Asset Allocation 5 Years From Retirement

What should your asset allocation be five years from retirement?

Should you De-Risk your portfolio for retirement? What does a good pre-retirement glidepath look like? Five years from retirement, let’s consider your asset allocation.

What does an ideal pre-retirement glidepath look like to get your portfolio retirement ready for retirement?

How are Target Date Funds 5 Years from Retirement?

Target date funds start de-risking about 25 years before retirement. What is their asset allocation five years from retirement?

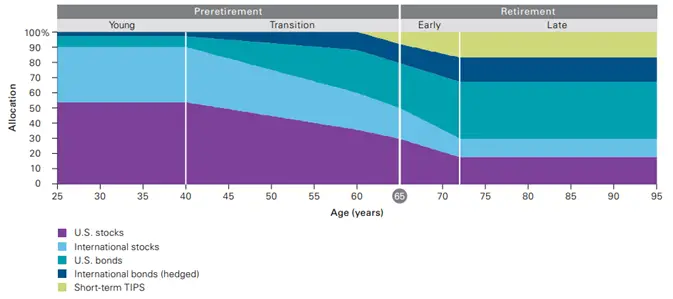

Figure 1 (Vanguard Target Date Fund De-Risking begins at age 40)

For instance, look at Vanguard’s model target date fund above. This is an example of a pre-retirement glidepath. They start de-risking at age 40 for a planned retirement at age 65!

As bond allocation has increased, International and US equities have decreased steadily over the last 25 years. Five years before retirement, add short-term TIPS. Note the change in asset allocation five years from retirement.

Does the average investor want to de-risk a portfolio 25 years before retirement? This seems excessive to me. Given that stocks win out over bonds during most 10-year periods, aren’t target-date funds leaving a lot of returns on the portfolio by this gradual decrease in stocks over decades?

When Should You De-Risk Before Retirement?

We’ve seen above that Vanguard starts de-risking 25 years before retirement, and the bond tent has a 40-year transition. What should your asset allocation be five years from retirement?

When should you increase bond allocation- when should you de-risk before retirement??

Adding bonds means giving up potential returns in the long run. Why do you have bonds in your portfolio?

Good Question! Bonds are volatility dampeners. That’s it. That’s the whole story for the time being. Bonds are not for income; they are to mitigate against sequence of return risk by decreasing volatility in the portfolio. You have bonds, so you never sell low.

Sequence of returns risk is the largest risk facing pre-retirees today. Sequence risk describes permanent negative effects on your long-term net worth if you withdraw from a down portfolio.

The withdrawing part is key. This is why you have bonds in your portfolio: if you need to withdraw money during a sequence of subpar returns. When is sequence risk at its very worst?

Sequence of Returns Risk 5 Years From Retirement

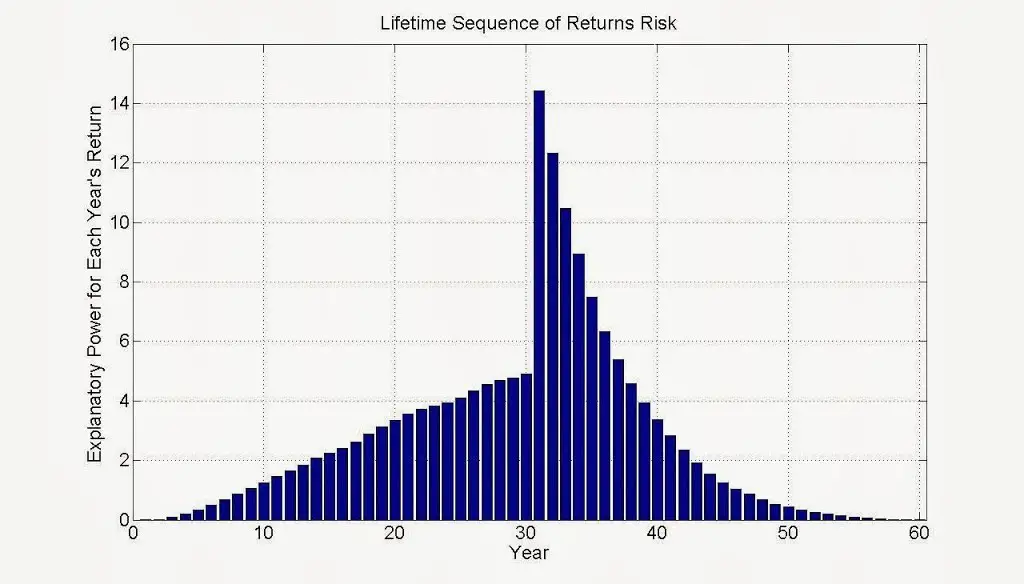

Figure 2 (Sequence of Return Risk, from Pfau)

In Figure 2, you retire at year 30. Before this, you can see how a significant negative market event affects your portfolio long-term. That is, each year, what is the risk that a negative market can cause sequence of returns risk?

