A Good Annuity Comprehensive Guide to SPIAs

What is a “good annuity?” It is an annuity an advanced investor might want to buy! Usually, you are sold annuities, but not so with a good annuity.

When considering retirement income, should you use “good” annuities such as SPIAs, DIAs, or QLACs? What do those letters mean anyway?

If you know a little about “good” annuities and are considering one, read on for a comprehensive treatment of your options. There are different types of good annuities! These will not be sold to you, so you need to go out and learn about them and sign yourself up. And as a warning: this is a tough read and not meant for a superficial glance. You have found the right spot if you are looking for retirement income options via good annuities!

And remember, you need to have your investing bases covered before you even think about annuities.

Let’s learn about good annuities and SPIAs! Shop around for SPIAs at LEVERAGE

What is the Meaning of Good Annuity?

A Good Annuity means a product you seek out and purchase to mitigate risks and provide income as part of your comprehensive retirement plan.

You don’t invest in annuities; you buy them. They are insurance products that transfer risk. This is important to understand. The purpose of a good annuity is to transfer your risk to a risk pool. You trade liquidity for income with good annuities. Remember, despite what Wall Street tells you, you don’t need to be 100% liquid at all times; liquidity comes at a cost.

What risk are you transferring? That you might run out of money!

Instead of possibly running out of money, a good annuity guarantees a stream of income that won’t stop until you (and perhaps your spouse) die. And no, the insurance company doesn’t “win” if you die early. The risk pool wins!

Mortality credits are paid out to you when you take your income stream. What does that mean? Mortality credits are the increase (above bonds alone) in your income from an annuity because you have pooled your risk. This is because the insurance company knows that some people will die early, and thus, they can pay everyone a little more from the start.

Many fancy, expensive, complicated, agent-sold annuities don’t offer mortality credits. If you are being sold an annuity, chances are there are no mortality credits. A good annuity, on the other hand, features mortality credits. Again, mortality credits are why you “make more money” with an annuity than if you own just the underlying bonds. Some say: “Why own an annuity when you can just buy the same underlying investments as the insurance company does.” Do you understand why that is false? Good.

Let’s dive in and discuss the lineup of GOOD ANNUITIES.

What is a Good Annuity to Buy?

Next, look at the (very few) good annuities to buy. They include:

- SPIA

- DIA

- QLAC

Single-Premium Immediate Annuity (SPIA) is a good annuity

A SPIA is an immediate income annuity meant to provide income and some longevity protection (the risk of running out of income if you live a long life). The income you get every month doesn’t stop until you (or you and your spouse if you purchase a Joint and Survivor Annuity) die.

You get the mortality credits when you turn the income on (less than 13 months from the lump sum payment to the insurance company). SPIAs are helpful if you have an income gap now. As they are not inflation-adjusted, you will lose purchasing power with them in the future, so I don’t consider them longevity annuities.

Deferred Income Annuity (DIA) is a good annuity.

Another annuity specifically for longevity insurance is a DIA (Deferred Income Annuity). With a DIA, you make an initial lump sum payment but defer turning on the income for several years. In exchange, you get a higher percentage of income when it eventually is annuitized.

You get mortality credits and a bonus for allowing the insurance company to use your money for a while. So, a DIA might suit you if you have an income gap in 10, 15, or 20 years. This is real longevity insurance because it meets a future income need. If you die before the DIA starts, I guess you don’t have that income need.

DIAs pay more because you irrevocably give the money to the insurance company to use until you turn on the income stream. Eventually, they will pay you more per paycheck, which means they are relatively protected against inflation.

Given that DIAs “lock in” current interest rates when considering future payments, I’m not excited about them. Another option is a MYGA that you 1035 into an SPIA. This may offer you an equivalent amount of future income with less illiquidity. More about that later.

Qualified Longevity Annuity Contract (QLAC) is a good annuity

Before we get into QLACs, let’s talk about the account type you invest in. Brokerage, pre-tax, or Roth?

A Good Annuity in a Brokerage Account, a Pre-Tax Account, or a Roth?

