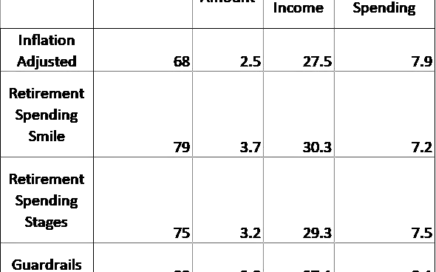

Asset Allocation 5 Years From Retirement

Asset Allocation 5 Years From Retirement What should your asset allocation be five years from retirement? Should you De-Risk your portfolio for retirement? What does a good pre-retirement glidepath look like? Five years from retirement, let’s consider your asset […]