A Fictional Retirement Plan

I wanted to start off a new series of blogs about fictional retirement plans. What can we learn about retirement planning by doing case reviews for fictional couples?

Let me know if you enjoy this so I can do more in the future.

A Fictional Couple’s Retirement Plan

Dot and Dan are 64 and 68. He is retired and on social security; she wants to retire now. Do they have enough money to reach their retirement goals?

Well, great question! To answer it, we have to understand what their goals are!

They want to know:

- Can we retire with 120,000 a year on a 2.5M nest egg?

- Should we pay off our mortgage?

- What about safety first? Should we get an income or a deferred annuity?

If there is something left, the kids can have it. Dot and Dan have no significant legacy concerns for their children or charity. They are happy to spend down all of their assets during their retirement.

Dot is in good health and plans to live another thirty years. She was the breadwinner between the two and has a larger IRA. On the other hand, Dan is a bit older and not in great health. He thinks he will live to be about 80 or 85, and Dot plans to live past 90.

So, what do you think? Do Dot and Dan have enough to retire?

Some Basic Financial Details For our Fictional Retirement Plan

Dot and Dan have about $2.5M saved up, and their asset allocation is 70/30. They want to take out $120,000 a year to live on, in addition to the mortgage and health insurance. Dot plans to use Cobra until Medicare age.

Social security: As Dot made more money and is expected to live longer, she needs to wait until she is 70 to claim. When she claims, Dan can see if a spousal check is larger than the check he is getting on his own record. Social Security is supposed to change to your larger benefit automatically, but you need to double-check.

Monte Carlo Success rate is 90% with this plan, which is fine by them since they can be flexible with their spending and have set an aggressive spending goal.

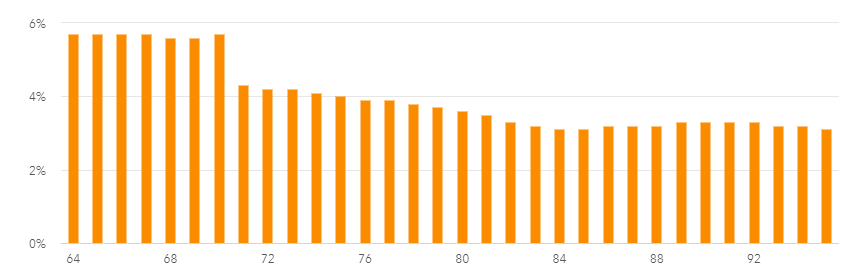

Figure 1 (Withdrawal Percentage from the Portfolio)

Above in Figure 1, you can see the withdrawal percentage from their portfolio. Initially, it starts at about 6%, then decreases to 4% when Dot claims social security at age 70. Note that the withdrawal percentage decreases over time rather than increases with inflation as per the usual “4% withdrawal Rule-of-Thumb.”

What about a Mortgage in Retirement?

This is a tough call. These folks have a 30-year mortgage out at 3.5%. The home is worth 500k, and the amount on the mortgage is 400k. They are unsure how long they want to live in the home and are okay carrying debt into retirement.

There are advantages to paying off the debt: -debt-free -less interest payments over time -less stress.

There are also advantages of keeping the mortgage -better cash flow -less risk during your most vulnerable ten years -can pay it off any time -more liquidity

Since they are okay with debt, it may be best to keep the mortgage rather than try to pay it off, especially as they move in the next 5-10 years. This allows the greatest flexibility. If they don’t pay off the mortgage, they can have liquid reserves if the economy goes bad (and it will eventually!). Once past sequence of returns risks, they can always just pay it off or get a reverse mortgage. Most likely, however, they plan on moving at some point; it doesn’t make a ton of sense to pay off the mortgage.

Plus, they can’t afford to without a large tax bill! To see that, we need to see what they have for tax diversification.

Tax Diversification in Our Fictional Retirement Plan

Let’s see where their money is located.

