Modeling and Building a Roth Conversion Ladder in Early Retirement

Folks get confused when talking about Roth Conversion Ladders, a series of partial Roth IRA conversions, and backdoor Roth IRAs.

Here, we are discussing early retirement and trying to access your pre-tax retirement money penalty-free before 59 ½. To do so, you must navigate one of the 5-year Roth IRA rules—the one on conversions. This is a Roth IRA Conversion Ladder.

To get your conversions out from a Roth conversion, if you are less than 59 ½, you must wait five years. So, if you retire early and need some of your pre-tax money to fund your retirement before 59 ½, read on! And we will clear up the confusion regarding a Roth conversion ladder vs. Roth conversions vs. the Backdoor Roth.

Roth Conversion Ladders vs. 72(t)

I have a blog on Modeling a 72(t) in Early Retirement, where I compared and contrasted it to the Roth Conversion Ladder. You may want to start there, but the take-home message is that you need money in your brokerage account to do a Roth IRA ladder and to live on for five years while the ladder seasons. If you don’t have cash/stocks to sell to pay the taxes on Roth conversions, you are stuck with the much less flexible 72(t).

Roth Conversion Ladders vs. Backdoor Roth

Roth ladders are not a backdoor Roth. You make the backdoor Roth contribution because you make too much money to directly contribute to a Roth IRA.

Remember, everyone can contribute six or 7k yearly to a traditional IRA. This contribution is non-deductible when you file taxes if you make too much money.

You use the backdoor since you can’t use the regular (or front door) contribution to a Roth. So, once you have non-deductible money in your traditional IRA, you convert it to a Roth IRA. Since this money is never deducted (it is after-tax), this conversion has no tax liability. Backdoor Roth IRAs are simple if you have no other deductible IRAs and you figure out form 8606 on your taxes. Generally, you will need to educate your CPA about form 8606, too.

The Backdoor Roth IRA is a way to get some tax diversification over the years, especially if you and your spouse can do it yearly.

Roth Conversion Ladder vs. Partial Roth Conversions

Roth conversion ladders are not a series of partial Roth conversions. Well, they are, but they are done for different indications.

A Roth IRA conversion ladder is access to pre-tax retirement accounts without a 10% penalty.

Ok, without further ado, let’s look at how you model and build a Roth ladder as part of early retirement.

How to Build a Roth Conversion Ladder

Consider a 45-year-old who will retire with $1M in a brokerage account and $2M in a 401k. He plans to spend 120k a year, per the 4% rule.

The Monte Carlo odds aren’t great for this plan. I’ll tell you that traditional retirement software doesn’t like early retirement. They often give abysmal Monte Carlo odds for plans that will work out just fine. Remember, early retirees have a great deal of flexibility and ingenuity. After all, this guy figured out how to save $3M by age 46! So, let’s give him some credit and assume he will make better financial decisions than the average bloke in the future.

Retirement planning is good for the next 1-2 years, but who knows what returns, inflation, and Congress will do afterward? So start with a reasonable plan and pivot when needed.

Let’s look at taxes!

Tax Considerations of a Roth Conversion Ladder

Taxes are the main reason to consider a Roth ladder. Avoiding the 10% penalty on early IRA withdrawals is vital, but tax considerations are a close second.

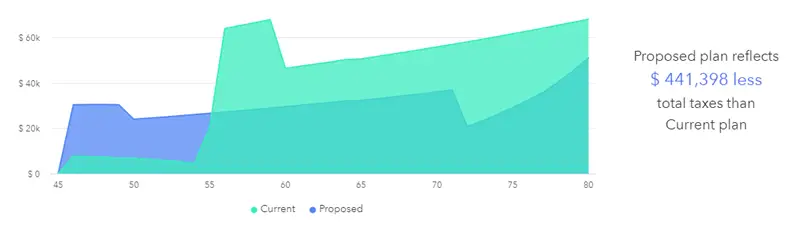

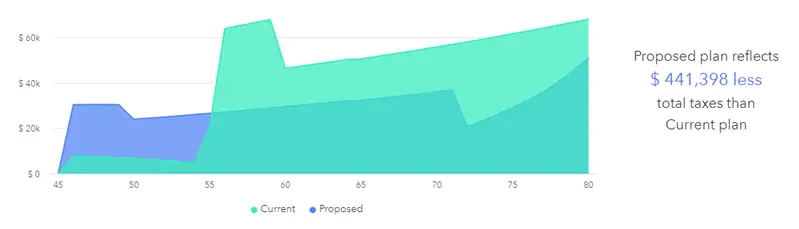

Above, you can see the taxes paid each year with and without a Roth conversion ladder. In green, you have low taxes until you are 55. You run out of money in your brokerage account and spike your taxes as you have to fund your expenses entirely from your pre-tax retirement accounts. Of course, the IRA (or 401k) has been growing in the background during that decade, so you have much larger RMDs over time.

Compare that to the blue, where you do a Roth conversion ladder, initially forcing you to pay higher taxes. This process keeps your brokerage account from being decimated, and over time, you are not forced to pull money from your pre-tax retirement accounts. You smooth out your taxes over time and pay $440k less over the next 35 years.

Next, let’s look at effective tax rates over time as well.

