401a, 403b, and 457b Plans

Physicians are high-income professionals who optimally defer income into retirement plans during peak earning years.

If you can access a 401a vs 403b vs 457b, you work for the government or a not-for-profit hospital system. Which account should you use and in which order?

Well, that depends on whether you are a government or non-governmental employee! Let’s discuss physician retirement accounts: 401 (a), 403 (b), and 457 (b) plans.

Governmental vs. Non-Governmental Retirement Plans

As I mentioned in the introduction, the plans differ greatly depending on whether you are a government (local, state, or non-VA federal) or non-governmental employee.

You have some unpacking if you are a non-governmental employee (that is, you work in a not-for-profit hospital). The rest of the blog is for you. But if you work for the government, your decision is pretty easy!

Let’s get the Governmental physicians out of the way first.

Governmental Physician Retirement Plans

VA Physicians

The Thrift Savings Plan (TSP) is pretty awesome for accumulation, but consider ditching it to de-accumulate. While there are only five offerings (Large Cap, Small Cap, International, Bonds, and a cool “G Fund”), they are inexpensive, and sometimes less is more (especially with passive funds and low costs). In addition, there are target-date funds, which are fine for many in accumulation.

The TSP is a federally qualified defined contribution plan. Aside from a few quirks, it is exactly like a 401k. Use it!

The TSP has a Roth option. It offers a 1% free match and a 5% total match.

Other Governmental Physicians

Non-VA governmental physicians might work for local, state, or federal healthcare facilities. This means you have a governmental 457 (as opposed to a non-governmental 457… you must know the difference).

The governmental 457 is awesome and should be maxed out after you get your match. It just might be the best retirement plan in existence! There is no penalty for early withdrawals once you separate from service, and the governmental 457 can just be rolled into an IRA if you want.

So, do this: get your match (usually by contributing to a 403b, but it could be the 401a). After you have your match, fill up your 457b. Next, if you still want more tax deferral, fill up the rest of your 403b or 401a. Remember, the 457 limits are separate from the other retirement plan limits. That means 22.5k plus 22.5k plus the match.

There might be a Roth option somewhere in the mix. Roth or not Roth depends on Tax Arbitrage.

Physician Retirement Plans if You Work at a Not-For-Profit Hospital

The 401, 403, and 457 dance gets more complicated when you work at a not-for-profit hospital. The first decision you need to make: should I invest in the non-governmental 457?

Should I Invest in the Non-Governmental 457?

Please read my blog about non-governmental 457(b) plans for details (it is the best on the web).

In short, the NG457 is not your asset and may have bad distribution options. You should only use one if you know what you are getting into.

If you use your 457, you can defer an additional $22,500 a year. Please understand that the 457 limits are separate from the other retirement plan limits. An NG457 can be useful in early or traditional retirement, but an NG457 is generally not a good idea early in your career.

401a vs. 403b, 401k: Other Retirement Plans for Non-Profit Hospitals

After deciding whether to invest in your NG457, the next problem is how your retirement plan is set up. You might have a 403b that matches into a 401a, a stand-alone 401a (which both you and your employer fund), or a 401k that has the chassis of a 401a.

Yes, not-for-profit hospitals are starting or switching to 401k plans typically reserved for corporate for-profit entities. After some tax law changes in 2006, you can have a stand-alone 401k plan, and the match goes right into that 401k.

Before this, and still most commonly, hospitals set up a 403b plan for employee contributions, and the match goes into a 401a. A 403b plan could take your employer’s match, but if they do it that way, there is no vesting, and the money is yours right away! Of course, they want you to have to vest, so you stick around for at least six years after signing—golden handcuffs lite.

If you have a 403b and a 401a, your hospital may soon switch you to a 401k. Let’s look next at this evolution.

Comparing Retirement Plans 401a vs 403b vs 457b

To nail things down, let’s go over the most common comparisons. Remember, this is not applicable if you are a Governmental physician.

401a vs 401k

This is the account where you get your match. Of course, the 401k is also where you make your contribution.

401a vs 457b

The non-governmental 457b plan is an entirely different beast and requires separate considerations. Do not confuse an NG457 with any other type of plan.

401a vs 403b

You might have both of these plans. In this plan, you will contribute your employee funds (403b) and get your employer match (401a).

401k vs 457b

Aside from the independent $23,500 you can contribute yearly, these plans have almost nothing else in common.

401k vs 403b

See the discussion about the evolution of physician retirement plans above.

Church Plans

If you work at a church, then don’t read this. There are blogs devoted to your plans.

Matches are Free Money!

The match in an employer-sponsored retirement plan is important! Of course, with your contributions, you get an income tax deduction.

But if your employer matches 3%, you get an instant 100% return on your 3% investment! The Match is part of your salary; don’t leave it on the table. Make sure you are always investing enough to get matching contributions.

The matching contribution in my plan is 100% of the first 5%. So, if I put in 5% of my salary, I get a 5% match plus 1% basic = 6% match. Again, plans can have different matches. Know your 401 (k) plan matching contributions! This is essential for 401 (k) plans!

Also, note that a $280k salary is limited on matching contributions. If you make $400k a year, you will only get the match on the first $280k of your salary, no matter how much you contribute.

Summary Plan Description

So, to see if your 401a has a true-up, find the Summary Plan Description. Sometimes, this can be found online; sometimes, you must ask HR for a copy. By law, not all 403b plans will have a summary plan description, but they should have something similar.

(Looking for a True-Up in your Summary Plan Description)

I found my 403b plan’s Summary Plan Description online and searched for “true.”

My plan has a true-up, so I can front-load it, but I might not get my full match until next year!

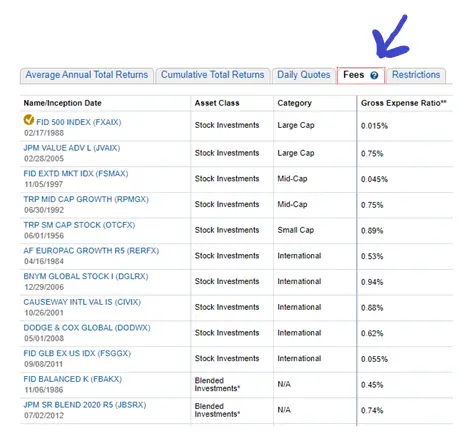

Pay Attention to Fees!

(Fees and 401a)

Remember, current expenses—fees—correlate best to future returns. You can tab over from average annual total returns to fees and find the Expense Ratio.

Summary: Physician’s Retirement Plans: 401a, 403b, and 457b plans

These plans are all employer-sponsored retirement plans that allow you to defer income. 401a vs. 403b vs. 457b are all pretty much alike.

The 401a plans are particularly confusing, as they can be called money-purchase or profit-sharing retirement plans. The functionality of these plans depends on whether the government or a not-for-profit hospital employs you.

The 403b plans were initially designed to house annuities but then gained functionality to allow custodial investments in mutual funds. Now, they are a dying breed and will, for the most part, be relegated to history.

The 401k plan (which may be built on a 401a chassis) is the future for not-for-profit hospitals.

Finally, 457 plans should be treated with extreme care if they are non-governmental and with affection if they are governmental. Remember, contribution limits for 457 and other employer retirement plans are separate, so consider filling out both!

Yes, all are tax-deferred. Which should you invest in, and in what order? The answer depends on whether you are an employee of the government.