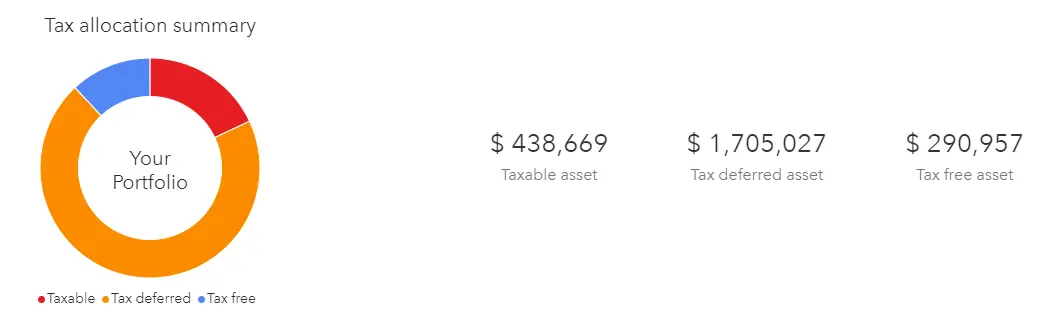

Figure 2 (Tax Diversification Summary)

Above, they have some money in the Roth as a tax-free asset. However, they have a lot of tax-deferred money, which may be a problem. Fortunately, most of the tax-deferred money is Dot’s, so she has a longer period before taking RMDs.

Also, Dot has a non-governmental 457, which she has funded for the last couple of years. Distribution options are decent; she can use it for the first 3-5 years to fund retirement before dipping into the IRA.

They could pay off the mortgage with the money in their brokerage account, but this would leave Dot and Dan with minimal cash reserves. That doesn’t allow for much flexibility, as it would force large distributions from the pre-tax retirement accounts if they have a lumpy expense.

Usually, at retirement, the plan is to have 2-3 years of assets in cash. Then, once a year, you can look forward to next year’s spending, decide what distribution you want to take from your IRA and fit this into your best tax bracket.

But what tax bracket should they expect to be in during retirement?

Tax Planning and the Fictional Retirement Plan

Doing a 20- to 30-year tax projection is important to know how best to manage your pre-tax retirement accounts. Of course, nothing about the future of taxation is certain. It is, however, important to have a plan now so you can react to future changes rather than just willy-nilly wander through retirement. After all, a dollar you don’t give the Government is another dollar you can spend on retirement!

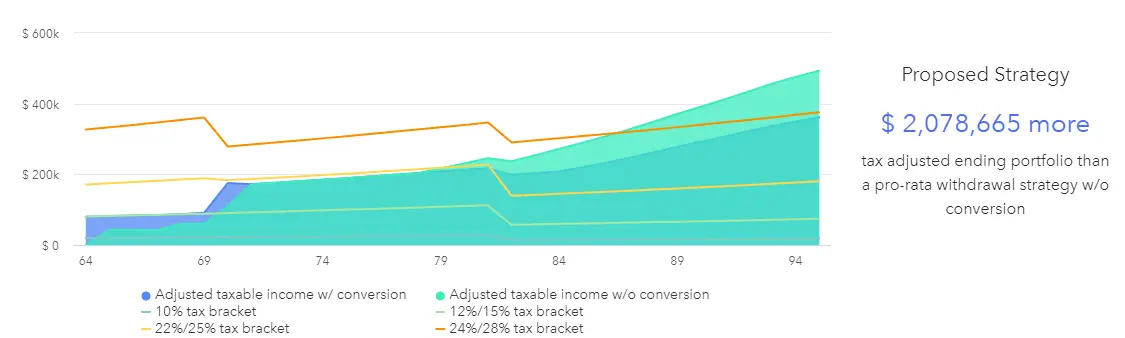

Figure 3 (Tax Bracket Planning)

You can see above tax bracket and partial Roth conversion planning. A lot of information is packed in here, but this is often the heart of retirement planning for folks with large IRAs.

Note in dark green (which becomes light green later) is their projected income and the effect of RMDs without partial Roth conversions. Dot has a 457, so she plans to take that out from 65 until 69. Dan has some smaller IRAs that kick in when Dot is 68, and Dot takes social security at 70. Her RMDs start at age 72, but note that there isn’t a bump in the taxable income then. This is because they actually need distributions from her IRA between 70-72.

Over time, we can see that Dan dies when Dot is about 83, and her tax brackets go down as she is now filing taxes single. This is called the Widow Penalty and is important to consider. Without the partial Roth conversions, her RMDs eventually force her into the 35% tax bracket. Can we do better than that?