Additional Tax Considerations—Effective Tax Rate and the Tax Brackets

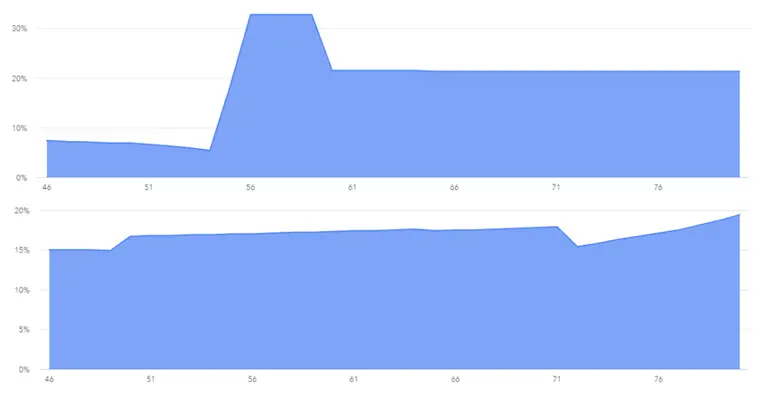

Above, you can see the effective tax rate over time. On the top is without a Roth ladder, and below is with. You start at 10% vs. 15%, but you spend much of your time at 21% vs. 16% effective taxes for the rest of your retirement. Keeping the effective tax rate smooth over time means saving money in taxes over time.

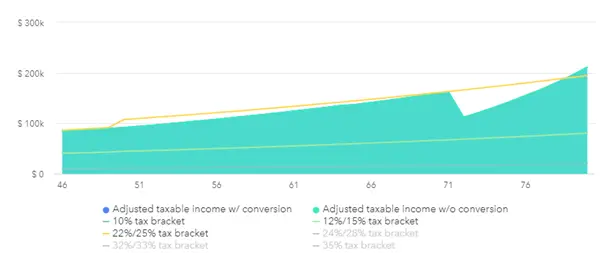

One final graph. Instead of the effective tax rate, let’s look at the marginal tax brackets. This is the plan with the Roth Conversion Ladder. He stays under the 22/25% tax bracket his entire life instead of being forced to spike his income up to higher brackets later in life.

Focus on filling up your lower brackets over time to liberate your pre-tax retirement accounts with a lower overall tax liability.

So, a Roth IRA ladder aims to fill up the 22% tax bracket until 2025. Then, in 2026, the TCJA expires, and the 22% bracket becomes the 25% bracket. Since taxes are more expensive then, we don’t focus on filling up the 25% bracket; we take out enough every year to help pay the bills and stay out of the next highest tax bracket down the line.

Modeling the Amount to Convert Each Year via a Roth Ladder

So, how big are the rungs of the ladder? How much must you convert in your Roth Conversion Ladder each year?

There are a couple of breakpoints to consider in early retirement. The first is the top of the 12% tax bracket (which will become 15% in 2026). Since the next highest bracket is 22% (25%) above that, this is a natural break between the brackets that folks with low spending goals in retirement can consider.

Next, the 24% tax bracket is excellent. After the standard deduction (where income is free!), the 24% tax bracket is my next favorite. For many mid and almost all high-income folks during retirement, conversions up to the 24% bracket in the next couple of years is a relative no-brainer.

More often than not, folks considering a Roth Conversion Ladder in early retirement will be interacting with the 12/15% tax bracket. Note that this guy has $3M in assets and only plays around with the 22/25% bracket. Generally, well-to-do folks with a limited Tax Planning Window will get up to the 24/28% tax bracket later in life. Above that, we jump to 32/35 brackets. These brackets are for those for whom anything less than the maximum tax bracket in the future is a win.

Let’s see what conversions modeled above look like via cash flows.

Cash Flows in a Roth Conversion Ladder

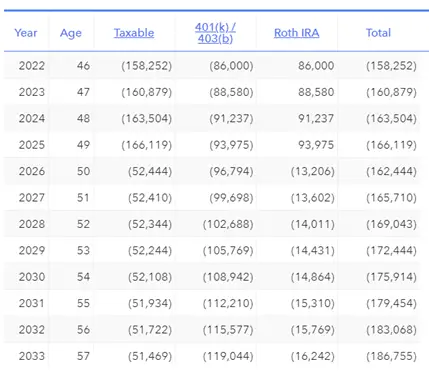

Above, you can see how expensive retirement is from the taxable column. To pay for living expenses and the extra taxes on the Roth ladder, we need to pull much more than 4% during the first few years. That’s ok. Once we start taking money out of the Roth to live on, that will drop below 4%. We are pre-paying our safe withdrawal rate during the Roth ladder-building process.

Next, note the amount of Roth conversions to fill up the 22% tax bracket until 2025. This is converted from the 401k (or, more likely, an IRA) to the Roth IRA. Then, in 2026, note that we will continue conversions (money out of the 401k column) but will start a series of partial Roth conversions to control our tax liability in the long term. This is in the middle of the 25% tax bracket and must be enough to “de-bulk” the IRA.

It is also important to note that you spend down first from your brokerage account as a rule of thumb. This means you have less interest and short-term capital gains over time, which allows you to fill your lower brackets with more Roth conversions. This is why, in general, it is useful to spend down your brokerage account early in retirement. Tax drag sucks.

Summary: Modeling and Building a Roth Conversion Ladder in Early Retirement

So, what did we learn?

A 72(t) is suited for those who don’t have after-tax assets to pay the taxes during the 5-year rung construction of a Roth ladder.

If you make too much money to use the front door, the Backdoor Roth IRA is done, but you still want to build some tax diversification. A Roth Conversion Ladder and partial Roth conversions are the same but done for different reasons!

The tax planning window is massive when you retire early. And taxes are on sale right now until the TCJA expires. Consider making a 20- or 30-year tax projection when you retire early to ensure you smooth out your taxes over time. You can access your pre-tax retirement accounts before 59 ½, but you need a strategy.