Roth Conversions

Let’s talk about what is new for Roth Conversions.

The point: there are many different types of Roth conversions, and they may be affected differently by changes in the law in the next few years.

Let’s start with a series of yearly Partial Roth IRA Conversions, which is an important and powerful tool for pre-paying taxes (think of it as an insurance policy in case taxes are higher), controlling future marginal tax rates, and optimizing your legacy.

Of course, there are other types of Roth Conversions. A “Roth Conversion” means taking a non-Roth retirement account and converting it to a kind of retirement account called a “Roth.” Below is a partial list of the uses of “Roth” and the reason why the topic is complicated:

- Roth conversion occasionally during low-income years or as a series of yearly partial Roth conversions.

- Roth conversions in-plan in 401k employer plans.

- Backdoor Roth Conversions, where you take advantage of your after-tax contribution to a traditional IRA.

- Mega Backdoor Roth Conversions are after-tax 401k to Roth 401k or Roth IRA Rollover.

- Roth IRA as Emergency Fund

- Roth Ladder is used to access pre-tax retirement accounts for income (as a way to avoid the early withdrawal penalty on retirement accounts).

Remember to check out how Roth conversions are a little like longevity insurance for my latest take on the goodness of Roth conversions.

Partial Roth IRA Conversions

Let’s review partial Roth IRA Conversions.

They are done by rolling over pre-tax funds from a retirement account into Roth accounts, thus paying taxes at your marginal rate the year of conversion. Partial Roth conversions optimize tax diversification to control future income, taxes, and surcharges.

Since the SECURE Act passed, partial Roth conversions are more important than ever, and stretch IRAs cannot be left as a legacy. So now, you must consider the taxation of your pre-tax account over your lifetime and your heirs’ lifetime!

Can you do partial Roth conversions? Why pay tax now instead of later? There are many reasons, but the most important is controlling future tax liabilities. Pre-tax accounts continue to grow for you and your silent partner, the government. These accounts are deferred income, and taxes are owed on the contribution and the growth in the account.

At age 72 (or 75), you are forced to take distributions from pre-tax retirement accounts, called Required Minimum Distributions (RMDs). These RMDs, as we shall see, can become quite large; this leads to a legacy of ordinary income taxes for you or your heirs.

Let’s look at a retirement tax plan that includes partial Roth conversions, then run through a list of frequently asked questions to answer whether you can do partial Roth conversions.

Partial IRA Conversion to a Roth

Generally, you don’t want to convert all your pre-tax money into Roth in the same year. If you do so, you will owe a lot of taxes!

The goal is to convert part of the pre-tax money over several years, thus partial Roth conversions. This leads to lower taxes over your lifetime. Often, it is most efficient to “fill up” the tax bracket you are in.

So, for instance, if you are in the 24% tax bracket, find the top of the bracket and convert it to fill up your taxable income to that mark. If you go slightly over, it is not a huge deal. You are only taxed at the higher bracket for the amount you exceed. Remember, marginal taxes are different than effective taxes! The goal of partial conversion to a Roth IRA is tax bracket arbitrage over the rest of your life.

Generally, it would be best to have a 20-30-year tax projection to know your yearly goal conversion amount.

For instance, if RMDs start you in the 28% tax bracket when you turn 72, it may be good to fill up your 24% bracket now. This is tax bracket arbitrage, where you pay taxes now at a lower rate than you will in the future.

The tax brackets are set up with “low brackets” (the 10 and 12%), “middle brackets” (the 22 and 24%), and high brackets. It is generally less efficient to “jump” between the low to middle or the middle to the high brackets, but it depends on your future tax projection.

Let’s look at an example of Partial Roth conversions.

An Example of Partial Conversions to a Roth IRA

When are partial Roth conversions indicated to lower overall taxes during your remaining lifetime?

