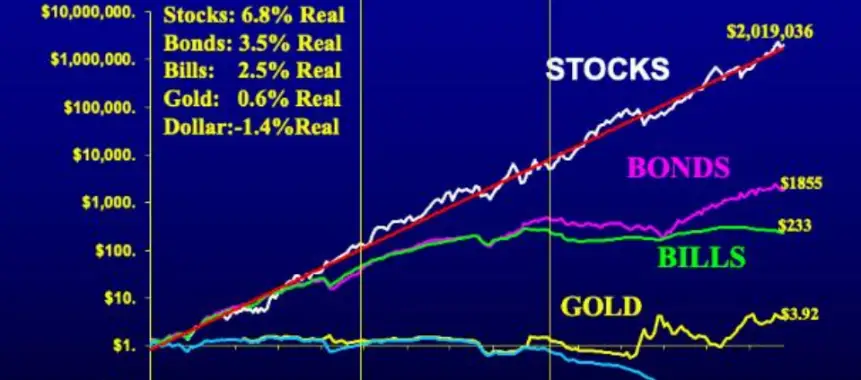

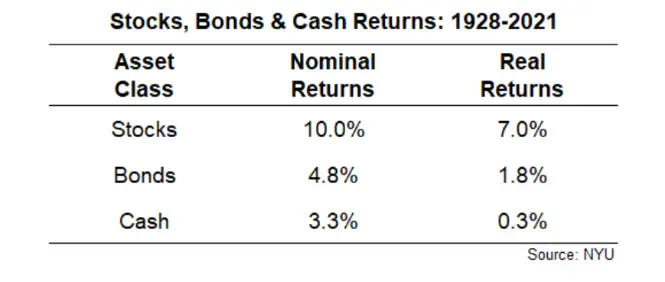

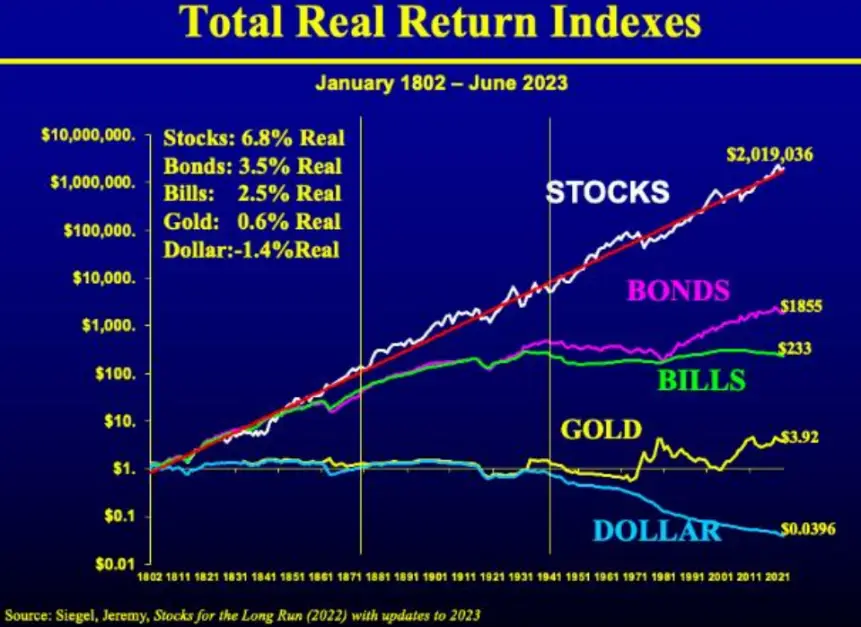

Here are your real returns:

For a more detailed view, you can see how these numbers have done historically.

Why You Lose with Cash

A savings account guarantees loss over time since you cannot keep up with inflation. This is an inflammatory and contradictory statement because most people think cash is safe. Cash safely destroys your purchasing power over time.

It’s not a big deal in the next ten years, but it’s huge over 30 years. Cash drag is real, but who cares in the short term? It is only when you must hurdle inflation over the next 30 years that cash drag matters.

Instead of being a haven, cash is a loser to inflation; what are the real returns on cash?

What are the REAL Returns on Cash?

Cash returns about 0.3% real every year. This means after expenses and taxes, you lose.

Cash is not a viable long-term investment option. We all know this because inflation is the reason we invest in the first place.

Cash is king in the short term and the jester after that.

Long-Term Real Return of Stocks and Bonds

The Long-Term Real Returns of Stocks is 5% and for Bonds 2%. I know it says 7% and 1.8% above, but we can round up with the bonds, and it should be five rather than seven for stocks.

Before you start asking why I think it is five rather than seven, we have our answer: we need to invest in stocks to have a real return—said another way, if you are worried about inflation, a significant amount of your portfolio needs to be in broadly diversified low-cost US and International ETFs. Own the world.

What is the Real Return of Stocks and Bonds?

The real return is better with stocks than bonds.

That’s what the last 100 years of data show. Past results are not predictive of future returns, and there have been 30-year periods (most recently, the 1980s) where long-term bonds crushed stocks. It happens. But that’s why you have an asset allocation that includes both.

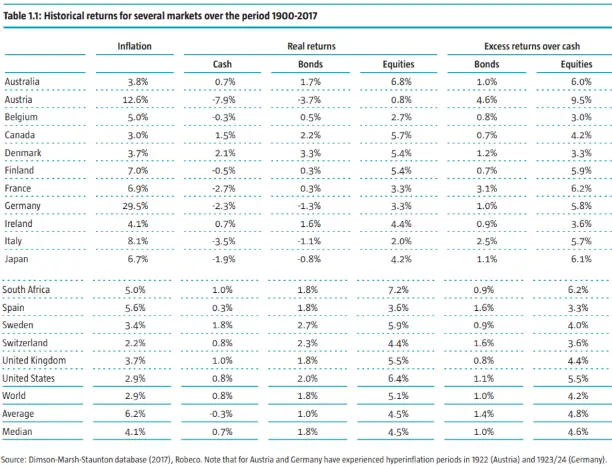

Above, you can see inflation in some contraries of interest and the average inflation. You can look at the real returns if you want, but let’s focus on the last two columns, the excess returns over cash (inflation-adjusted or real): after adjusting for inflation, bonds beat cash every year by 1-1.4% and equities beat cash every year by 4.2-4.8%.

Cash sucks, bonds are hardly better (but necessary), and stocks are king in the Real long term.