Lock in Training Rates for Disability Insurance

I’ve been giving financial talks to third-year family medicine residents for seven years, and I have been impressed with the degree of improvement in their financial literacy. The one exception is that I have to meet a resident who had their own occupation disability insurance set up before they graduated. I advise getting disability insurance while you are still a resident and can get training discounts.

Let’s discuss disability season for early career physicians, during which you can lock in the training discounts for the duration.

I use LeverageRx for physician disability insurance.

Disability Insurance for Physicians

Employed physicians get disability through their employer, but it is usually not enough, may not be related to their own occupation, and, of course, terminates when they end their employment.

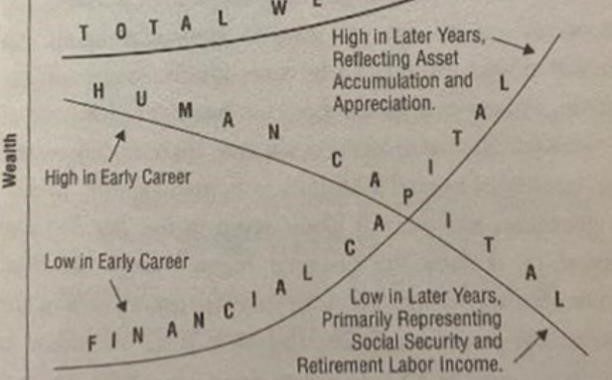

While disability insurance is expensive, there is no better investment early in your career than insuring your human capital. Once financially independent, you can let go of your disability insurance. Meanwhile, nothing will derail your financial independence quicker than disability. Well, death and divorce also aren’t great.

So, everyone agrees that early-career physicians need disability insurance. When should you get it? Let’s examine the numbers and see why training discounts are so important.

Training Discounts

During training, many insurance providers offer 10-20% discounts that stay with you for the duration of your policy. There are usually grace periods after training so you can look up to 180 days after graduation. An independent insurance agent can help you shop around and find the best policy for you.

Training Discounts for Males

For this example, let’s look at a disability policy for a 31-year-old male. In residency, a policy for $5k insurance per month costs $150 a month. To annualize the cost, a policy to protect a $60k yearly salary costs $1806, about 3% of the protection amount.

Next, at age 34, we assume a $5k per month increase in the policy, which costs $166 a month. So, for $120k of protection, you pay $3,795 a year, about 3.1% of the protection amount.

Assume this 34-year-old did not lock in training discounts and wants $10k per month of disability insurance. At that point, $120k of disability insurance costs $5115 monthly, 4.3% of the amount protected.

The big picture is that you spend 4.3% of the disability payout to protect your human capital without the training discounts and 3.1% if you lock in disability insurance while in residency.

Assuming you have no medical events over the three years where you don’t have independent disability insurance, you pay an extra $1320 for the same coverage. After four years, you start saving money because you locked in training discounts.

After 20 years, you have saved $21k in premiums by getting disability insurance while in training.

Training Discounts for Female Physician

Disability insurance is more expensive for female physicians.

I’m not going to bore you with the numbers because my eyes are glazing over, but for a 34-year-old resident, coverage is 4% of the protected amount, and a $60k increase after three years is 4.1%. If she wants the same amount of disability insurance without the training discounts, she should expect to pay 5.6% of the coverage.

It takes female physicians 4.9 years to make up for those extra three years of coverage, and after 20 years, she expects to save $33k.

It’s Disability Insurance Season for Early Career Physicians

It is disability insurance season for early-career physicians. While disability insurance is not the sexiest topic on the road to financial independence, it is one of the most important ways to protect your human capital. Human capital is what most residents have, along with their negative net worth.

Lock in training discounts and save money over the years. For most, not only do you get the extra coverage for the time you lock in the discounts, but you save money in premiums just after 4-5 years. The savings increase over time and help you become financially independent earlier.