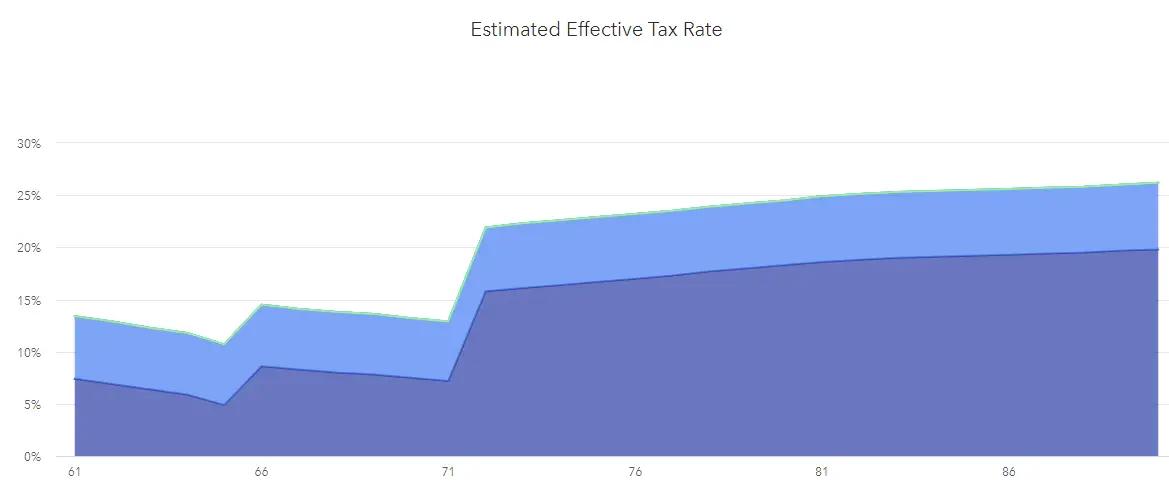

Figure 1 (Estimated Effective Tax Rate with a $2M IRA and a large brokerage account)

Let’s start with the estimated effective tax rate with a $2M IRA. In Figure 1, you can see a couple retires at 60. They pay both state (light blue) and federal (purple) taxes from their investment income (in a brokerage account). As they spend down the brokerage account, the taxes due decrease until the Tax Cut and Jobs Act expires at the end of 2025 when they are 66. At that point, there is an increase in federal taxes.

Then, at age 72, Required Minimum Distributions start, and this couple pays more in taxes. RMDs steadily increase over time yet are lower than the initial assumed growth of their IRA, so the amount they owe in taxes increases.

If we try to smooth out the tax rate over time at a lower effective tax rate overall, we can save on taxes! Enter partial Conversion to a Roth IRA, where you pay taxes now to pay less in the future!

How do you Choose which Bracket to Fill with Conversions?

Which tax bracket should you fill with partial IRA conversion to a Roth?

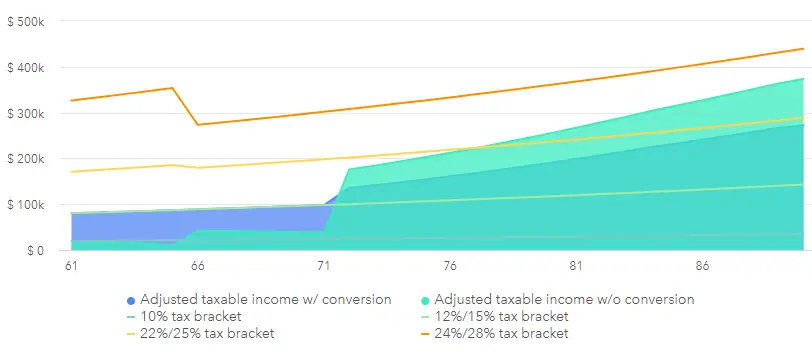

Figure 2 (Tax brackets and partial Roth conversions)

Figure 2 shows the tax brackets overlying the taxable income with and without partial Roth conversions. This is a slightly complicated figure but the most crucial concept to understand.

In green, note that the future expected taxable income starts in the 10% tax bracket and increases at age 66 when the TCJA expires. It then jumps into the 22/25% tax bracket when Required Minimum Distributions begin at age 72 and grows over time into the 24/28% tax bracket.

