Retirement Spending Smile or Lumpy Expenses?

Future expenses are a major puzzle in retirement. How much money will you need to spend in the future?

You have ‘guaranteed’ lifelong sources of income, such as social security, pensions, and good annuities. These can floor your income, providing a steady source for your needs during retirement. Other sources of income, such as business and rental income, may also be more or less continuous income streams.

In addition, you have your investment assets, such as stocks and bonds. These provide a variable source of income and are best suited to your wants.

But what are the expenses during retirement? Are they constant? Are retirement expenses like a “smile” or perhaps more “lumpy” than that?

Let’s explore spending in retirement by evaluating the Retirement Spending Smile vs. Lumpy Expenses.

Retirement Spending Smile vs. Lumpy Expenses

Retirement Spending Smile

The retirement spending smile loosely describes overall spending in retirement. The idea is that spending gradually decreases during retirement, especially on fun things (variable expenses). But, of course, if you live long enough, there will be increased spending late in life on medical and personal care expenses.

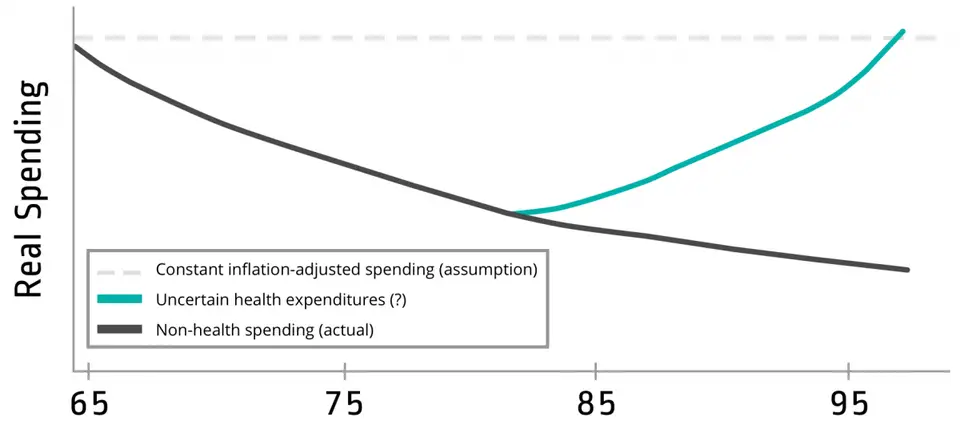

Figure 1 (The Retirement Spending Smile)

The retirement spending smile above in Figure 1 demonstrates real spending (black line) decreases with time. The initial slope of the decrease is rapid and flattens over time. The slope is approximately 1% less than inflation per year.

Health and Long Term Care expenditures, however, manifest later in life. These expenses are uncertain and variable and increase with Age.

Lumpy Expenses and Retirement Spending Shocks

Variable expenses, on the other hand, also arise during retirement. These are either known or unknown.

Known lumpy expenses include automobile purchases, vacations, and routine but unscheduled home issues such as new HVACs and roofs. One could also assume that common uninsured health expenses, such as dental and hearing aids, also fit into the known lumpy expenses. These are the expenses that some folks use sinking funds for.

Unknown lumpy expenses or spending shocks include unexpected health care expenses (major medical issues), family expenses (like failure-to-launch children and aging parents), divorce, and last but certainly not least, the loss of a spouse.

So, are retirement expenses like a smile and decrease with age or lumpy? Of course, they are both!

Let’s look at each model of retirement expenses to optimize retirement spending. How do you model expenses in retirement?

Lumpy Expenses in Retirement

Let’s talk about what might constitute a lumpy expense in retirement.

What are some lumpy expenses to be aware of?

Perception of Lumpy Expenses in Retirement

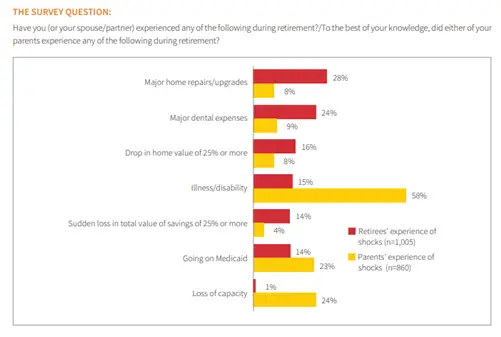

Figure 2 (Perception of lumpy expenses in retirement)

It is interesting to see which lumpy expenses people worry about. Compare what current retirees worry about vs. what they think their parents’ concerns were.

