A Step-by-Step Guide to the Mega Backdoor Roth

The Mega Backdoor Roth is an excellent way for high-income earners to tuck away a ton of Roth money for retirement.

There are a couple of things you need:

- High Income

- a 401k Plan that allows after-tax contributions

- And either in-plan Roth 401k Rollovers or in-service distributions

This is a Step-by-Step Guide to the Mega Backdoor Roth, starting with how I did mine.

What is a Mega Backdoor Roth?

What is a Mega Backdoor Roth? It is also known as an After-Tax 401k (which isn’t a great name for it since you need the Roth rollover piece as well for it to make sense) or a “Super Roth.”

It is NOT the “Rich Man’s Roth,” a marketing pitch for cash-value life insurance products.

In many ways, the Mega Backdoor Roth is a supersized version of the Backdoor Roth IRA but is done in a 401k. IRAs, however, have small contribution limits, whereas 401k plans have much larger contribution limits.

It probably should be called a “Mega Backdoor 401k to Roth IRA rollover.” But that’s too wordy. Let’s call it a Mega Backdoor Roth. Or Mega Roth.

The goal: take after-tax money from your salary (that you have already paid taxes on) and get it into a Roth IRA. It is crucial to get it into a Roth IRA because the GROWTH of a Roth IRA is also tax-free! Any growth is taxable if you leave After-Tax money in your 401k!

Some plans allow a direct in-plan rollover of your after-tax 401k contributions into the Roth part of the 401k plan. This can be done in addition to your employee contribution of $20.5k (plus the catch-up if you are over 50), either pre-tax or Roth.

Regardless of the specifics, the goal is to get more Roth money!

The Mega Backdoor Roth is the best way to do that! If you have a good 401k plan.

How the Mega Roth is Different from the Regular Backdoor Roth IRA

A regular Backdoor Roth IRA is necessary for high-income folks because there are income limits on Roth IRA CONTRIBUTIONS. There are no limits on traditional IRA contributions—you can’t deduct them if your MAGI is too high.

The usual Backdoor Roth IRA is done via a non-deductible contribution to an IRA followed by a conversion to Roth. Since the money is after-tax (non-deduced), there is no tax for the conversion.

There are no income limits for Roth conversions.

The issue with the standard Backdoor Roth IRA is that the source of the contribution is an IRA. This means that Pro-Rata rules apply. In addition, the IRS views all of your IRAs as a single account, so you run into tax problems if you try to convert funds that are both pre- and post-tax.

The Mega Backdoor Roth 401k is a 401k, so there are no pro-rata issues. It is also done with after-tax money. We don’t call this money non-deductible because you never took it as salary in the first place.

You will also pay social security taxes (if below the wage base) and Medicare taxes on the after-tax contribution. But, of course, if you had taken the money as salary, you would have paid that as well.

Let’s look at a step-by-step process for doing a Mega Backdoor Roth.

How the Mega Backdoor Roth Works—Step-by-Step

- Read the plan documents and make sure you can make after-tax contributions

- Figure out your contribution amount (pre-tax or Roth) and determine your match

- Subtract number 2 from the 401k total limit. This is $66k (plus catch-up if you are over 50) in 2023

- Elect to make after-tax contributions from your salary. You will pay ordinary income taxes and employment taxes on this

- If your plan allows in-plan rollovers to Roth 401k, do it! The IRS calls this In-Plan Rollover to Designated Roth Account

- If your plan allows in-service withdrawals, do a trustee-to-trustee transfer (not a 60-day rollover) of the after-tax 401k into your Roth IRA

- If your plan doesn’t allow 5 or 6, you might consider adding to your after-tax 401k a few years before retirement and then rolling it over when you retire. Here, you would take your pre-tax contributions and growth from the after-tax earnings and roll those over to a traditional IRA, and take your after-tax contributions and roll those over to a Roth IRA

- Don’t forget the Tax forms!

Here are the steps in more detail:

Pictorial Step-by-Step Guide to the Mega Backdoor Roth

Read Plan Documents

How do you know if you have an excellent 401k plan that allows Mega Backdoor Roths? You are going to have to read the plan documents!

First, find out if you are allowed to make after-tax contributions.

