Should You Use your Non-Governmental 457(b) Plan?

This is the ultimate guide to non-governmental 457(b) plans. If you are a highly compensated employee of a non-profit institution and want to know if you should use your 457 plan, chances are you are in the right spot, especially if you are a physician.

Many physicians and executives can access a non-governmental 457(b) plan. Also occasionally known as a Top Hat Plan, they can get confusing quickly.

First, the following information is not for those with governmental 457 plans. If you work for the county or state government and have a governmental 457 plan, congratulations! You have another (and probably better) 403b plan. Use your 457 first, and move on!

Secondly, if you have a non-governmental 457(f) plan—well, take plan documents home and plan to waste several hours trying to figure that puppy out. I’ll detail the differences between the 457(b) vs. 457(f) below.

Moreover, there are many flavors of Non-Qualified Deferred-Compensation (NQDC) plans. Look closely and discover what type of plan you have. NQDC is the broad category of plan. You must dig deeper into the plan documents if you have a for-profit employer. All 457 plans are NQDCs, but not all NQDCs are 457s.

In essence, this ultimate guide to top-hat plans is for a highly compensated non-profit institution—a 501(c)(3)—and is considering investing in their employer’s non-governmental 457(b) plan. Remember, the money is not yours (it is an asset of your hospital and subject to its creditors) until it is in your personal bank account.

Definition and Purpose of the Non-Governmental 457 Plan

A non-governmental 457 plan is an extra or bonus tax-advantaged salary deferral plan for a select group of employees. They allow you to defer your salary during peak income but have different distribution options than qualified plans (401k and 403b). Since they are non-qualified, they cannot be offered to rank-and-file employees. Qualified plans cannot discriminate and must meet nondiscrimination testing.

On the other hand, Top Hat Plans must discriminate.

Why do employers offer non-governmental 457 plans?

Congress authorizes employers to offer non-governmental 457 plans with preferential tax treatment to encourage retirement savings.

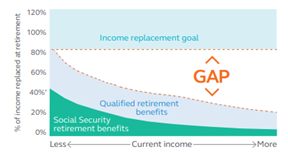

Figure 1 (Why employers offer non-governmental 457 plans)

457 plans are often pitched with a figure similar to the one above. Note that the “income replacement goal” is 80% of the figure. Social security income is green, and qualified retirement benefits sit on top. As your current income increases, there is a larger and larger gap between replacement goals and your ability to put away money for retirement.

In short, if you make more money during your career, they expect you will spend more money in retirement and thus have a need to fill that “gap.”

While we can criticize in multiple ways, the idea that you should save more money if you earn more holds true.

Beyond the ability to put away more tax-deferred income, employers offer non-governmental 457 plans to retain talent and encourage loyalty. These plans aim to keep executives and key employees happy and engaged.

Let’s move on to the basics of 457(b) plans.

Basics of the Non-Governmental 457(b) Plan

IRS Code Section 457 provides tax-deferred treatment for these non-qualified deferred compensation plans. Sometimes called NQDC plans, sometimes Top Hat Plans—it can get confusing quickly.

Quickly, here are the basics of the non-governmental 457(b):

- Limited to a select group of employees (thus not Qualified plans which, by definition, cannot discriminate against rank and file employees)

- The plan is unfunded, and all assets are the property of the employer

- Assets are available to creditors of the employer due to bankruptcy or litigation

- Total contribution limit of $23k in 2024

- CAN NOT be transferred to any other pre-tax plan (Such as IRA, 401k, etc.). This is important: you can not do a rollover on a non-governmental 457 plan to an IRA.

- Have very different distribution options than qualified plans

There are a couple of important points above. First, you don’t pay current income taxes with a 457 because you cannot access the deferred income. The employer cannot hold the assets specifically for you separately. They promise you a future salary but hold the assets in their general funds, not in a particular account with your name on it. The 457 plans are unfunded. Creditors and predators have the right to your assets before you do.

Those are the basics. What are the most important considerations before you defer your salary?

Most Important Consideration for a Non-Governmental 457 Plan

For most folks in their highest income-earning years, a Top Hat plan is a chance to defer paying taxes on salary until later. This can be a good idea if:

- You are in the top two or three tax brackets

- Or, you are getting close to retirement

- Or, you are considering funding options for early retirement

- AND you are fully contributing to other pre-tax accounts

- AND there are acceptable distribution options

In summary, a non-governmental 457 is NOT the plan you fund first.

You only invest in a non-governmental 457 plan if you have your other ducks in a row AND you have a need! Your ducks include fully funding other retirement accounts, including HSA and backdoor Roth. The need is to have the highest tax brackets within 5-10 years of retirement or consider early retirement.

