It’s Time to Rebalance this Account

I have a good-sized retirement account that I invested in the Merriman Ultimate buy-and-hold portfolio, and it is time to rebalance. Will you help me?

I have $450 in cash in this account. It is at Schwab, so I’m sure it wasn’t swept into anything paying a real interest rate. So, at some point, I need to understand where this cash is coming from and how to invest it when it comes in optimally.

Otherwise, this is a 12-fund account worth about the SIPC limits. Let’s start at the bottom line (the Account Total. I made 7k today on this account, yet I’m still almost 10k behind when I rolled this account over two years ago. It was bad timing, and the market is about to get to new all-time highs after a long time of going sideways. It is normal for the stock market to keep hitting all new-time highs, and it has been a really long time since it has. This account benefitted from working from 2007-2022. It is a rollover into a solo 401k from one of my W-2 gigs at a hospital.

Help Me Rebalance

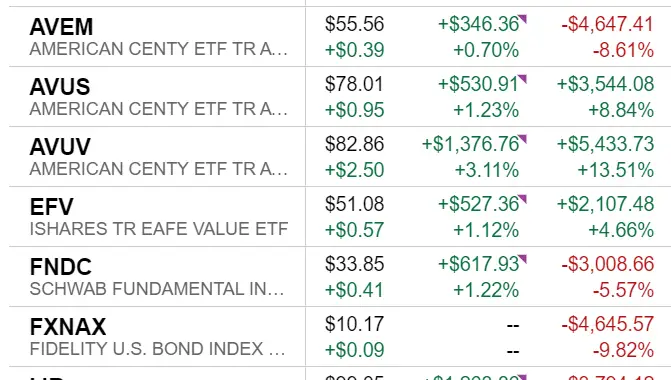

Who are the winners and losers in my ultimate portfolio in the last two years?

Winners

Avantis US Small Cap Value ETF (AVUV)

How about that small-cap value working again? Just today, I’m up 3%, and it is up 13.5% despite the poor timing of the initiation of this account.

Do you think now is time to pear back on small cap value, or should I let my winners run?

Only 4 of the 12 ETFs are Winners

It has been such an ugly two years that only 4 of my 12 ETFs are green. Ugly. What is number two after small-cap value?

Second Winner in the Last Two Years

AVUS | Avantis U.S. Equity ETF

I love the name of this ticker. Remember, Avantis has ETFs; you can access them without an advisor. I use Vanguard, ITOT, and Avantis ETFs.

Large cap had a bad 2022 but is killing it in 2023. The Magnificent 7 buoyed the market and the equal weight and everything else has trailed large cap growth.

iShares MSCI EAFE Value ETF (EFV)

The next surprise is that EFV is the number three best performer over the last two years. Value Ex-US and Canada is working if you look back at two years. Since it has been such a poor performer over the last 15 years, do you think I should trim this position or let it ride?

The Last Winner

RPV – Invesco S&P 500 Pure Value ETF

Believe it or not, value is working again. RVP is up 2% today and is the last winner I have in my two-year-old portfolio, up just over 3.6% since I bought it.

Here is the lesson to learn. Value has had a better last couple of years than growth. Where have you heard that before?

My Losers

This is a decent chuck of money invested after rolling over a couple of years of 401k contributions and matching grants. Since I FIREd, I decided I needed a solo 401k, and it was an adventure and totally not worth it. Regardless, this account is now two years old and just a bit below negative. After all, it was invested the month the market hit all-time highs. I don’t need this money for 20 years. But it is a bucket an needs rebalanced. What are my biggest losers, and should I buy them during my rebalance, or should I try and time the market?

The Biggest Losers: Bonds and Emerging Markets

AVEM and FXNAX were my biggest losers. Emerging markets have had a bad decade plus, and bonds had their third-worst year ever in 2022.

I want bonds rather than cash right now, and emerging market value has never been cheaper.

The Rest of the Worst

As I said, 8/12 ETFs are down over the last two years. Help! Also doing poorly are FNDC, IJR, and VNQ.

International small cap, US Small cap, and REITs are the rest of the worst. Is it time to go all in with these three asset classes? Or is the impending doom of commercial real estate going to submarine all REITs, and is small actually a factor? Value has had a comeback. But do small companies necessitate a better risk premium than those who form moats and monopolies? Is there a small cap premium in a world of big data?

It’s Time to Rebalance this Account

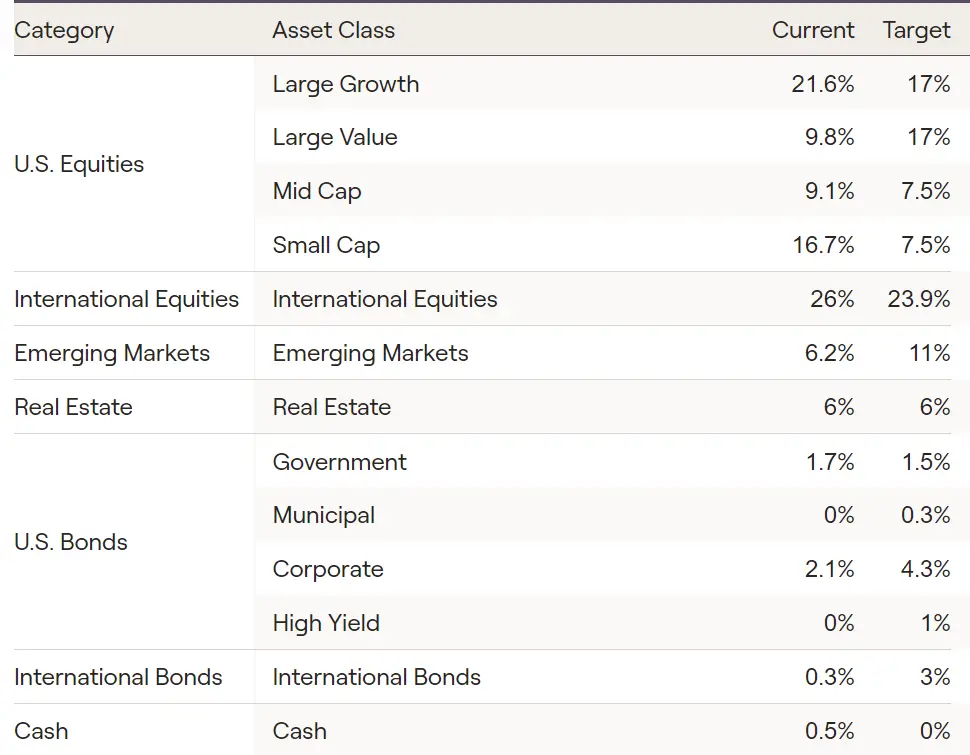

It’s time to rebalance this account. But I’m not going to. Remember, this account doesn’t exist in a vacuum; it is part of my overall asset allocation.

Above is my whole portfolio. Note that I have less large-cap value than the program recommends, and I have quite a bit more small-cap and small-cap value.

So, I generally like to rebalance every other year or so. Maybe next year?