After-Tax Contributions

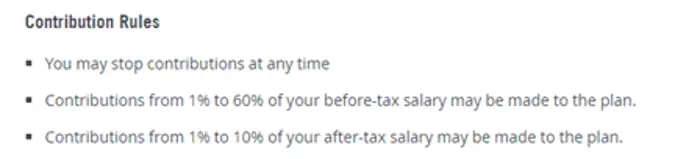

Figure 1 (Make sure Plan Documents allow After-Tax Contributions to do Mega Backdoor Roth)

For example, my plan allows 1-60% of before-tax salary to the $22k employee contribution and 1-10% of pay to after-tax contributions. Remember, the after-tax contributions do not have a limit of $20.5k; they have a limit of $66k MINUS your employee contributions MINUS the employer match.

Next, find out if you can make in-plan conversions or in-service distributions.

In-Service Distributions

The plan documents specify that I could withdraw it anytime if I rolled in money from a different pre-tax account (such as another 401k, 403b, or IRA). Also, any after-tax voluntary contribution can be withdrawn at any time. Importantly, this is not a hardship withdrawal. This is a withdrawal “at any time.” Hardship Withdrawals have very different issues attached to them, which are not addressed here.

Next, find out how much in-service withdrawals cost

Cost of In-Service Withdrawals

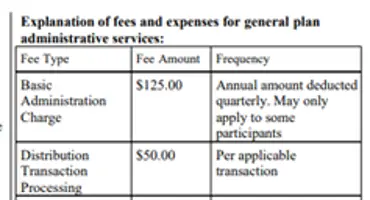

Figure 3 (Figure out the cost of doing a Mega Backdoor Roth)

Here, there is a $50 charge for any distribution transaction. This means that I want to limit the number of in-service withdrawals I do. Also, it is interesting to note that there is a $125 yearly fee to use this 401k. Not great if you have a small amount invested, but at least it is not a percentage of the investments!

Usually, in-plan Roth rollovers are free.

Next, you want to make your after-tax contributions.

Make After-Tax Contributions

This plan allows pre-tax and Roth contributions and bonus pre-tax and bonus Roth contributions. For the prior, the usual salary is deferred, and for the latter, just bonuses are deferred. I’m interested in the after-tax (non-Roth) contribution.

Once the pre-tax contributions are maxed out, I will adjust the after-tax contribution to max out the 401k limit. Unfortunately (or I guess, fortunately), a very generous employer match limits the amount of after-tax money that can be invested.

Then, see how much money you save in your After-Tax account.

Figure Out How Much After-Tax you have to Convert

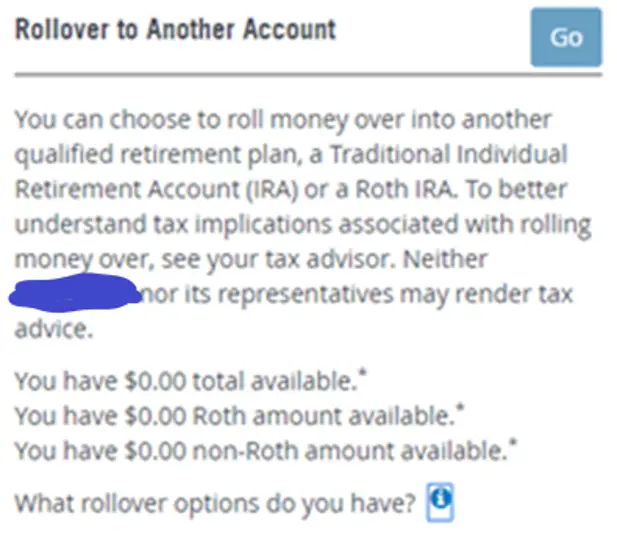

Figure 5 (The Rollover to Another Account keeps track of the amount you have available to convert via the Mega Backdoor Roth)

I don’t have a screenshot of this before rollover, but you can see where it keeps track of my non-Roth amount in a separate account. This is the amount available for Roth rollover to a Roth IRA. Please note the separate account is important. If your plan doesn’t have a separate account for your after-tax contributions, there are pro-rata implications I won’t get into here.

Note that you can “go” on this tab on the webpage, but it takes you to a phone number. At least in my plan, you have to call the custodian to do a custodian-to-custodian rollover.