Twenty-five years before retirement (year 5 of the graph), you see very little explanatory power of a negative market causing sequence risk. This slowly but steadily increases over time until the year you retire.

In year 30 (the year you retire in the graph above), the explanatory power jumps by 3.3 times! Yes, sequence of return risk is most significant the year you retire and start withdrawing from your account.

Here, we are not focusing on the “tail” risk once you retire but rather the risk BEFORE you retire. Looking at Figure 2, the risk in the five years before retirement is not insignificant, and there is risk for even the decade before that!

Mitigating Pre-Retirement Sequence of Return Risk

As an aside, it is challenging to study pre-retirement sequence of return risk.

Please stick with me here for a second.

If I’m trying to study WHEN you should de-risk your portfolio before retirement, the only significant data point is WHEN the market drops. The best time to de-risk your portfolio is right before a significant market correction, and you are always better off taking lots of risk until right before the correction happens.

So, since we are looking at the left part of the graph in real-time rather than in the future, as with the tail, it is hard to nail down a way to study de-risking, the only question, and the one that no one ever can answer, is when is the market crash?

That said, I note that those in the accumulation phase and in retirement (who have adequately mitigated sequence of returns risk) have NO Market Risk. This is a bit controversial, I know.

Only in pre-retirement do you have market risk.

When to De-Risk a Portfolio Pre-retirement

So, when should you de-risk your portfolio pre-retirement? I suggest 5-10 years before retirement.

Risk is highest the year before you de-risk your portfolio and increases in real-time every year you don’t de-risk.

How to Set Asset Allocation 5 Years From Retirement

Morningstar talks a little about HOW to de-risk the portfolio for retirement.

The idea is to know your accumulation asset allocation and understand your target pre-retirement asset allocation. Then, over time, increase the fixed income/bond allocation to reach the target allocation.

You can do this immediately: selling equities and buying fixed income. Or, you can do this over time through rebalancing. Or, stop re-investing dividends and instead re-balance into fixed income.

Another way to de-risk your portfolio over time is to change the investments with your new money. However, one should almost always dollar cost average new money into equities and buy fixed-income assets rather than stocks during your transition phase.

There are many ways to skin this cat, and substance beats form when de-risking the portfolio before retirement.

A more challenging question is, what should your asset allocation be when you de-risk?

How Much Should You De-Risk Before Retirement?

How much you should de-risk before retirement is a very individualized issue. Asset allocation is the first true decision that an investor makes after deciding to invest in the first place.

Ten years before retirement, you should take as much risk as balances cans and needs in accumulation mode. How much risk can you tolerate and how much risk do you need to reach your goals? The usual pre-de-risking asset allocation ranges from 60/40 to 100/0 stocks to bonds.

What should your asset allocation be five years from retirement? That is:

How much should you de-risk?

Look back at Figure 1. Vanguard has a 70/30 asset allocation ten years before retirement. This then decreases to 50/50 at retirement. Next, they get even more risk-averse through retirement and decrease to 30/70 over the next ten years.

So, should you consider starting retirement somewhere between 30/70 and 40/60? It depends on your goal asset allocation and what lets you sleep at night. More commonly, a 60/40 portfolio at retirement may be adequate to protect your downside during the initial withdrawal phase of retirement.

I like considering how much “safer” money you want to avoid sequence risk. Is 5 or 7 years enough? As it turns out, some might consider being much more aggressive in their asset allocation five years from retirement.

Summary- Asset Allocation 5 Years From Retirement

De-risking your portfolio in preparation for retirement is essential.

De-risking includes preparing for sequence of returns risk. I suggest you consider de-risking your portfolio 5-10 years before retirement.

Specifically, between 5 and 10 years before retirement, decrease from your accumulation asset allocation to your retirement asset allocation. These are personal decisions, but if one went from 80/20 (or higher) down to 60/40 (or lower), you would not be seen as having three heads.

Of course, if you have enough other sources of income and don’t need to withdraw from your portfolio, no de-risking is necessary.

Conversely, you will also be less apt to de-risk if you don’t fear sequence risk or think you can ride out short-term economic downturns.

At least now you have some suggestions on what to do if you decide to do it.