Widow’s Penalty: Increased Taxes after Loss of a Spouse

What is the widow’s penalty?

What happens at the death of the first spouse? After the emotions, there are also tax and financial implications: The Widow’s Penalty. Also known as the Widow’s Tax Penalty, taxes increase for most when they become widowed.

Tax implications of filing taxes as single instead of married filing joint often leave the surviving spouse worse off financially.

In addition to a loss of social security income, what income remains hits higher tax brackets. Therefore, the Widow’s tax is an important consideration when retirement planning for a couple.

After all, one spouse will be left behind. What happens then?

Do Widows Pay More in Taxes Once a Spouse Dies?

Yes, widows pay more taxes. This is because the standard deduction is cut in half when you file as a single compared to married filing joint and the compression in tax brackets.

For instance, the top of the 12% tax bracket is $41,775 when you are single and twice that ($83,550) when you are married filing jointly. This means you will pay an extra 10% for the next $41,775 the year after you lose a spouse.

What are the Implications of the Widow’s Penalty?

What are the implications of the Widow’s Tax?

- Decrease in Social Security and Possible Increase in Taxation of Social Security

- Decrease Standard Deduction

- Increase in Marginal and Effective Tax Brackets

- Increase in IRMAA

- RMDs often stay the same (with compressed tax rates)

- Possible loss in Pension Income

Next, let’s look at an example. Here, we have a 70-year-old couple. What happens to taxes after the first spouse dies at age 73?

Widow’s Penalty and Net Worth, Taxes

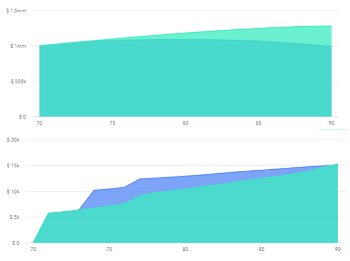

Let’s look at a scenario to see how the widow’s tax penalty works. Here, we have a 70-year-old couple, and a spouse either dies at 73 or does not. How does that affect net worth and taxes over time?

Figure 1 (Net Worth and Yearly Taxes Due with Widow’s Tax)

On the top of Figure 1, you can see that this couple is 70 and have a $1M net worth. In dark green, you can see a slight decrease in net worth over time with a spousal death at age 73, vs. no spousal death in light green.

Why is there a decrease in net worth? One reason is increased taxes on the widow. The Widow’s Tax!

On the bottom of Figure 1, you can see how much is spent yearly in taxes. At baseline in green, the couple owes about $6,000 in taxes, which slowly increases over 30 years to $15,000.

In blue, a spouse dies at age 73, increasing taxes to $10,000 a year. The widow continues to pay increased taxes over the remaining 30 years.

Next, let’s look and see what spousal death does to the tax rate.

Increased Taxation of the Surviving Spouse. The Widow’s Penalty

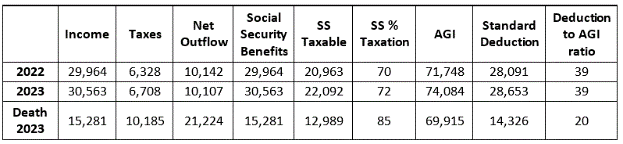

Figure 2 (Depiction of Taxes, Social Security Taxation, and Standard Deduction with the Widow’s Tax)

In figure 2, 2022 on the left: the year before death. Below are two possibilities: 2023 without and with 2023 Death of a spouse. Now we can see how the death affects the following years’ taxes.

Note that income decreases by 50% after death (due to the loss of a social security check).

Taxes, however, also increase by more than $3k! What! Less income, yet more taxes!

Net outflow increases to cover both increased taxes and loss of social security.

Note next: social security benefits received, the amount taxable on their 1040s, and the percent of social security included in their taxable income. Due to the spouse’s death, the full 85% of social security is included after the spouse’s death, when it is only 72% taxable (and twice the amount) before death.

Also included are AGI and the standard deduction. I invented a ratio: the standard deduction to AGI ratio. The higher, the better because that means you have a significant standard deduction compared to your adjusted gross income. Note the increase in taxable income due to the cut in half of the standard deduction.

Do Widows Get a Tax Break?

No, widows do not get a tax break. If your spouse died this year, you can still claim as married filing joint. If the widow has dependents, there is a qualifying widow filing. The point of the widow’s tax is that widows get the opposite of a tax break!

An Academic Perspective of the Widow’s Tax Penalty

I thought it interesting that an academic-ish paper was published calling the Widow’s Tax “fearmongering.”

The title: Widow tax hit: much ado about nothing? The purported purpose of the paper is to prevent “fear appeals used by financial planners to motivate client behavior.”

The author suggests we relax and let go of the fear. I’m not sure that fear is what we are after; just understanding the tax implications after the death of a spouse!

He further suggests that the impact of higher taxes and loss of disposable income is “minor.”

While truly not massive, the paper shows the jump in effective tax rate is 30-55% for a wealthy couple and 12-15% for a median couple. That’s pretty impressive to me and perhaps not what I would consider minor.

In addition, the reduction in disposable income is 12-20%.

He states only when the tax torpedo is invoked can there be problems and bags on people pitching Roth conversions and life insurance as a way to prevent widow’s tax.

But I think he misses the point. If you can do some simple planning and not suffer an increase in taxes and a 20% reduction in disposable income, is that worth it? Is that fearmongering?

Conclusion: Widow’s Penalty

Due to the Widow’s Penalty, also known as the Widow’s Tax Penalty, there is an increase in taxation of social security and a decrease in the tax brackets. This leads to an actual reduction in net worth over time as more income is needed from the fully taxable IRA to pay taxes and expenses.

In addition, there is a loss of a social security check with the Widow’s Tax. In this scenario, social security met 43% of income needs of the couple, whereas it only meets 26% of the needs of the remaining spouse.

While variable expenses decrease after a spouse’s death, most of the fixed needs stay the same. Most singles will find they spend about 80% of what they did before the death of their spouse.

Aside from the emotions, there are financial implications with the death of a spouse.