Lifecycle Investing and 100% Equities for Life

One hundred percent equities for life? That’s what a new paper on lifecycle investing recommends.

Beyond the Status Quo: A Critical Assessment of Lifecycle Investment Advice was published earlier this month and reported that 50% US and 50% international equities are the best asset allocation for your entire life. Instead of, say, 80/20 when you are young and 60/40 when you retire (or any target date fund), you are supposed to be 100% equities the whole time. And in de-accumulation? The same!

This makes sense as the historical returns of equities have been better than cash or bonds. But let’s dig into a few assumptions and understand when and why you need bonds, at least at some point in your life.

Paper’s Assumptions

The paper assumes you save for 40 years, retire with Social Security, and use the 4% SWR to model withdrawals. You can then use different asset allocations, including target date funds and different stock-to-bond ratios (including 100% stocks and all cash).

Longevity is random and based on mortality tables.

Results

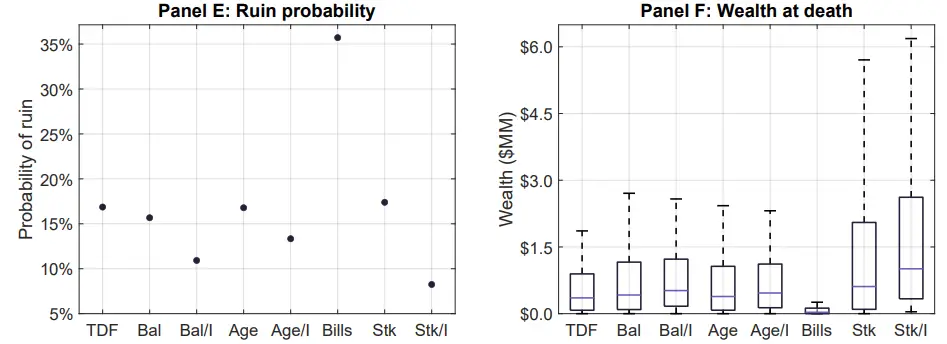

Using historical data, different asset allocations had different probabilities of ruin. Starting with panel E, above, TDF (target date funds), BALanced, BALanced plus International, Age-weighted, age-weighted plus international, T-Bills (cash), Stocks (100% US), and Stocks plus international (50/50) have different chances of ruin. The highest, of course, are using T-Bills since you don’t accumulate as large of a nest egg before retirement. Next, all other asset allocations have a 10-20% chance of ruin, except for the 50/50 US/International portfolio, which has the lowest chance of ruin.

In panel F, you see the amount left behind at death. You can see the 90% percentile is almost $6M, while the median levels are much closer for all asset classes (aside from T-Bills).

Should I be 100% Equities All the Time?

So, should you be 100% equities all the time? Yes, during accumulation, you can be 100% equities. I argue that 90/10 has about the same returns as 100/0, so it is ok to have an emergency fund.

Other lifecycle plans argue that you can use leverage when you are young. That is, borrow money and invest in stocks. You do this when you have a mortgage, as a mortgage is the same as negative bonds.

The Vanguard lifecycle method is much more traditional.

Beyond the status quo, however, you can be much more aggressive than traditional retirement advice suggests.

The paper doesn’t mention the sequence of returns risk. It makes sense to de-risk 5-10 years before retirement.

Then, a rising equity gluidepath or a bond tent can be used to have maximal (yet de-risked) exposure to equities.

The status quo is that older people cannot tolerate the risk of an all-equity portfolio. Does the fact that an asset class (equities) has a better historical return than other asset classes change that status quo? Behavioral finance has a lot to say on the subject.