What is Desired Inflation?

Should you worry about inflation?

Inflation is the desired state of the economy when it is low and consistent (because the alternative is much worse). This is why fewer recessions have occurred since we came off the gold standard.

Low is 2-3%, and consistent is most of the time. What is desired inflation? Why do we want inflation in the economy?

What is Desired Inflation?

People try to predict future inflation rates. They are always wrong.

Inflation affects those in retirement more than those in accumulation, but what can you do about it?

Historically, inflation is good for a stable economy. We don’t want zero inflation. What is “desired” inflation if it is non-zero?

Why is There Inflation?

Why is there inflation? Low inflation is the best way to prevent deflation and hyperinflation. And that is why there is inflation.

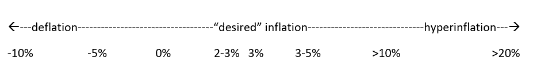

Low-level and predictable inflation is halfway between the economy killers of deflation and hyperinflation.

The line graph above is my creation. On the left is deflation, and on the right is hyperinflation.

Deflation kills the economy. Think of it this way: if something is going to be cheaper next week or next year, why would you ever buy it today? You will never buy anything today because it will be cheaper tomorrow. If no one spends money today, tomorrow never comes, and prices continue downward due to a lack of demand. Even zero percent annual inflation is bad because we want to encourage people to spend money today, not tomorrow. A zero percent interest rate is too low. It is below desired inflation.

Hyperinflation needs another, more detailed treatment. But 8% for a couple of years is not hyperinflation. There is no risk of hyperinflation currently.

Desired inflation is somewhere between 2-5%.

What is Desired Inflation?

Desired inflation is probably 2-3% in retirement. Inflation is generally 1% less than expected in retirement (that’s the retirement spending smile).

It is fine at 3-5% over long periods. It happens, and you can plan for it. Even 10% inflation over a few years is ok. It depends on the sequence of inflation risk (which is similar to sequence of returns risk)

Desired inflation is homeostasis for the economy. We want to keep the body temperature (the inflation rate) in the normal range so that we don’t get hypothermia (deflation) and develop multi-system organ failure (failures of banking and credit systems). We don’t get hyperthermia (hyperinflation) and develop a fever (prices going up so quickly that you must buy them today, which increases demand, increasing prices).

At either end, there is a feedback loop that destroys the economy. It is a negative feedback loop that deflates away your economy on one end and a positive feedback loop that makes goods unaffordable on the other.

What Will Future Interest Rates Be?

What will happen to interest rates in the future?

I can tell you exactly what will happen to interest rates. They will go up, and they will go down.

How much rain will you get next summer? While you can predict the average temperature and rainfall next summer, that doesn’t tell you exactly how much to irrigate. Or how bad the fire season will be.

Future interest rates depend on exogenous shocks and the unknown unknown, like next year’s rainfall. The rest is priced in.

Short-term rates predict short-term rates, but nothing predicts intermediate or long-term rates. This is despite a 40-year bond bull market due to falling interest rates.

What will the next 40 years bring?

What Will Future Interest Rates Be?

Over the centuries, credit has been less expensive. It is easier to collect your debts now than 20 or 1020 years ago; thus, you need less interest to loan out money.

Since less is required to loan money, the cost of money is less, interest rates are lower, and depressions are less likely. Over the last 100 years, the average interest rate has been about 3%. Future interest rates will be about 3%, or they will be higher or lower. Short-term predictions are not useful.

Summary- Desired Inflation

Good inflation is better than the alternative.

Inflation will continue to be normal for the extended future. If it is not normal for more than a few years, start planning for the end of the economy.

What should you do about it? What worked well last year won’t work well now.

Inflation happens. Expect it. Don’t overthink and stick with your plan.