First, the red bars represent retirees’ experience of lumpy expenses. The yellow bars show what retirees think about their parents’ spending shocks.

Retirees believe they have more home issues, dental issues, and market losses than their parents.

More interesting than that, look at what people think their parents’ issues were! Illness, disability, loss of capacity, and Medicaid are all issues more likely to happen to my parents than to me! Interesting!

What can we learn from this? Perhaps we need to worry more about illness, disability, and loss of capacity. We see these issues reflected in our parents but are less concerned about these serious issues personally.

A List of Actual Lumpy Expenses

What are the lumpy expenses we need to consider in retirement?

Taxes

Taxes not infrequently are well-to-do retirees’ largest expense.

How do you get a lumpy tax problem? Having lumpy expenses and pulling money from your pre-tax accounts to pay for them.

Healthcare

The healthcare system is broken, and price transparency is a major issue. From surprise out-of-network charges to catastrophic illness or ambulance/helicopter bills that aren’t covered, you never know when to reach into your billfold or purse to pay medical bills.

Healthcare costs above a floor can be deducted from income. This is a slightly confusing topic, and it doesn’t help that the IRS changed the floor from 7.5% to 10% and back to 7.5% again.

When are you subject to lumpy medical bills?

Figure 3 (Healthcare spending by Age)

Healthcare is such a concern that I want to examine the lumpy costs associated with it. Above are out-of-pocket medical expenses by Age. Note that median spending is the highest at age 90-94 when healthcare spending is common.

The 95th percentile out-of-pocket expenses stay pretty flat until above age 85.

Key Point About Lumpy Medical Expenses

This brings me to a key take-home point. Concerns about lumpy medical expenses are common. However, it is important to note that most folks have medical insurance in retirement. So, while medical costs are common lumpy expenses, insurance often mitigates them.

As represented in Figure 3, the median cost of health care doesn’t go up significantly over time. With insurance, healthcare costs are more like fixed expenses. However, the distribution curve has expensive outliers or a fat right tail. Note the 95th percentile costs are going up sharply late in life.

Long-Term Care

I fear long-term care expenses. Chances for lumpy expenses are high.

Statistics, however, are misleading because ‘the industry’ wants you to be scared enough to buy Long-Term Care insurance. Statements like “70% need long-term care at some point in their life” are absurd! This is the percentage of folks needing some service during their lifetime. A much smaller proportion of people get through the 90-day elimination period and begin accessing insurance benefits.

I don’t like traditional Long-Term Care insurance, but unfortunately, we may see these policies implode in the next two decades.

I’m not too fond of hybrid insurance, either. Most folks with lumpy long-term care costs can use these as tax deductions, allowing tax-free withdrawals of pre-tax money. This concept is difficult, and the insurance salespeople haven’t figured it out yet.

Housing

The money pit. Major housing expenses are common lumpy expenses. Home retrofits for medical issues are also of concern.

Travel

This is a good lumpy expense! Take a cruise around the world.

Gifts

Supporting kids, grandkids, or parents with gifts can be lumpy expenses. For example, is your daughter’s wedding considered a gift?

Pet Emergencies

Pets are important for psychological health and can be expensive!

Loss of a Spouse

Spousal loss is inevitable, but the timing is uncertain. Becoming a widow or widower has huge financial ramifications, which are not often considered when making a retirement spending plan. The Widow Tax Penalty can be devastating under the right circumstances.

Summary: Lumpy Expenses in Retirement

There will be lumpy expenses! Consider the idea of “consumption smoothing.” This concept involves retirees seeking consistent spending in their retirement and pre-retirement years.

Consumption smoothing is not probable. A better solution is a cash bucket in retirement. This is not a 3-6 month “emergency fund” but a 2-3 years cash bucket set aside for spending. You would refill this bucket yearly from your other assets to smooth consumption.

Let’s move on to the Smile!

The Retirement Spending Smile

Some find it difficult to start spending in retirement after decades of saving.

Also, during economic downturns, it is natural for most folks to cut back even during retirement. This might be a form of self-insurance, as running out of money is one of the largest concerns for retired people.

However, as we saw above, the trend overall is a gradual decrease in spending over most of retirement until healthcare costs start to increase late in life. This is the retirement spending smile!

Let’s look at some issues with the Retirement Spending Smile, which are important to consider.