We fill the 12% tax bracket with partial Roth conversions in blue until RMDs start at age 72. This depletes the IRA enough to stay out of the 24/28% tax bracket for the projected future!

This smoothing effect allows us to save in taxes with partial Roth conversions!

It doesn’t make sense to convert the whole IRA to Roth now. Don’t pay taxes at a higher rate now than you will in the future! There are, of course, some exceptions to this rule—such as those worried about the Tax Torpedo and perhaps those with substantial pensions or other incomes.

So, how much should you convert every year?

Yearly Amount of Partial Roth Conversion

The point of a partial Roth conversion is to take advantage of low-income and, thus, low tax brackets over multiple years. If you convert too much in a single year, the bulk of the conversion is exposed to higher tax rates. On the other hand, you pay less in taxes over time if you do partial conversions, just enough to fill up your goal tax bracket.

So, how much should you convert from IRA to Roth?

Figure 3 (Goal conversion amount every year)

Figure 3 demonstrates the proposed amount of partial Roth conversions by year. The amount converted is a yearly decision, but we can see the skeleton plan above.

It would be best to have a 30-year tax plan to understand the goal bracket. Of course, future taxes will change, but we can only plan for what we know now. Note in Figure 3 where planned conversion amounts decrease significantly in 2026 after the TCJA expires.

Once you have your goal bracket to fill, examine your other sources of income and decide how much to convert.

Recharacterizations

There are no more recharacterizations of Roth IRA conversions (you can’t undo them), so you must be careful not to go over by too much.

What if you convert too much now that you can no longer recharacterize (or undo) the conversion? Then you will owe ordinary income taxes on the amount you over-converted in the highest marginal tax bracket. For example, say you converted $10,000 too much into the 22% tax bracket. Then, you will owe an additional $2200 in taxes the year of conversion. Again, this is not a huge deal, but don’t overshoot by way too much.

Taxes and Partial Roth Conversions

The point of partial Roth conversions is to pay the least in taxes over your lifetime. But, of course, the less you pay in taxes, the more you have to spend or give away.

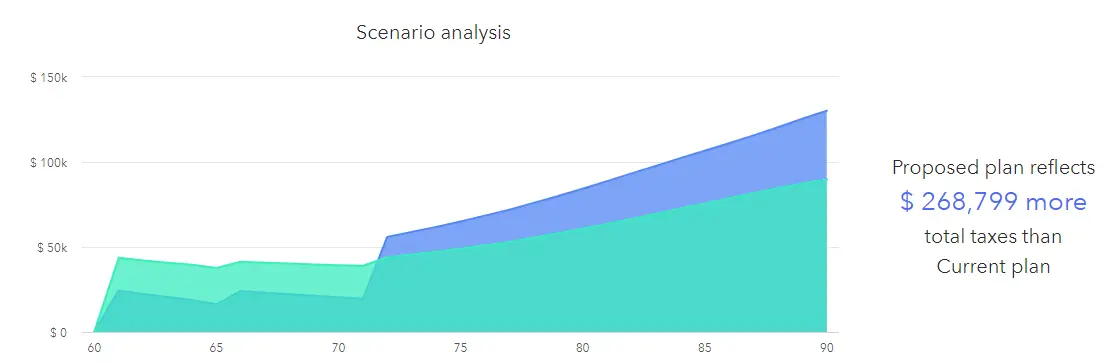

Figure 4 (Yearly amount of taxes paid with and without partial Roth conversions)

Figure 4 shows the taxes paid yearly with and without partial Roth conversions.

In dark blue, without conversions, you pay more in taxes once Required Minimum Distributions start and owe more than $268k of additional taxes over your lifetime!

With partial Roth conversions in green, you smooth out the taxes paid during your lifetime and save in taxes. Now, that is some good tax planning!

How to Pay Taxes on Partial Roth Conversions

Another important consideration is having enough funds in your brokerage account to pay the taxes on your partial Roth conversions.