In addition, there must be good distribution options, and you should have a plan for these distributions.

This is important to understand. As the 457(b) money is not yours, you don’t want to defer your salary to one of these top-hat plans without contemplation. There are significant downsides.

Downsides of Non-Governmental 457(b) Plans

What are the downsides to consider?

- The deferred salary is subject to the creditors of your employer

- These plans are unfunded, which means your employer does not have to set aside money to pay for these liabilities in the future

- Can you roll over a non-governmental 457 plan to an IRA? No!

- Unlike 403b plans, you pay Medicare and FICA taxes with 457 Plans

- Distributions are reported on W-2 forms rather than 1099s

- Most importantly, distribution options can make or break a top-hat plan

The issue with Medicare and FICA taxes differs from that of qualified plans. Since this is considered deferred salary, you must pay Medicare and FICA taxes if owed. In addition, when you get distributions, you are issued a W-2 by your employer rather than a 1099 from a qualified plan. Usually, the salary you defer is above the wage limit for social security, so you pay the 1.9% FICA tax upon deferral.

Let’s discuss the most critical potential downside separately.

Non-Governmental 457 Distribution Options

Since these plans are Non-Qualified Deferred-Compensation (NQDC) plans, they don’t have to follow ERISA guidelines. Importantly, this means they do not have Summary Plan Descriptions.

That said, non-governmental 457 plans do need to have some documentation. Ask your Employer for a copy of the plan documents.

In the plan documents, look for the 457b distribution options. The default distribution option for a nongovernmental 457 plan is a lump sum distribution within 60-90 days of severance from the employer. Also known as separation from service, you get ALL your deferred salary reported in a W-2 lump sum in one tax year. If you are not careful, this can result in a significant tax hit at higher rates than deferred.

Employers can and usually do offer other 457b distribution options. For example, they may extend out distributions until you are 70 or start them after a different specified delay. It is important to note that the distribution decision is irrevocable; sometimes, plans may offer you a one-time chance to change your mind.

Usually, you are forced to take distributions over 5-10 years. This is important—if you are still planning on working a highly compensated job after leaving your current employer, you will have to take the nongovernmental 457 salary on top of your current salary.

This is why waiting to fund one of these plans is essential until you know your traditional or early retirement plans. Deferring income now just to take it soon while still earning income doesn’t do any good.

Planning for non-governmental 457 b distributions can be tricky. Therefore, your 457b distribution options are the first important consideration.

Tax Planning and Nongovernmental 457 plans

Tax planning is vital for nongovernmental 457 plans since they are deferred salary.

Suppose you plan to take distributions after you are 70. The fully taxable distributions sit on top of the taxable portion of your social security, pensions, and annuities and required minimum distributions from your qualified retirement accounts. Significant tax arbitrage or tax savings are still possible if you are in the highest two or three tax brackets while working or near the end of your career.

For those considering early retirement, there are other considerations. People who retire early have a fantastic Tax Planning Window, and deferred salary from nongovernmental 457 plans can be a blessing or a curse. Suppose you need the income, great. Just remember you are going to pay ordinary income taxes on the distributions. Be aware this income may keep you from getting Premium ACA Tax Credits for health care insurance and limit your ability to do Roth conversions.

Knowing your distribution options is crucial to tax planning with your nongovernmental 457 plan.

Employer Bond Ratings and Nongovernmental 457(b) Plans

Also, it is essential to check your employer’s fiscal health. You can search for your employer and “bond ratings.” There are firewalls and paid services to wade through, but make sure you find a PDF report of your employer’s bond ratings.

You can be more confident and take a 5-10-year distribution if they have good bond ratings. On the other hand, if they have poor bond ratings or significant lawsuit liabilities, consider taking a lump sum or 3-5-year distribution.

Advanced Concepts in Nongovernmental 457 plans

If your head is already spinning, you have the basics above to confidently decide whether or not to invest in your nongovernmental 457(b) plan. There are other considerations, however, which I will address below for the advanced investor.

Rabbi Trusts

Occasionally, non-governmental 457 plans are placed in Rabbi trusts. These irrevocable trusts protect the assets if there is a change in management but not due to general creditors. Usually, if there is a change in leadership, they will assume the liabilities of the 457 plan, but they can force the distribution of the assets or even claim them as their own. Remember, though, that top management also invests in the nongovernmental 457 plan, so it is in their financial interest to see that a fair outcome is negotiated during a change in leadership.

Employer Contributions

IRC 457 allows annual employer and employee contributions to 457(b) plans. Typically, at least in health care, nongovernmental 457(b) plans have employee contributions. Note that 2023 ERISA plans increased the contribution limit to $22.5k, the same as 457(b) plans.

457(f) plans are different and have different contribution limits.