Yes! It looks like they have some room in their 12/15% tax bracket to do yearly partial Roth conversions. What a steal! She was a high-income earner, so she deferred taxes at the 39% tax bracket and now is paying 12 or 15% to take that money out. Also, this decreases the tax liability in the future and keeps her out of the 35% tax bracket (the highest yellow line) when she is a Widow.

Why not convert up to the 22 or 24% tax bracket while the TCJA is still in place until 2025? Sometimes it doesn’t make sense to pre-pay taxes even at the “moderate” tax brackets. If they did this, they could actually get rid of most of their pre-tax retirement accounts and convert them into Roth. But then they would have no income to fill up the standard deduction and the lower tax brackets. So, pay 24% now or 15% in the future? Also, they would drain the brokerage account by doing overly aggressive Roth conversions. Not cool, as you never want to pay the taxes for conversions by pulling taxable money out. If you do so, you are paying tax on the money you are using to pay the taxes on the taxes. Huh? Just know you need to have money in a brokerage account to pay taxes on Roth conversions; otherwise, it seldom makes sense to do so.

Finally, note they save almost $2M by doing partial Roth conversions and using a sensible tax-efficient withdrawal strategy. This is over 30 years, but it is still a nice return on investment to do retirement planning.

What Does Pre-Paying the Taxes Look Like?

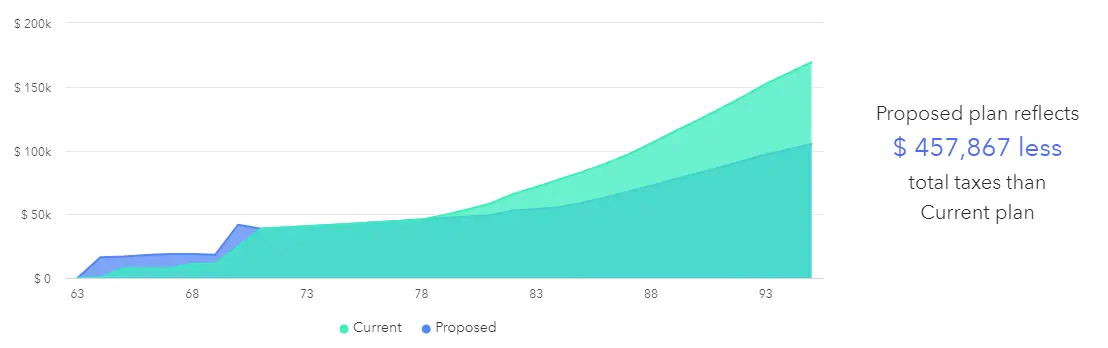

Figure 4 (Pre-Paying the taxes)

Just let’s have a quick peek at figure 4. This shows the amount owed to federal taxes every year during retirement. Note they could pay next to nothing for taxes during their Tax Planning Window, but if they do so, the “tail” during late RMDs become huge. By doing Roth conversions into the 12/15% tax bracket, they pay $450k less in taxes over their lifetime.

Insurance Options

They do not need income, so a SPIA is not indicated.

They do have quite a bit in pre-tax money, and Dot was interested in longevity insurance. She plans to shop for QLACs for herself (which she will max out at $200k for a single life since she is expected to live longer than Dan; if she pre-deceases Dan, he doesn’t need the money). In addition, Dan will likely devote some from his IRA on a single-life QLAC on Dot as well. She plans to turn on these QLACs around 80-85, depending on her health, and this will offer a nice boost in income should she live that long.

They have traditional long-term care insurance for over a decade now, and they plan to keep it.

Finally, they changed their asset allocation from 70/30 to 60/40 for the first five years of retirement. This de-risked their portfolio. Eventually, depending on what happens, they will consider returning to 70/30 as part of a bond tent strategy.

Summary- Fictional Retirement Plan

So, there you have it. What do you think?

In summary, we have a well-to-do couple with a mortgage and aggressive spending goals in retirement. They can do some minimal Roth conversions early on in retirement and save a bundle. However, they don’t have a ton of cash, so they need to be careful not to run out. Finally, they have a moderately large Roth account. This is great because they can use it whenever they want to without spiking their income and being forced into higher tax brackets.

I think our fictional couple will do just fine!