This is important for several reasons. First, if you pay the taxes out of your pre-tax account, you will need to withdraw additional money and pay taxes on the money you are using to pay taxes! This is a bad idea.

Second, by depleting your brokerage account to do partial Roth conversions, you will save in taxes in the future! This is because you use taxable accounts to convert money into a tax-free account. This is important: you decrease your overall tax liability by using your brokerage account to put money into tax-free status. Thus, it can make some sense to pay more taxes now than you might in the future and convert at a higher bracket now than you will be in the future. This saves you on current and future taxes due to the depletion of the taxable brokerage account.

You should consider partial Roth conversions even if you need to pay capital gains tax. Paying the lower capital gains tax rates may later reduce your ordinary income—usually a good trade-off!

Summary of Partial Roth Conversions

That was a good (long) discussion about whether you can do partial Roth conversions.

Roth conversions will likely always be allowed because the government and the taxpayer like them. The government likes them because they get their money now, and people like them because of tax-free growth.

If you make more than 400k a year, your ability to do any Roth conversions in the future may be limited. However, if that is just a W2 wage limit, there will be plenty of ways to get around it, even for the wealthy.

Frequently Asked Questions about Roth Conversions

Can I do partial Roth conversions?

Yes, you can pay the extra taxes anytime you want, but it is most beneficial to do them when your income is the lowest. During your Tax Planning Window, after you have retired but before taking social security (at 70) and beginning Required Minimum Distributions (at 72), you usually have the lowest income and thus can access your lowest tax brackets.

How much to convert?

Partial Roth conversions can be done through your standard deduction and 10 and 12% tax brackets. These conversions are usually no-brainers. If you have large pre-tax accounts, frequently, you want to do conversions up to your 22% tax bracket. Conversions above this amount (up to the 24% tax bracket or higher!) can make sense for some folks.

Can I do partial Roth conversions with all types of pre-tax accounts?

Yes, for the most part.

You cannot do partial Roth conversions from non-governmental 457b plans as these have distinct distribution requirements that require you to take the tax-deferred income as W-2 income.

Partial Roth IRA conversions from TSPs are problematic as well. Roll TSPs into IRAs before conversions.

It is easiest for all other pre-tax accounts to roll over (via direct trustee-to-trustee transfer) your pre-tax money into a traditional (pre-tax) IRA and then do Roth conversions from there. For most custodians, you can often click a few buttons and immediately do partial Roth IRA conversions.

Is it worth it?

Yes, you save in taxes! To be sure, it would be best to have a 30-year tax projection.

Online Partial Roth Conversions Calculators

Partial Roth conversions Calculators are available online. Roth conversions are a year-by-year decision depending on your other sources of income, so while it is crucial to have a 30-year tax projection, decisions are usually made in November or December of the conversion year.

Partial Roth Conversions and:

Roth Contributions

You can do unlimited Roth conversions regardless of income. With Roth contributions, you are limited by AGI. You can contribute $6k (or $7k if older than 50) to a Roth IRA if you have earned income and your AGI is below the phaseout. There are NO INCOME LIMITATIONS for Roth conversions.

Calendar Year

You must do Roth conversions in the calendar year. This is a challenge as you often don’t know your real income until after the year ends. In addition, you may have to guess your marginal tax bracket after a partial accounting of all your income. Thus, you must do partial Roth conversions by December 31st and pay taxes in that tax year.

After age 72

According to the financial plan, you can continue after 72 when it makes sense. Often, you will remain in lower tax brackets despite having to take Required Minimum Distributions and other forms of income than your heirs will be in if they have to recognize the pre-tax IRA as income.

Before Age 59 ½

There is no penalty for early withdrawal for partial IRA conversion to a Roth. It is technically a rollover rather than a withdrawal; hence, there is no 10% penalty. However, note that if you pull money out to pay taxes on your Roth conversion before 59 1/2, there is a 10% penalty.

State Income Taxes

State income taxes are also due on Roth conversions. So, if you plan on moving to a lower or no-income tax state, it may be wise to hold off or adjust your strategy.