You can also find this information on your monthly statements.

Rollover After-Tax Contributions

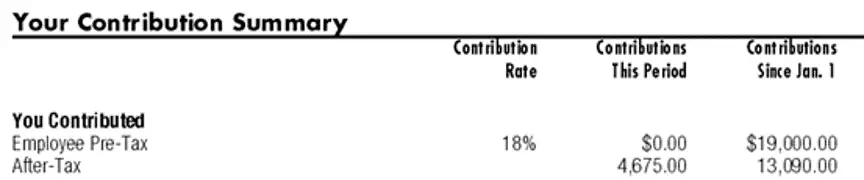

Figure 6 (Note the amount of After-Tax Contributions available to Rollover)

Above, in the contribution summary, you can see the after-tax contributions this period and contributions this year. This sum does not include the earnings of the after-tax money, which may be invested aggressively if you want, or you can leave it in cash. If you are going to convert frequently, it is probably best to leave it in cash until you convert it.

What about the tax forms?

Don’t Forget the Tax Forms

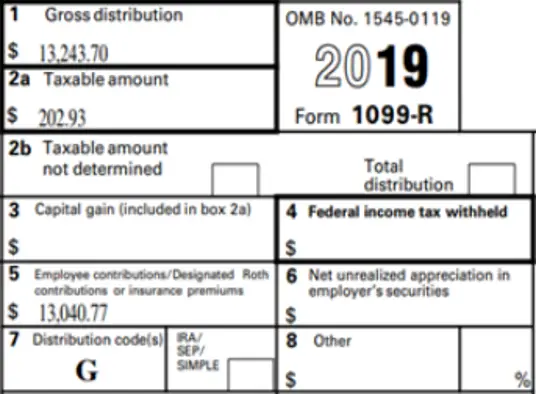

Figure 7 (Tax Forms from the distribution)

Above, see the 1099-R for tax purposes. This will need to be included when you file your taxes. Note box 1, the gross distribution, that I made some money while the funds were in After-Tax limbo in the 401k. In fact, I made (box 2a) 202.98 or 1.5% on my money. And now I will pay ordinary income taxes on that amount. Box 5 shows the after-tax contribution amount minus the $50 fee I paid. Nice of them to take that money from my basis! Not. Also, note that the pennies don’t quite add up for whatever reason. I can’t figure out why, but I’m not worried about that since the IRS rounds to the nearest dollar.

Let’s look at box 7 for a second.

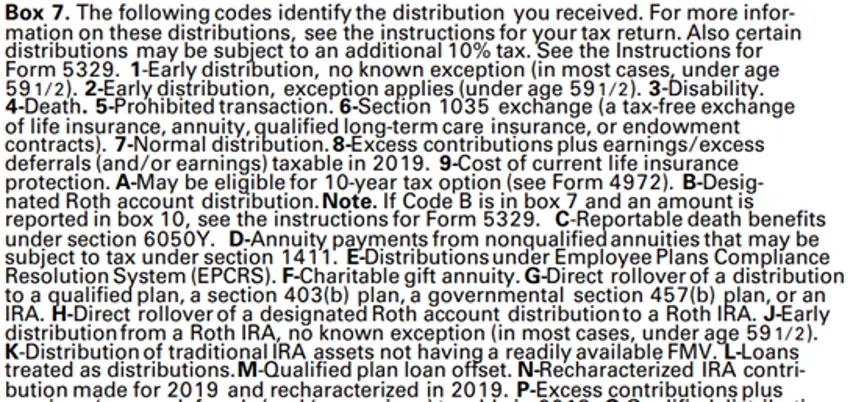

Distribution Code on the 1099-R

Figure 9 (Box 7 1099-R)

This is important. If this box is checked with an incorrect code, you might be forced to pay taxes again on your after-tax contribution. Note that code “G” is checked. This indicated a direct (trustee-to-trustee) rollover of a contribution to another qualified plan or an IRA. This indicates no 10% early withdrawal penalty as it was a direct rollover to another retirement plan. This, together with the basis from box 5, indicates the money goes tax and penalty-free to another acceptable retirement plan such as a Roth IRA.

Finally, the money is in our Roth IRA! What next?

