Taxation of Long-term Capital Gains

A separate (and some would say mystical) taxation system exists for long-term capital gains and qualified dividends. Let’s discuss the Long-Term Capital Gains Tax and how the standard deduction applies to capital gains.

Ordinary income has progressive tax brackets, which can be confused when interacting with the long-term capital gains tax.

Let’s learn how long-term capital gains tax is added to ordinary income and how the standard deduction applies to capital gains.

Long-Term Capital Gains stack on TOP of ordinary income.

Let’s explain how that works and look at Long-Term Capital Gains rate updates.

As usual, Kitces has the best graphics on the internet to demonstrate complex tax concepts.

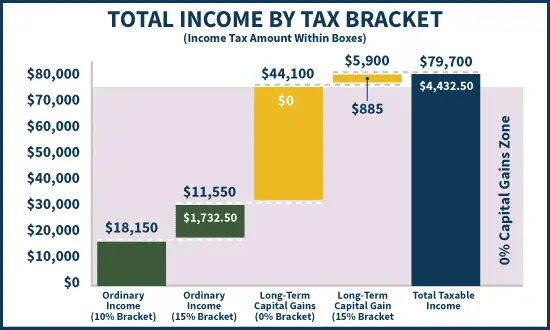

Figure 1 (Long-Term Capital Gains Stack on Top of Ordinary Income)

In Figure 1, the numbers are slightly off due to yearly changes, but let’s look at what happens conceptually.

Green is ordinary income, and yellow capital gains.

The first ~18k of ordinary income is subject to this example’s 10% tax bracket, and the next ~11.5k is subject to the 15% tax bracket. Long-term capital gains are stacked on top of that in yellow.

Did you know there is a zero percent Long-Term Capital Tax bracket? That’s right; zero taxes are paid up to the zero percent LTCG bracket limit! Above that, you hit the 15% Capital Gains tax bracket.

Let’s spell that out again. Until you reach the 15% Long-Term Capital Gains tax bracket, you pay zero on the capital gains that stack on top of your ordinary income. Above that amount, you are now in the 15% LTCG tax bracket and pay 15%.

Note the critical concept of your total taxable income in Blue. This includes Both ordinary income and capital gains.

Before this, you can deduct your pre-tax deductions, such as your 401k. After this, you get below-the-line deductions and the standard deduction. But, of course, most people hate taxes, so I’m just going to hand-wave and gloss over this part.

How does the standard deduction affect the Long-Term Capital Gains taxes? I’m glad you asked.

How the Standard Deduction Applies to Long-Term Capital Gains Tax

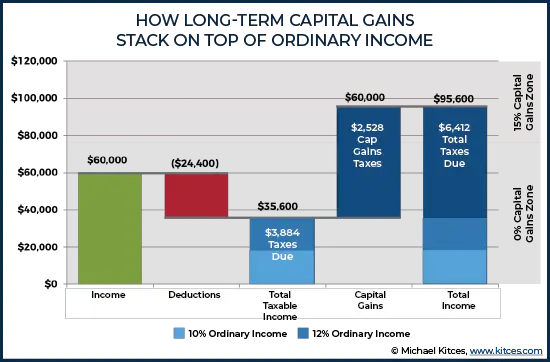

Below, we can see how the standard deduction affects long-term capital gains tax.

Figure 2 (How the Standard Deduction Applies to Long-Term Capital Gains)

In green, again, is ordinary income. Then, you take the standard deduction in Red. This decreases the starting point for our next step, adding the Long-Term Capital Gains.

But before we do that, we have ordinary taxes due. You pay taxes on ordinary income depending on the amount you have exposed to the ordinary income tax brackets. That should make sense to you.

The effective tax rate is the total tax divided by your income.

Next, you have the marginal rate. That is the amount you pay on the next dollar of income you earn. Those tax brackets apply to ordinary income.

ABOVE your ordinary income, you stack on Capital Gains.

The standard deduction applies to capital gains if you don’t have any ordinary income.

In Dark Blue, some Long-Term Capital Gains are exposed to the zero percent capital gains tax bracket. But, above that, the rest of the capital gains are exposed to the 15% capital gains bracket.

How are Capital Gains calculated?

