Tax Rate Arbitrage and Roth Planning

Tax rate arbitrage is an important concept in retirement planning.

You must understand tax rate arbitrage to buy the government out of your retirement. When should you harvest or accelerate income, and when should you avoid or defer it?

Another way to consider this question is: Should I do a Roth or Traditional 401k? Or should I do Roth conversions—pay the tax now, so I don’t have to pay my silent partner later? Whether to Roth or not is a yearly decision based upon this year’s income compared to your income every other year of your life.

Tax rate arbitrage means using your current and future year’s income in concert with the progressive tax rates of the federal tax code. Over your lifetime, you pay less if you “create” more income in years where you have low taxes (and thus create less income when you have high taxes) because of the progressive ordinary tax rates.

Remember, pre-tax retirement account contributions come from your marginal tax rate. Later, the same money fills the lower brackets of our progressive tax system when withdrawn (or converted to Roth). So, even if taxes are higher in the future, you can use tax rate arbitrage to your advantage and save on taxes.

Let’s begin! First, we need to understand tax rate arbitrage and the difference between the marginal and effective tax rates.

Marginal vs. Effective Tax Rate

Let’s start by looking at the marginal vs. effective tax rate.

Neither one shows up on your tax return, but both are important concepts!

Marginal vs. Effective Taxes in Tax Rate Arbitrage

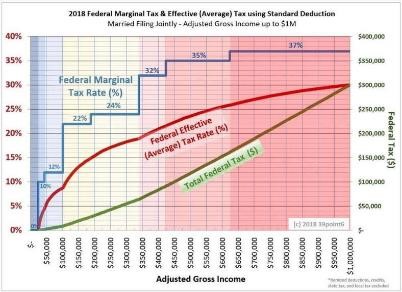

This is a great graph to help differentiate marginal vs. effective tax rates. Ok, deep breath. Ready?

The percentages on the left side (in red) and the red line are the effective tax rate. The effective tax rate is the average tax paid on your total income. That is, you take your taxes over your total income and the percentage you pay to the government in taxes at your effective rate.

The effective tax rate (a percentage of your total income) translates into an actual dollar amount, the total federal taxes (in green). So, for an adjusted gross income of 100k, your effective tax rate is about 9%, and you pay about $9000 in taxes. For an AGI of 350k, we get 19% and $67k.

Next, the “tax brackets” are your marginal tax rate. Note that your marginal rate is the percentage of federal tax you pay on your last dollar. All other dollars must fill the lower brackets until you earn enough to move to the next rung or step of the ladder.

Also, note that along the bottom, the adjusted gross income increases. See how it affects the federal marginal tax brackets as they step up irregularly? Again, this is a progressive tax code; the more you make, the progressively higher taxes your marginal (last) dollar is exposed to.

The important point is that your effective tax rate is always lower than your marginal tax bracket. As you approach infinite income, your effective tax rate curve approaches the asymptote of your marginal bracket. Fun.

How to Calculate Effective and Marginal Tax Rate

How can you calculate your effective and marginal tax rates? Don’t. Have the computer that did your taxes do it.

You can calculate them if you want to have a fun Saturday night playing around with taxes. Take total income from the 1040 and add back retirement account contributions. Remember, as a W2 employee, your 401k contributions don’t hit your top line. Then, find the total tax and divide it.

Your effective tax rate is the average percentage of federal taxes over total income. I’m not going to discuss issues with State taxes right now.

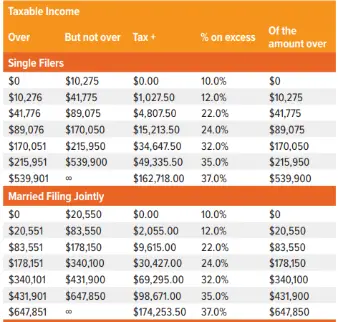

Next, the marginal brackets change every year, but below, let’s look at an example I like.

How to Calculate Effective Tax Rate

Above, you can see the taxable income for single filers and married filing joint. See how income fits into the tax rates? I like this example because you can see how much you owe in federal taxes as you go through the tax brackets.

