Mandelbrot, Chaos Theory, and The Misbehavior of Markets

Stock market returns are not just random—they are randomly random. That is, stochastic.

While I love the word stochastic, it and Chaos Theory are poorly understood by ordinary people. This is too bad because stochasticism explains much of our daily life. Like, weather, or are you exposed to a virus today just going about your business? And, if exposed, will you get infected, symptomatic or not? These are all stochastic processes.

However, the real implication of Chaos Theory on the stock market is that market returns do not have a normal distribution. That is, there is no Bell Curve of stock market returns. Returns are randomly random, or fractal.

While chaos theory can seem far removed from the stock market, Mandelbrot brings theory and practice together in an important yet mostly neglected book. Let’s explore chaos, fractals, and Mandelbrot to improve DIY investing.

What is Chaos Theory, and the Stock Market?

Chaos Theory reveals symmetries that occur in complex adaptive non-linear systems. While that is a mouthful, the general idea is that initial starting conditions (e.g., a butterfly flapping its wings on a different continent) can set off massive consequences later (e.g., a hurricane resulting from the butterfly flap). Though one cannot predict the outcome, fractal patterns emerge.

It is easy to see fractals in stock market returns. Tick-by-tick returns for a single stock mirror the patterns of returns for the market over the decades. If you take the x-axis (time) off any return chart, no one can tell if the returns occurred over seconds or years. Stock market returns are fractal.

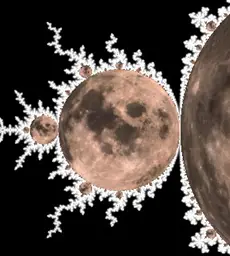

Above, you can see a fractal. The patterns all look the same if you zoom way in or pull way back out. The small patterns are inherent in and make up the large patterns.

What does chaos theory have to do with the stock market? Market returns do not follow a normal distribution (bell) curve. They are not even random walks down Wall Street. They are stochastic returns that can be modeled using the fractals of chaos theory.

All stock market models assume that the returns fit a normal distribution curve. Thus, fundamentally, all historical models of the stock market are wrong.

Mandelbrot explains why the model used to describe the stock market is wrong.

Mandelbrot and Investing

Benoit Mandelbrot is best known for coining the term “fractal” and his work in the early field of chaos theory. He summarizes how chaos theory can be applied to the stock market in his book:

The Misbehavior of Markets: A Fractal View of Financial Turbulence

“The brain highlights what it imagines as patterns; it disregards contradictory information. Human nature yearns to see order and hierarchy in the world. It will invent it where it cannot find it.”

― Benoît B. Mandelbrot, The (Mis)Behavior of Markets

Don’t pick up the book in the interest of your time unless you have an interest in fractals and investing. Or, note that Nassim Nicholas Taleb remarked that Mandelbrot’s book is: “The deepest and most realistic finance book ever published.”

The underlying idea is that a normal distribution curve does not represent market returns. Another way to think about it is volatility clusters.

That is, when there is volatility, there is a lot of it. When the market is calm, there is very little volatility. That seems self-evident, but since there is no normal distribution of returns, standard deviation is not a marker for volatility.

Mandelbrot’s subtitle is “a fractal view of financial turbulence.” Turbulence (or volatility) is fractal. He points out that we have to view risk, rewards, and extreme risk (ruin) through the lens of fractals to understand them deeply.

Before getting to some deeper points, let’s review the book’s three sections.

The Misbehavior of Markets: A Fractal View of Financial Turbulence

First Part: Models Fail to Describe the Market

The first part of the book is rather straightforward: Current models fail to adequately describe the financial system. This history lesson explains how we arrived at current models and why they fail to truly represent the nature of the stock market.

Second Part: Chaos Theory

The next part develops the MultiFractal theory and discusses the true nature of markets. This is worth the price of admission. I’m not going to discuss the multifractal theory much more, as you will need to read the book to understand this concept cohesively.

Pick up James Gleick’s Chaos for a simpler, less market-specific overview of the topic,

Third Part: Future Paths

As far as future paths, Mandelbrot does a decent job describing the problem, but he fails to provide solutions. This is not a criticism; it results from working with a complex non-linear system.

In summary, this book is not about making a killing on Wall Street; it explains why others fail to do so. The simple fact is that most are using the wrong model.

But what should be replaced with? Now, that is the question. It begins with fractals.