How Capital Gains Tax is Calculated

No one calculates Capital Gains Tax by hand; the software does it for you. CPAs often can’t precisely explain how long-term capital gains tax sits on the ordinary tax brackets. Seriously, ask one the next time you see one at a party. Do CPAs go to parties?

The general principle is to subtract the money exposed to the zero percent bracket, leaving you with the taxable portion of Long-Term Capital Gains.

Next, remove the part above the 15% tax bracket so you can pay 20% on the remainder. Easy! There are two steps to get the three tax brackets: zero, 15, and 20%.

But wait, don’t forget about NIIT!

Don’t Forget About NIIT

NIIT is as annoying as it sounds. The Net Investment Income Tax (NIIT) is a 3.8% Medicare tax that phases in for MAGIs above $200k/$250k filing individually/jointly.

Those who enjoy paying NIIT will file form 8960. Multiply the calculated amount above the phase-out by 3.8%. Cha-Ching! That’s what you owe in NIIT.

So, NIIT changes the number of tax brackets depending on if you are above or below the threshold.

How Many Long-Term Capital Gains Tax Brackets Are There?

Most think there are three capital gains tax brackets: zero, 15, and 20%.

They are wrong! There are four Long-Term Capital Gains brackets, thanks to NIIT!

There is no 20% Long-Term Capital Gain tax bracket. How about that? Instead, anytime you are above the 20% LTCG bracket, you are also above the NIIT threshold to pay both.

The Long-Term Capital Gains Tax brackets are zero, 15, 18.8, and 23.8%. Love it.

What are the implications of the LTCG brackets? But first, let’s talk briefly about capital gain harvesting.

Capital Gain Harvesting

Don’t forget the possibility of Tax Gain Harvest (recognize capital gains at the 0% tax bracket), especially during your tax planning window!

And Qualified Dividends

Don’t forget that Qualified Dividends also get special tax treatment. What is a qualified dividend? Well, a dividend that isn’t ordinary is qualified. Ordinary dividends are exposed to ordinary tax rates.

Ordinary dividends don’t meet the criteria for being called qualified. This can be due to the type of investment (REITs, MLPs, money market accounts, etc.) or duration. There is a 60-day holding period. You need to have owned the stock before dividends are paid to get qualified treatment.

If you are a buy-and-hold investor, don’t worry about ordinary vs. qualified. You will get a 1099-DIV that tells you what number to put in what box.

Long-Term Capital Gains Tax Rate

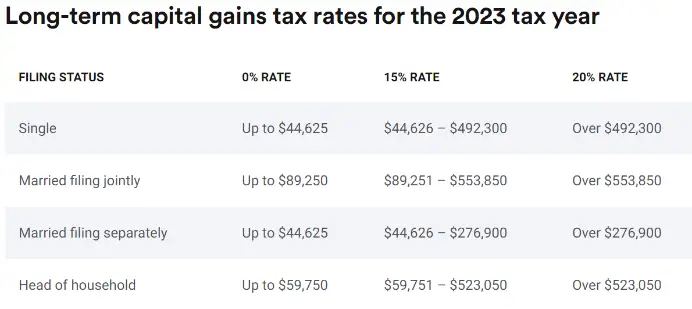

In 2022, there will be new Long-Term Capital Gains Tax rates, with the brackets adjusted upwards for inflation.

As you can see above, the zero percent tax bracket now extends to $89k for married filing jointly. However, due to NIIT, the 15% long-term capital gains rate remains at $250k and $200k for those filing single. You then hit the 18.8% bracket until you get into the 23.8% bracket at the specified incomes (reported as 20% above).

Summary Long-Term Capital Gains Tax

As I mentioned, most people are confused about how they pay taxes on their long-term capital gains.

Remember that long-term capital gains stack on top of ordinary income. So, take your income minus the standard deduction and add your long-term capital gains and qualified dividends. This is the amount of money you pay in long-term capital gains taxes. The standard deduction reduces capital gains if you have no ordinary income.

Also, if there is room in the zero percent tax bracket, you pay zero taxes on the amount that fits in that bracket. Above that, you pay 15% until you reach the 18.8% bracket. Then, you pay 23.8% taxes on the remaining Long-Term Capital Gains above a certain amount.

See, easy! I bet you won’t remember how to do that a week from now…