For instance, say you make 200k in 2022. As a single, you owe $34k and change plus 32% of the amount greater than $170,050. For a married filing joint, you owe $30k and change, and the surplus hits the 24% tax rate.

Most use computers and TurboTax to calculate their effective tax.

Okay, now that we understand marginal and effective tax rates, we need to realize that they change over one’s lifetime as one’s income goes up, then down, and then up again (when required minimum distributions start). This change in income allows tax rate arbitrage to be effective!

Tax Rate Arbitrage over Time

Your income and effective tax rate change over time, allowing tax rate arbitrage.

You have a low tax rate when you don’t earn much money. Thus, it is often a great time to make Roth IRAs and Roth contributions to your retirement plan at the beginning of your career. Then, at low tax brackets, go all Roth all day long.

When you start earning more money, it often pays to defer taxes until later. Then, later, in retirement, you might “earn” less income and thus have access to your lower tax brackets, where you can recognize the deferred income. So save high, buy low.

Let’s see an example of an effective tax rate over time.

Effective Tax Rate Over Time

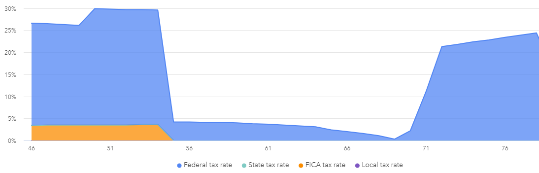

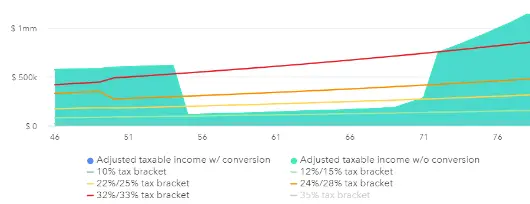

Effective Tax Rate over Time and Tax Rate Arbitrage

Above is a graph of effective tax rates while working from 46-55 and then in retirement from 56. Note the significant change at retirement, then again at age 75 when RMDs kick in. (There is also a slight increase in 2026 when the TCJA expires, and the graph above shows RMDs starting at 72 (before Secure 2.0))

Also, note the effective tax rate is not zero during retirement, as there is still investment income. Remember, you might owe ordinary taxes on interest, non-qualified dividends, and short-term capital gains. You might owe ordinary taxes if you have actively managed high-turnover mutual funds in your brokerage account!

But also, if you have enough income, you owe 15% on long-term capital gains. Capital gains may be taxed in a parallel tax system at progressive tax rates. Remember, long-term capital gains stack upon ordinary income.

Okay, let’s talk capital gains for a second. You include taxes paid on capital gains when considering your effective tax rate. However, a separate, parallel taxation system for capital gains goes into your effective but not marginal tax rate. Remember, the marginal rate is on your last dollar of ordinary income, which does not include long-term capital gains and qualified dividends. Does that make your head hurt, too?

Back to the graph above. Taxation also includes FICA while working. You pay ½ if you have a W2 and all of it if you have a 1099. State taxes are also interesting to consider in retirement, as sometimes they are due on income but not on social security, pensions, and/or RMDs. Each state is a little different; is your state retirement-friendly?

In this example, the effective tax rate is 30% before retirement and drops below 5% until RMDs kick it back above 20%. After that, effective tax rates will slowly increase through retirement as RMDs increase.

Whew, there are many moving parts to taxes over your lifetime!

Next, let’s look at the marginal tax rates over time.

Marginal Tax Rates over Time

Marginal Tax Rates over Time and Tax Rate Arbitrage

Above, we can see the same scenario for the marginal tax rates over time.

You are above the 32% tax bracket (which becomes 33% when TCJA expires in 2026). Your marginal tax rate is 35%, so you pay 35 cents in federal taxes on the last dollar you earn.

Income on investments keeps you in the 22% tax bracket during early retirement.

Then, note that RMDs kick you back in the 35% bracket. It’s too bad they didn’t do Roth conversions up to the 25% or even 28% tax bracket. They would have saved a ton in taxes over time…

Speaking of saving a ton of taxes, let’s talk (finally) about tax rate arbitrage.