Remember, there are different account types. For example, there are non-qualified (also called taxable or brokerage accounts) and qualified (pre-tax retirement accounts) accounts. And don’t forget Roth, though you need to be careful before putting a good annuity inside a Roth account.

You can buy SPIAs in both qualified and non-qualified accounts. The difference is the income stream’s taxation. This gets complicated quickly, but remember that pre-tax retirement accounts will always be fully taxable.

With a brokerage SPIA, only part of the income is taxable annually. Eventually (hopefully), you get your basis (that is, your original investment) back, and then the pure “growth” becomes fully taxable from then on. The insurance company calculates an exclusion ratio for you, which dictates how much you must pay each year in taxes. You don’t have to do the math, but taxation can get complicated.

So you can get a SPIA in all three account types.

Until recently, DIAs could only be purchased in your brokerage account. You could not get a DIA in a pre-tax account because of RMD issues. This problem was solved by Congress: Enter QLACs.

Why is the Good Annuity Good?

Single-Premium Immediate Annuities are NOT like the other annuities on the market.

This is not a Variable Annuity which is expensive and complicated.

This is not an indecipherable Fixed (or Equity) Indexed Annuity with non-guaranteed caps and participation rates. And this is not like the new kid on the sales block: are you being sold a RILA?

SPIAs are simple! You get a lifetime income stream in exchange for a lump sum.

In essence and fact, SPIAs allow you to buy a pension.

They are so simple and easy that the insurance “advisor” doesn’t sell them because the commissions are low. It is said that annuities are sold, not bought. That is true for most annuities but not SPIAs!

Consumers want SPIAs because they are a good annuity. They are bond replacements in your asset allocation. But to truly understand what makes a Single Premium Immediate Annuity a good annuity, you must realize mortality credits.

Mortality Credits make SPIA a Good Annuity

Without being too morbid, we are all going to die! Insurance companies know that, and they take advantage of that fact. They play both sides of that coin.

Insurance companies sell life insurance that pays out when someone dies. On the other hand, they sell annuities that stop paying out when someone dies! So, insurance companies can hedge their life insurance bets with annuities or hedge their annuity bets with life insurance.

When SPIAs sell, they are placed in a “risk pool.” The actuaries know how many people will die each year in that pool. They don’t know who will die, but they know how many people in the risk pool will die.

When you buy a SPIA, you get mortality credits because the insurance company knows they will pay less each year. People die; the living keep getting income.

Insurance companies use bonds to cover their liabilities on the good annuity. DIY investors say they can get the same returns as SPIAs because they will buy the same bonds. But DIY investors don’t have risk pools; they don’t get mortality credits!

Mortality credits are increased payments everyone gets because the actuaries know that some people in the risk pool will die off yearly. You get paid more (even initially) because the money is at risk.

A Good Annuity’s Largest Downside

And that is the largest downside of a good annuity. Your money is at risk.

If you die, the lump sum you turned into income dies with you!

Folks can’t get over that fact, leading to the annuity puzzle.

I want you to recognize that losing money when you die is good! Seriously, it gives you mortality credits and an increase in payment ABOVE what you can get from bonds! As you survive longer than the actuaries expect, you continue to benefit from the higher income that similar bonds alone cannot provide. All because of mortality credits.

Tax Considerations of SPIAs

Let’s move on to taxes!

There are always tax considerations with annuities. This is especially true when required minimum distributions come due.

(Tax considerations of IRA SPIAs)

Let’s examine why there are more taxes with a Single Premium Immediate Annuity in an IRA.

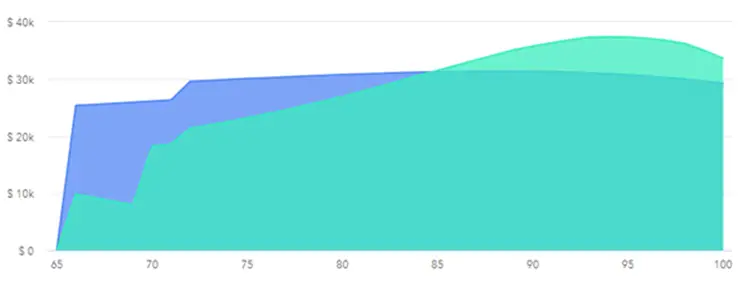

In green, find yearly tax payments with just social security. They are low until required minimum distributions kick in at 70 (this data is from prior to the change in RMDS to 73). Then, at 71, there is another small bump when The Tax Cut and Jobs Act expires. Over time, taxes increase with required minimum distributions. Eventually, they slow down as the distributions eat away at the IRA balance.