Non-Governmental 457(f) Plans

Occasionally, you run across non-governmental 457(f) plans in health care, which may be called “Golden Handcuffs.” These are called “ineligible” 457(f) plans and have employee and/or employer contributions. If the employer is for-profit, these are often informally funded via permanent life insurance products. These life insurance products act as a wrapper to defer taxes on the growth of the assets, which otherwise would require trust income tax payments. Typical (stocks and bonds) products or life insurance products can be used in not-for-profit settings. These 457(f) plans are complicated! For a comparison of 457(b) vs. 457(f), see this.

Catch-Up Contributions

Plans may have “Catch-up” contributions within three years of the normal retirement age. Check the plan documents.

Portability

Occasionally, upon service separation, you can transfer your non-governmental 457(b) plan to your new employer’s 457(b) plan if both plans allow it. However, this is the exception rather than the rule, so you should not utilize your 457(b) plan early in your career if you plan on traditional retirement.

So, what are the rollover options for a 457(b)? Usually, you do not have the option to roll over a non-governmental 457(b) plan. But because so many miss this point, let’s restate this explicitly. Non-Governmental 457 (b) rollover rules state that you cannot roll over a 457 (b) into an IRA, and most other non-governmental 457(b) plans do not accept incoming rollovers.

Withholding

You are provided a yearly W-2 form; generally, 20-25% of your distribution is held back for taxes. You can adjust your W-4 plan with your ex-employer and affect withholding.

This is Not a SERP

A supplemental executive retirement plan (SERP) is a top-hat plan that provides supplemental pension benefits. These plans typically look at your qualified and social security benefits and give a pension above and beyond those benefits. These are similar to direct benefit plans rather than 457 direct contribution plans.

Non-Qualified Deferred-Compensation (NQDC) Plans

Non-qualified deferred compensation plans (NQDCs) include excess benefit plans (which attempt to give employees options above the IRC 415 limit) and top hat plans. NQDCs can take many different forms and depend on the employer’s or employee’s goals. Section 457 covers NQDC plans specifically for government and tax-exempt organizations.

Conclusion: Ultimate Guide to Non-Governmental 457(b) Plans

What have we learned?

Congress allows our employers to offer us non-qualified benefits to encourage us to save for retirement.

If you work for the government, you are on the gravy train if you have a governmental 457(b).

If you work for a non-profit, you must be careful before investing in your non-governmental 457(b). Many considerations are outlined above, but 457 (b) distribution options trump all other concerns. You cannot roll over your NG 457 (b) plan into an IRA! You can and should if you have a governmental 457 (b) plan.

If your 457 plan has good distribution options, consider your need for additional tax-deferred savings. And remember the rollover rules or rollover options! Unfortunately, you cannot roll over a non-governmental 457(b) most of the time!

Next, you must have a future tax plan in place. This is why the distribution options are essential to consider.

Not all (or even most!) should consider using their non-governmental 457 plan. But if you do, understand the limitations and advantages of an additional tax-deferred plan.

This was a fantastic article and really provided clarity when I needed it as my husbands work recently decided to offer a 457. Thank you!

Great article! What bond rating would you think would be safe enough to use a non-governmental 457? Does it have to be at least investment grade or should it be even higher?

Since this is W2 income, can I use it to contribute to a back door Roth?

No. See “What isn’t Compensation” here.

Deferred compensation received (compensation payments postponed from a past year) is explicitly excluded.

Can I use it for qualified charitable contributions?

No, no QDC’s!

Since the annual distributions of the non-governmental 457(b) plan funds are reported as W-2 income, will such income be counted towards your “high 35” years for the purposes of determining your monthly social security benefit?

In Downsides… above, you said: The issue with Medicare and FICA taxes is different than qualified plans. Since this is considered deferred salary, you must pay Medicare and FICA taxes if owed. In addition, when you get distributions, you are issued a W-2 by your employer rather than a 1099 as from a qualified plan. Usually, the salary you defer is above the wage limit for social security, so you just pay the 1.9% FICA tax upon deferral.

So if a person retires with no other employment income and takes annual 457(b) distributions, how do you determine the amount withheld for social security taxes and Medicare? Note this is for someone taking 457(b) distributions for 5 years from age 60-65 and is not on social security or medicare. What is the percentage (social security and medicare) owed for this situation assuming a total W-2 income of $100,000 per year?

Since annual distributions of the non-governmental 457(b) funds are reported as W-2 income, will such income be counted towards your “high 35” years of income for the purposes of determining your monthly social security benefit?

I don’t know! My impression is no but I heard from someone that they were withholding FICA/FUTA. You can look on the 1099 and see a box that says something like income reported to social security. If it is reported to social security, it might. But again, my impression is no.