What is Tax Rate Arbitrage?

Tax rate arbitrage uses the tax code to pay less in taxes over your lifetime.

Understand the breakpoints and play on either side of the breaks. Money is fungible, so get it in your pocket by paying less tax. This is how you can buy Uncle Sam out of your retirement.

If you make a lot of money at some point in your career, do Roth IRAs/401k when you are young and not earning much. You pay more taxes at a lower marginal rate to save money in a tax-free account. This grows, and you can spend it later without bumping up your “income” in retirement, thus being exposed to higher marginal taxes later in life.

Then, you defer as much money as possible during your peak earning years. This can be via a traditional retirement plan, non-governmental 457, or other non-qualified retirement plans. The income you defer comes out of your top marginal tax rate and lowers (albeit slightly) your effective tax rate.

Next, do Roth conversions (from qualified plans) or spend the money (from non-qualified plans or qualified plans if you need the money) during your Tax Planning Window. Your tax planning window is the time after you have earned income and before you have to recognize social security and RMDs as income. That’s the way to do tax rate arbitrage!

As an aside, you can also accelerate and defer income by using different sources of depreciation, such as business, real estate, or farm and ranch tax deductions with W-2 income.

How Tax Rate Arbitrage Works

To see how tax rate arbitrage works, look at an example of a dollar. To defer it, you save 35 cents in taxes during your peak earning year. Sweet!

Next, you owe 25 cents in taxes to get that dollar back to spend in retirement. You saved a dime! That’s 10% of your money saved by tax rate arbitrage!

Conversely, if you are doing partial Roth conversions in retirement, you spend 25 cents to convert the money from tax-deferred to tax-free. This might prevent you from being bumped into the 35% tax bracket in the future. So would you pay 25 cents now not to be forced to pay 35 cents later? It sounds like a pretty good deal!

Tax arbitrage works this way: Save 35 cents to defer it, then spend 25 cents to get it back later.

Or, if you will spend 35 cents to get it in the future, pay 25 cents to get it now. RMDs might force you to take out more deferred money than you need to live on if you have too much in your pre-tax retirement accounts! So, paying the taxes now (doing Roth conversions), you might spend 25 cents now so that it doesn’t cost you 35 cents in the future!

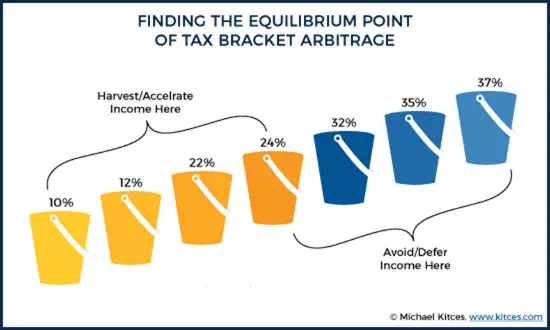

What is Tax Rate Arbitrage? Source Kitces

Above, you can see (in general) how to use tax rate arbitrage. You want to harvest/accelerate income when you are in the low buckets (10 and 12%). Roth all the time. In the middle buckets (22 and 24%), you need to know how income is this year compared to other years.

Finally, when you are in the high-income buckets (32% and up), it is likely a good idea to consider avoiding/deferring income via traditional (tax-deferred) contributions to retirement plans. Some who already have massive pre-tax retirement accounts and are scared of the size of future RMDs might want to consider paying some taxes now to hedge their tax rate arbitrage bets for the future.

Summary- Tax Rate Arbitrage

In summary, defer taxes during peak income, accelerate taxes, and harvest income during low-income years. That is tax rate arbitrage!

Of course, it gets more complicated. Your strategy changes if your heirs are in a high vs. low tax bracket. And there are QCDs to use for charity. Don’t forget about NIIT and the capital gains tax brackets! And IRMAA.

Remember, why do you want the Roth money? What is its purpose? What do you intend for it to do?

Knowing what you want your money to do for you is essential before you can tell it where to go.