With a $1M IRA SPIA (blue), initial taxes are higher as the income from the SPIA is fully taxable. SPIAs from pre-tax accounts (such as IRAs and 401k) are always fully taxable. However, taxes stay flat over time as the income from the IRA SPIA satisfies the required minimum distributions.

What are the expected Required Minimum Distributions for each account? Initial RMDs at age 70 are:

- Social security: $45,000

- 250k SPIA: $33,800

- 500k SPIA: $22,500

- 750k SPIA: $11,200

- 1M SPIA: none

So, SPIAs decrease RMDs, but overall, there is an increase in tax liability, especially early.

There must be additional advantages to a SPIA? First, let’s look at sequence of return risk and income.

IRA Annuities in the Setting of Sequence of Returns Risk

(Sequence of Return Risk and IRA SPIA)

The most significant risk in retirement is Sequence of Returns Risk.

What happens if a sequence similar to 2000-2010 occurs again at the worst time, right at retirement.

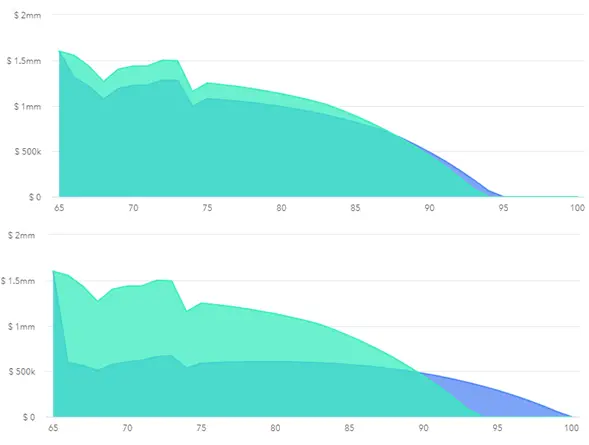

Above, see the effect a $250k IRA SPIA (top) and $1M IRA SPIA (bottom) have with Sequence of Return Risk. For both, the light green is social security without any SPIA.

With the small SPIA, there is very little dampening of volatility. There is also minimal benefit; the portfolio expires an additional year after social security. Of course, social security continues for both. Social security starts at $24,000 a year and has an inflation adjustment. With the SPIA, you get an additional $ 17,000 floor income for the rest of your life.

With the large SPIA, there is much less volatility during a bad sequence. Indeed, as you need to withdraw less from your investments during the down years, the income value drifts slightly up. After that, with the stable floor income, there is a prolonged decline in the portfolio value. When the portfolio expires at age 100, you are left with social security and a $68,000 SPIA payment for the rest of your life.

Let’s review and decide if a Single Premium Immediate Annuity in your IRA is a good idea.

Conclusion: SPIAs in IRAs – A Good Annuity

Well, what did we learn?

Qualified Single Premium Immediate Annuities are SPIAs in your IRA. You can purchase a qualified annuity when you transfer funds from your qualified accounts (IRAs and 401k) to an insurance company.

SPIAs in IRAs can improve the chances of success in your retirement. Even if you run out of nest eggs, SPIAs provide ongoing, guaranteed income while you are alive.

In addition, not uncommonly, you have even more of a legacy with a SPIA than without! While folks are worried about “giving” away their money to purchase a pension irrevocably, it is not uncommon for their heirs to be better off. In addition, a SPIA in an IRA may protect against Sequence of Return Risk.

Taxation is an issue. Single-premium Immediate Annuities from qualified (pre-tax) sources are always taxable. This can have implications for the taxation of social security and may cause issues with the tax torpedo.

Ultimately, you can use pre-tax money to buy an income stream. This income can cover your floor or fixed expenses. These expenses don’t go away with time, nor does the income from your SPIA.