Invest in the Roth IRA

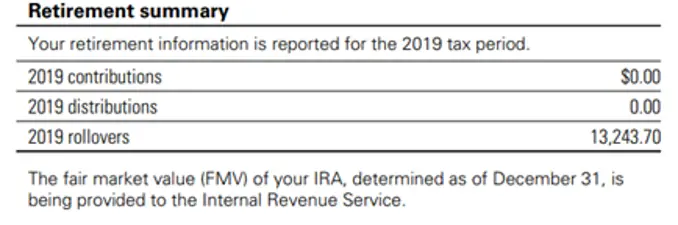

Figure 10 (Mega Backdoor Roth now in the Roth IRA as a rollover)

Above, you can see the Roth IRA, which has a rollover amount equal to the distribution amount. That was a nice Roth rollover for my working years! Again, a small amount of taxes will be paid on the earnings while the money sits in after-tax 401k limbo, but having every dollar you can in Roth is nice.

So, that’s a pictorial history of my Mega Backdoor Roth. I hope you enjoyed it! Let’s round out this piece with a few advanced topics.

Advanced Topics in Mega Backdoor Roth

Let’s review some advanced topics when considering the Mega Backdoor Roth 401k.

And the Solo or Individual 401k

Look closely at the “off the shelf” versions of popular custodians and make sure they can do a Mega Backdoor Roth if you have a Solo 401k and enough business income. Often, Roth and after-tax contributions may be more tax-efficient if you are self-employed and qualify for the 199A QBI deduction.

And the 199A QBI Deduction

Depending on the industry you are in, and where you are relative to the phase-outs, you may want to make pre-tax, Roth, or after-tax contributions in your solo 401k. Unfortunately, if you take money out of your taxable income as a pre-tax contribution, you may not get to take the 20% 199A QBI deduction! This is a complicated discussion but has considerable tax implications. See your CPA.

And the IRS

If you accumulate earnings from your after-tax contributions, there are some special rules to follow. First, take a distribution after you separate from service. You can put the pre-tax money and the earnings on the after-tax contributions into a traditional IRA and move the after-tax contributions into the Roth IRA. This saves you from paying taxes now on the accumulated earnings. It used to be a pro-rata distribution with separation of service, but no more.

In addition, you don’t use form 8606, which is for IRAs. Instead, you use form 5498 from your Roth custodian. If you use turbo tax and do a Mega Backdoor Roth, be prepared for additional headaches.

And max out your Roth 401k or Roth IRA first

Again, the Mega Backdoor Roth is just for those with additional money to save. Max out your Roth or pre-tax contributions first and the traditional Backdoor Roth IRA, etc.

And Roth 401k Contributions

You can add $22k of Roth contributions into your 401k plan if there is a Roth option. This point can be debated, and I won’t get into the debate here. Should you do pre-tax or Roth 401k depends on your future and current tax brackets and future and current sources of income, among other factors. I am taking as much deduction as possible as I plan on partial Roth conversions in the future at a lower tax bracket during my Tax Planning Window.

And a Reminder of the Point

The point is to get tax diversification through Roth Optimization. Load as much money into Roth retirement accounts as soon as possible to take advantage of Tax-Free Growth and Distributions

When NOT to do a Mega Backdoor Roth

Don’t do a Mega Backdoor Roth 401k if:

- You aren’t already maxing out your employee contributions and Backdoor Roth IRA

- If you don’t have in-plan rollovers or in-service withdrawals, you might want to wait until you are 3-5 years out of retirement to start after-tax contributions

- You have better uses for your money

- You will likely need to take distributions from your pre-tax accounts before RMDs instead of considering partial Roth conversions

Step-by-Step: Mega Backdoor 401k to Roth IRA Rollover

I hope you enjoyed this step-by-step guide to the Mega Backdoor Roth!

Why do a mega backdoor Roth?

- Tax diversification is vital, especially to control your income in retirement

- Pay taxes now, and have years of tax-free growth in the future

- No Required Minimum Distributions on Roth IRAs (there is on Roth 401k money, so you want to roll over your Roth 401k into a Roth IRA before RMDs)

- Asset protection (retirement funds are better protected than brokerage accounts)

- Roth accounts are the best accounts you can leave to Heirs, and remember, due to the 10-year rule, there is no more stretch IRA for your heirs!