Self-Funding Long Term Care

Building wealth and self-funding long-term care insurance gives you the best of both worlds.

Since there are no good options for long-term care insurance, the baseline case is self-funding. Neither Medicaid nor insurance are great options; self-fund, and then consider other options if you cannot.

Let’s take a deep dive into self-insuring for long-term care.

How Likely Am I to Need Long-Term Care?

How likely are you to need long-term care?

It is not as simple as the statistics would have you believe. You see, “70% of people” will need care at some point. Yes, as we get older, many of us will need care.

But how many need and qualify for reimbursable care? The answer is much lower, perhaps 9% of those with a policy.

So, instead of the 70% number you hear in popular media, the actual number who use their Long-Term Care insurance is closer to 9%.

Next, how much does it cost?

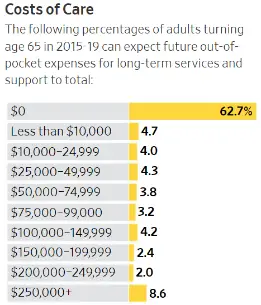

Look above at your total out-of-pocket expenses for long-term care services—almost 63% pay zero.

Next, note that just 8.6% pay more than $250k out of pocket over their lifetime.

In summary, instead of the 70% chance of financial devastation if you don’t have Long-Term Care Insurance, the number is more likely 8-9%. And it is only devastating if you cannot afford $250k (or rarely more).

Self-funding is usually the right answer!

How Much Do You Need to Self-fund Long-Term Care

So, how much do you need to self-fund Long-Term Care expenses?

The idea here is that if you are “rich enough,” you can cover the 250k or more you need 10% of the time.

Morningstar puts the self-fund number above $2.5M. The title of this piece, however, is “There is no magic number for self-funding long-term care insurance.” Instead, they suggest you:

- Gage the likelihood of needing long-term care

- Ballpark the cost of care (with this document)

- Customize based upon your situation and preferences

- Think through the backup plan

- See if you can afford it

- Segregate assets set aside for long-term care from other assets

Personally, I think that if you have more than ~$1.5M you probably want to self-fund for Long Term Care. Why? Because the alternatives are not very good.

What are the alternatives?

Should you consider traditional insurance or a hybrid product for Long-Term Care Insurance? To answer that question, let’s review what is available and think a little about the taxation and pitfalls of both.

Taxation of Traditional Long-Term Care Insurance

Let’s start with the taxation and pitfalls of traditional Long-Term Care policies. These policies underwrite morbidity risk. They are less common now than in years prior because of premium increase horror stories. Traditional policies may be expensive given chronically low interest rates, longer life spans, and increasing medical costs. Premiums are subject to increase over time. That is the pitfall.

Premiums paid to traditional Long-Term Care Insurance are tax-deductible for individual taxpayers. There is, of course, a floor that must be met to itemize these as deductions. The floor is difficult to get above, given the large standard deduction. In addition, the amount of the deductible premium depends on your age.

Some States have tax deductions as well. Partnership Plans are important to consider if you think you may eventually qualify for Medicaid.

A business owner can often deduct the full amount, but this is a complex topic and depends on type of business entity. See Kitces for general reference on business deductions.

What about the tax treatment of reimbursements? As with health insurance, you can deduct personal injury or illness payments. However, there is a limit of about $370 daily in qualified expenses. Payments above this are fully taxable.

Paying Premiums from a Health Savings Account

Usually, only medical expenses (rather than insurance expenses) qualify for reimbursement from health savings accounts (HSAs). LTCI premium payments, however, are, in fact, HSA eligible. The same age-based limits above apply. Any amount above the limits requires after-tax payment. If you use the HSA to fund premium payments, you can’t turn around and deduct the payments, as this would be double-dipping.

Pitfalls of Hybrid Long-Term Care Insurance Policies

Let’s move on to Hybrid LTC/Life Insurance policies.