Fractals in The Stock Market

Since fractals are paramount to understanding how we can apply them to the stock market, let’s spend more time unpacking them.

What are Fractals?

Fractals are self-similar. They start with basic rules and wind up amazingly complex. Yet smaller parts inherently reflect the whole.

Fractals are how we develop complexity from simplicity. It is seen in the shapes of nature (waves, weather, sand, landscape, trees, etc.).

Since fractals are difficult to comprehend, we often resort to pictures or fractal geometry to provide an example.

Above, you can see another geographic representation of a fractal. Consider this a three-dimensional picture of stock market returns regardless of the time frame.

Or:

How can you get 5-10 “100-year floods” in a short amount of time? Because weather (and climate) doesn’t distribute normally, it is fractal.

This is why there are multiple recessions in a short period or long stretches of boom times. The market has no memory, and tomorrow’s returns are not just random; they are randomly random. Small inputs can change everything in complex adaptive systems with unknown (and indeed unknowable) positive and negative feedback loops.

In other words, there are “fat tails” to worry about. Moreover, since volatility clusters, fat tails are contagious. So, while a normal distribution curve suggests that tail events are rare, fractals predict that they are startlingly common. Thus, the “100-year flood” occurs twice in one year.

This feature of the market, rather than being a bug, helps change our understanding of risk and reward and fat tails (extreme risk… AKA ruin).

A Fractal View of Risk, Reward, and Ruin

How can a DIY investor profit from understanding chaos theory? By understanding how fractals affect risk, return, and ruin (which is extreme risk or black swans).

A Fractal View of Risk

So what is risk? This is a profound question and the source of much misunderstanding.

Market snake oil sells you that risk is volatility, and you can hedge risk.

Mandelbrot argues that markets are much riskier than most realize. The theory is inadequate and inaccurate, so the entire financial system smacks of market timing. Instead, discussions of risk are tricky and complex.

A Fractal View of Reward

Since the market returns are not “normal” or random, much of the return comes in big jumps. Since volatility clusters, take advantage of the times of low volatility.

A Fractal View of Ruin

Mandelbrot’s most interesting ideas come from his discussion of ruin, so much so that Taleb’s The Black Swan is dedicated to Mandelbrot.

Black swan events are much more common in the real world than using normal distribution models would have you predict. These are the clustered fat tails that can lead to ruin.

Mandelbrot says: “Conventional models … are not merely wrong; they are dangerously wrong”

Additionally, markets deceive. Humans are pattern-seeking animals. Yet, there are no non-fractal patterns in the market. Therefore, we see things where there are not, which commonly leads to mistakes.

“If you are going to use probability to model a financial market, then you had better use the right kind of probability. Real markets are wild. Their price fluctuations can be hair-raising-far greater and more damaging than the mild variations of orthodox finance. That means that individual stocks and currencies are riskier than normally assumed. It means that stock portfolios are being put together incorrectly; far from managing risk, they may be magnifying it. It means that some trading strategies are misguided, and options mis-priced. Anywhere the bell-curve assumption enters the financial calculations, an error can come out.”

Lesson to Learn from Mandelbrot on the Stock Market

“But to say the record of their transactions, the price chart, can be described by random processes is not to say the chart is irrational or haphazard; rather, it is to say it is unpredictable.”

Yet Mandelbrot believes there are lessons to take despite the randomness. Here is a list:

- Low fees and expenses are paramount

- Broad diversification is a free lunch

- Know that unpredictable outcomes are predictable

- The data settles down with longer time frames, so stay invested

- Avoid those who are overconfident in conventional models of the market

Many of these points also can be considered icons of behavioral finance.

Summary: Chaos Theory in Stock Market

Sometimes, breaking out of the echo chamber of investment blogs and Wall Street advice is tough. Mandelbrot and his Misbehaviors of Markets deserve more credit. Break out of the notion that some people actually understand how the whole thing works.

Wall Street works most efficiently at separating you from your money. Their model is “complexity with a side of fees.”

Break free of the echo chamber; if the common model is flawed so deeply then risks are beyond what they predict. Chaos theory helps us understand that risk is not standard deviation and ruin is unpredictable (so you should expect it).

Good work as always David. If I understand this, doesn’t it imply that SWR calculations as well as paying someone large amounts of money to manage your portfolio to ‘beat the market’ are both inherently flawed and a waste of time and money?

I think it implies that most things people do to study the market is a waste of time and money!