What Are QLACs?

What are QLACs and should you get one?

Another “good annuity” is gaining interest: the QLAC (Qualified Longevity Annuity Contract). This is “a DIA for your IRA.”

A QLAC is a Good Annuity, Too!

A QLAC lets you take money (up to $200,000) from your pre-tax retirement account and defer income into the future. This is proper longevity insurance and maybe a consideration for those with a long life expectancy and sizeable pre-tax retirement accounts.

In addition, you can get joint and survivor payouts, and there are options for period-certain and return of premium. So, while QLACs have more bells and whistles, they can be an important part of your longevity plan.

Some are excited to use QLACs to decrease Required Minimum Distributions (RMDs). The money you use to purchase a QLAC is not included when calculating RMDs. QLACs delay RMDs, though, and you will pay eventually.

QLACs allow you to defer annuitization until as late as 85. As a result, they can be an interesting option for longevity insurance and spouse protection/planning if used as a Joint and Survivor annuity.

Compare a QLAC to a SPIA

Since you are likely more familiar with a SPIA, let’s start there.

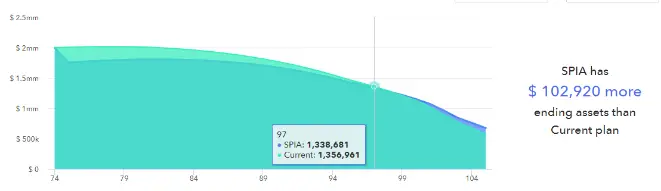

The Figure above shows a drawdown comparison between a SPIA and no annuity. In light green, without a SPIA, their assets decrease slowly over time. In dark green, with a $260,000 SPIA, note their assets decrease immediately as the money is irrevocably paid to an insurance company in exchange for the income stream.

At age 97, the plans “cross over.” That is, they have more remaining assets due to the income from the SPIA after that point. So if they live as long as planned, in the end, they have an extra ~$102,000 more left over for their heirs. Take away here: SPIAs can decrease the amount you leave to your heirs if you die before the “cross over” but increase the amount if you live longer than average.

What about a QLAC?

QLAC For Longevity in Retirement

In 2021, you can transfer 25% of your IRA (up to a maximum of $130,000) into a QLAC. Let’s look at $130,000 from an IRA and see what it buys if offered a 14.4% rate of return for a 10-year deferral of income. Note the higher interest rate due to the deferral.

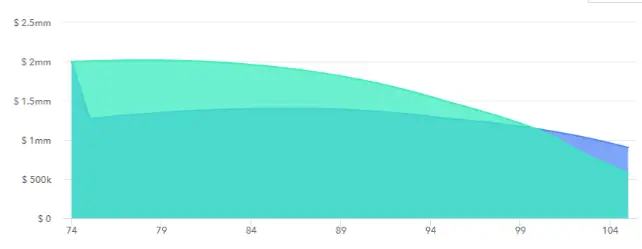

Above, you can see a QLAC vs no QLAC in a drawdown plan. Note that in dark green, a QLAC is purchased initially. Then, over time, the remaining assets have a lower withdrawal rate. As a result, the assets are not depleted over time, and you can see the cross-over point at age 99.

This means your net worth is higher if you live past 99 due to a QLAC.

Summary QLACs for Longevity Insurance

The IRS allows you to take a portion of your IRA and turn it into an annuity.

I like QLACs, and they are good annuities. They allow a return-of-premium feature but still have mortality credits. QLACs are great longevity insurance.

You can reduce your RMDs and guarantee a floor income to start later in life with a QLAC. If you are going to live a long life, what is not to like about that?

Show around for a QLAC at Leverage