More salespeople are pushing hybrid policies, where you get permanent life insurance with a long-term care or chronic illness rider. The riders vary in their cost. Another example is an accelerated death benefit rider. Many allow access to the cash value or death benefit if needed for LTC expenses. For example, you could get 2% of the death benefit a month in advance to pay for long-term care. Or you can get, for example, 25% of your death benefit a year for qualifying costs.

Your heirs may get a death benefit for (often) a lump-sum premium payment. In addition, these policies have a small amount of cash value and a defined dollar amount of LTC benefits. You can use only one of these three benefits. So, if you use the LTC rider or access the cash value, the death benefit either shrinks or goes away entirely.

Hybrid policies are relatively expensive and, in reality, don’t do anything well. The death benefit is small and may decrease with age. The cash value is low for the cost. As for paying long-term care costs, traditional LTCI policies are more effective and pay more.

An advantage: premium is paid up in advance, so it is not subject to increases.

Folks like these policies, however, because if they don’t “use” the LTC benefit (say they die in their sleep), they still get something for their money (the death benefit). All is not “lost.” Or, they can use the cash value instead, if needed.

Tax Implications of a Hybrid Policy- The Largest Pitfall

Hybrid policies have significant tax shortcomings. They are not tax-efficient; this is a downside most folks don’t think about. The salesmen won’t necessarily say anything about the inefficiencies: “consult with your tax advisor” is what you will likely hear.

Premiums are never deductible.

As for reimbursement of expenses, hybrid policies payout basis (the after-tax money you paid for the policy) first, leaving the fully taxable excess behind.

Neither of these are good features. No deduction going in, and your after-tax money coming out first.

However, we haven’t even discussed the most problematic feature of hybrid policies.

Should You Use your Hybrid Policy or an IRA to Pay for Long-Term Care?

Consider this briefly: if you have an IRA and a hybrid policy, which would you rather use for long-term care expenses? You would rather use your IRA. Really? But you bought the hybrid policy just in case you needed long-term care.

So, you have long-term care insurance but shouldn’t use it?

Exactly.

If you want to leave money to your heirs, use the fully taxable money in the IRA to fund health care costs. Then, if healthcare-related spending is above the AGI floor—as is common in years where you have massive LTC bills—you get a tax deduction. When you spend from the hybrid policy, there is no possibility of a tax deduction.

In addition, spending down your IRA on health care means less fully taxable income for your heirs. Thus, you save the tax-free death benefit in the hybrid life insurance policy. Your heirs would rather receive a tax-free death benefit from the hybrid policy than pre-tax income from the IRA.

So, hybrid policies are less effective, not tax-efficient, and even if you have one (and an IRA), you shouldn’t use it.

When might a hybrid policy be a good idea?

Using 1035 Exchanges – The Advantage of Hybrid Policies

If you have old annuities or permanent life insurance, consider a 1035 exchange if you want LTCI.

The advantage here is to take tax-deferred growth in these products and use them for another purpose without paying the taxes.

This is especially true for an annuity that is otherwise fully taxable as a death benefit. Or, if you have tax-deferred growth in a life insurance policy, use this money tax-free to pay qualified LTCI claims after a 1035 exchange to an appropriate hybrid policy.

Again, Kitces has a great review on the topic.

Yes, 1035 exchanges are complicated. They can make sense if you have an old annuity or life insurance policy that is not otherwise useful. Especially consider a 1035 exchange if there is a lot of tax-deferred growth and you have a high probability of needing long-term care.

The long and the short: leverage an old product into something you might have a better use for.

Self-Funding as an Alternative to Long-Term Care Insurance

The decision about long-term care insurance is tough. Single folks and those without legacy or charitable goals are less likely to want it.

If you have “enough” to self-fund or self-insure, likely more than $ 2M, the decision is more based on your health and personal risk preferences.

Most of the time, Long-Term Care Insurance is a waste of money.

Celebrate when you waste money on term life or auto insurance. And if you don’t have long-term care insurance and don’t use it, that’s great, too!