Recharacterization

Recharacterization of conversions is no longer allowed. Roth contributions may still be recharacterized.

Pro-Rata Rule

If you have basis in your IRA, you must have IRS form 8606 available and do conversions on a pro-rata basis. Specifically, if you have non-deducted IRA money, you have already paid taxes on the part of your IRA (which is the basis), and you don’t want to pay taxes again. Consider the Cream in the Coffee Maneuver to liberate your tax-free money from your IRA.

5-year rule

There are several 5-year rules. In this context, the money you convert from a traditional IRA to a Roth IRA cannot be accessed for five years without paying the 10% penalty. This is so folks under 59 ½ cannot simply avoid the 10% early withdrawal penalty by converting the funds into a Roth and then taking out the money. There is also a 5-year rule on the initial setup of any Roth account, which relates to taxation of the earnings.

Inherited IRAs

Conversions are not allowed on Inherited IRAs.

60-day Roll-Over

You must be careful when doing 60-day rollovers, as you can only do one every 365 days.

The SECURE Act

This recent Act did not address partial Roth conversions; however, the loss of the Stretch IRA may increase the importance of conversions as a legacy and/or estate play. Non-spousal Inherited Roth IRA may no longer be stretched and must be distrusted by the end of 10 years.

The Mega Backdoor Roth

Mega Backdoor Roth involves after-tax contributions to a 401k. If your plan allows after-tax contributions, you can put up to $57k total into your 401k (including employer contribution (match and profit-sharing), employee contribution, and after-tax funds). Next, if the plan allows it, this money can either be directly converted (in-plan) into the Roth 401k portion or rolled over (trustee-to-trustee transfer) of an in-service distribution to a Roth IRA. These are not considered partial Roth conversions but rather an in-plan 401k conversion or an after-tax to Roth IRA rollover.

Estate Planning

Roth IRAs are ideal to leave to heirs. Since Roth IRAs may no longer be stretched, they must be distributed to non-spousal heirs by December 31st, the 10th year after the IRA owner’s death. The distributions are tax-free, and there are no RMDs on Roth IRAs or inherited Roth IRAs. However, there are RMDs on Roth 401k balances, so those need to be transferred to Roth IRAs to avoid RMDs.

MAGI

Roth conversions are included as income for the MAGI calculation for both ACA premium tax credits and IRMAA.

Capital Gains

You might pay increased taxes on your capital gains due to Partial Roth Conversions. Remember that Capital Gains Stack Upon Ordinary Income, and conversions are considered ordinary income.

NIIT

They may cause your passive income to be subject to NIIT as well.

Social Security

Considered part of combined income for social security taxation purposes.

Medicare Tax (IRMAA)

Yes, you pay IRMAA if you convert too much, which is not subject to appeal.

Roth Conversion Pitfalls and Mistakes

10% Penalty Trap

This describes a trap when you make two mistakes while being under 59 ½. First, you use your pre-tax money to pay the taxes on the conversions, and second, there is now a 10% penalty on the funds used to pay taxes. Of course, you can do partial IRA to Roth conversions before 59 ½; just make sure you use brokerage account funds to pay the taxes and void the 10% Penalty Trap.

Can’t Convert RMDs

If you are over 72 and need to take RMDs, the first money out of your IRAs must be RMDs. RMDs cannot be converted into Roth; that is a contribution rather than a conversion. So, make sure you entirely remove RMDs before doing conversions.

IRA Aggregation Rules

You can take your RMDs out of one or all of your many IRAs if you take out a sufficient amount. IRAs are treated as if you only have one (aggregated), whereas 401k plans must each have a separate RMD. The Aggregation rules can trip you up if you take a small amount from one IRA and then try to do a conversion from another IRA before you take your entire RMD.

Need the IRA for Income

Finally, chances are, if you need the IRA for income, you probably shouldn’t do partial Roth conversions. This is because you likely don’t have sufficient funds outside your tax-protected accounts to live off of and pay the taxes on the conversions.