Inflation and the Retirement Spending Smile

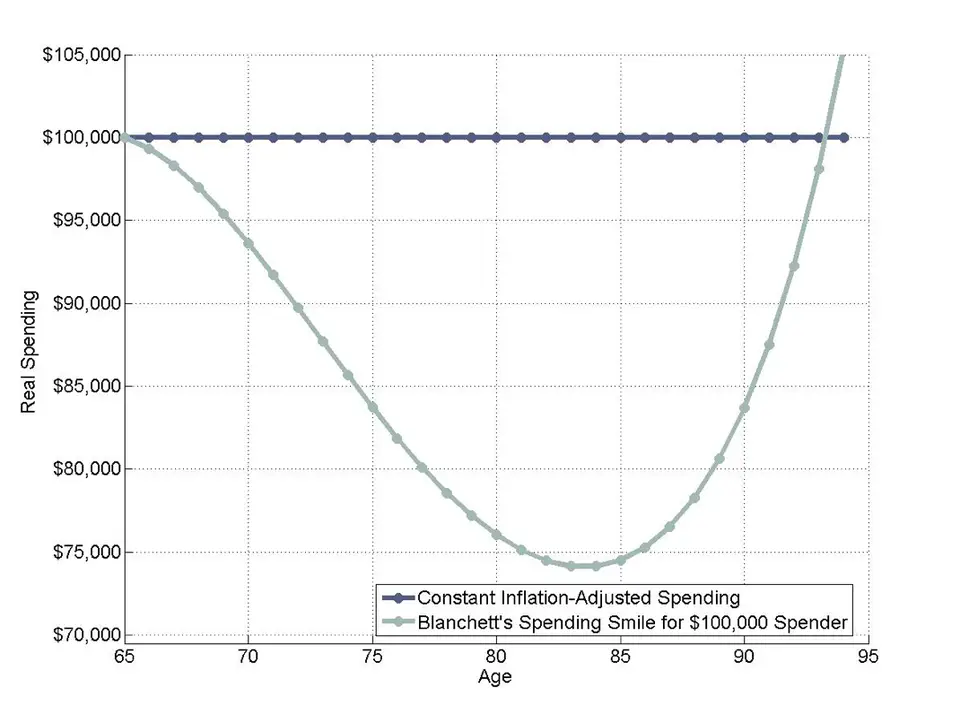

Figure 4 (Real spending demonstrating inflation-adjusted retirement spending smile)

Above, you can see the inflation-adjusted spending as a continuous dark blue line. This means you take out the same inflation-adjusted amount over 30 years. It is an example of how you would plan future spending using, for example, the 4% rule.

However, real spending decreases for the first 15-20 years of retirement and increases rapidly in the last five years before death. The spending smile does not exceed the inflation-adjusted amount until the last year or two of life.

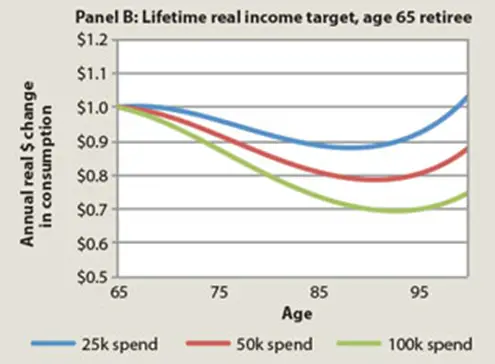

Digging a little deeper, the Smile depends on the resources available for retirement.

Effect of Income on the Retirement Spending Smile

Figure 5 (Retirement Smile depending on income level)

Affluent retirees have a different smile curve than those with limited resources (such as social security). Those with plenty of reserves rapidly decrease the spending rate in early retirement, while those with fewer resources have a different curve. This implies a bit of flexibility in decreasing spending in retirement.

This is represented above in Figure 5. The blue line represents folks with less income. The decreasing slope is slow and not as deep as those more affluent in green. The rate of increase in the curve is higher and faster in those with less reserve, and they have increased real spending above inflation-adjusted amounts at the very end of their retirement.

Conclusion: Retirement Spending Smile vs. Lumpy Retirement Expenses

So, How Much Can I Spend in Retirement?

The retirement consumption puzzle states that spending decreases in inflation-adjusted terms during retirement. Yet, while planning for retirement, we plan constant or even increasing spending goals.

The basic 4% Safe Withdrawal Rule method simulates spending that keeps pace with inflation. Unfortunately, this may result in having too much money left over at the end while not spending early enough in retirement on things you enjoy!

Planning to need ever-increasing amounts of income in the future restricts what can be spent early in retirement!

There are, however, known and unknown lumpy expenses that must be accounted for throughout retirement.

Nevertheless, all of this argues for more liberal spending early in retirement.