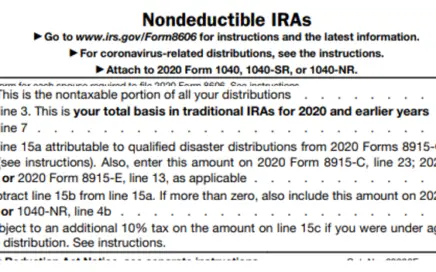

Non-Deductible IRAs – A Comprehensive Guide

Non-Deductible IRA After-tax contributions to a traditional IRA are a common problem. These results in basis in your IRA. That is, you have money you have already paid taxes on in a usually pre-tax account where you still owe taxes! […]