Don’t Die with your HSA

Let’s keep this short and to the point: Don’t Die With your HSA!

Yes, non-spouses can inherit leftovers from your Health Savings Account. However, while it is tax-free to you, unfortunately, it is fully taxable to your non-spouse heir. Thus, spending down the HSA during your lifetime and leaving other assets behind is a good goal. Leave it to your spouse or spend it!

Also, don’t forget the HSA and Medicare Penalty!

And remember the “backdoor HSA”

Let’s dig into the specifics of inherited HSAs and learn what happens to this beloved account type upon the owner’s death. Are Inherited HSAs Taxable?

Can an HSA be Inherited?

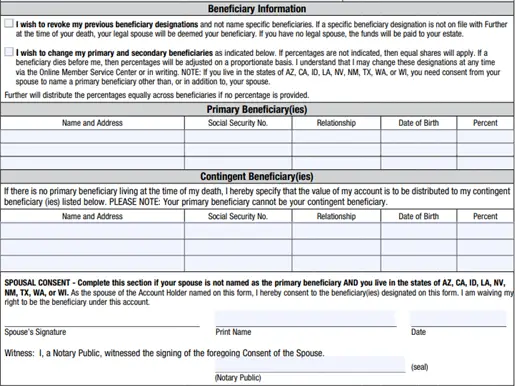

Yes, HSA accounts can be inherited. Like most retirement accounts, HSAs pass via beneficiary form (not will or trust). Let’s check out a beneficiary form.

The Beneficiary Form of an HSA

See above a typical beneficiary form for an HSA. Note that it goes to your spouse if it is not filled out. Perfect! Also, there are 9 states that require spousal consent (via Notary Public) if you want to have a non-spouse beneficiary. This is pretty common, and it is likely you have done this before if you have rolled over a 401k, 403b, and 457 plan.

Next, you can list primary and contingent beneficiaries on the form. You can still do disclaimer planning with these, as discussed below. So, if you don’t have a spouse, you can take advantage of the contingent beneficiaries.

But what happens if a spouse or a non-spouse inherits your HSA?

What Happens When a Spouse Inherits an HSA?

If a spouse inherits an HSA, they transfer it to their name and use it. Yes! They get tax-free reimbursement for qualified health care costs. If you have a spouse, leave the HSA to him or her.

What if you don’t have a spouse? Be careful now. What do you do with an inherited HSA?

What Should You Do With Your HSA If You Don’t Have a Spouse?

If you don’t have a spouse and still have money in your HSA, spend the HSA down!

When a non-spouse is left an inherited HSA, it is fully taxable to them in the year of death. The owner could have used it tax-free, but an inherited HSA is taxed at ordinary tax rates. Essentially, an inherited HSA acts like a fully taxable IRA, but there is no 10-year rule for inherited HSAs. It must be taken as income in the year of death.

The other consideration (which you would rarely, if ever, do with other retirement accounts) is to leave the HSA to your estate. If you have a lower tax rate than your heir, your estate will pay taxes at the HSA owner’s marginal rate upon death. Next, you pass on the cash through your estate rather than the fully taxable HSA.

Conversely, if your heir has a lower tax rate than your estate on your year of death (not estate taxes, but rather the 1040 ordinary income tax rate of your estate the year you die), leave it to him or her directly. Either way, once you die, the HSA is fully taxable in the year of death—to you if you name your estate or to your heirs if you name them.

There is no additional 20 percent penalty tax (as there would be for nonqualified distributions before age 65) for inherited HSAs.

To Review:

- Leave your HSA to your spouse

- If you don’t have a spouse, leave it to your estate if your tax rate is lower than your heirs

- If your tax rate the year you die is higher than your heirs, leave it to them via the beneficiary form

- Keep a file with your health care expenses. Your estate can get tax-free HSA reimbursement on this amount (see below)

- Remember, once you are 65, you can withdraw from the HSA without a 20% penalty. This will be taxed similarly to any other pre-tax retirement account

- You can always give your HSA to charity!

Other Advanced Ideas on Inherited HSA

If you don’t have a spouse, spend the HSA on qualified health care expenses. If you have massive healthcare expenses, you might not want to use your HSA that year. Remember, health care expenses (including premiums and additional items) are an above-the-line deduction above a 7.5% AGI floor. Read more about that phenomenon here: Long Term Care Insurance Issues Your Agent Won’t Tell You. This is a pretty common planning error: do not save your HSA for Long Term Care costs.

If you must leave a large HSA behind, you can spread it to several people to minimize the tax impact in the year of death. Even if you are leaving them inherited IRAs as well, they can take less from the IRA in the year of death and still get a 10-year pseudo-stretch on the inherited IRA.

Also, remember to fund your HSA with your IRA once in your life (QHFD)

Finally, remember you can give your HSA to charity. That way, no one pays the taxes!

Disclaimer Planning and HSA

There are primary and contingent beneficiaries of an HSA. Just like with inherited IRAs, the primary contingent can disclaim it. If they do, it passes to the contingent beneficiaries as if the primary beneficiary was dead. There are no gift tax issues; this can be a tax-efficient way to pass on an HSA. With disclaimer planning for the HSA, you don’t need to guess future tax rates. You can decide who gets the HSA after the death of the owner.

HSA Estate Planning

After the HSA owner’s death, you can still use the HSA owners’ receipts for medical care (either in the final year or if they have a file folder full of past qualified expenses, you can use those) to access the HSA tax-free. This is reported on the final year’s tax return.

Thus, if the HSA owner has a file folder full of receipts for qualifying medical care, getting a distribution from the HSA to reimburse those expenses is worth your time. This is also called the deathbed drawdown.

HSA to Pay for Long-Term Care PREMIUMS

HSAs are often a great way to pay for long-term care insurance PREMIUMS but are often not an efficient way to pay for long-term care expenses. If long-term care expenses are above a 7.5% AGI floor, they are tax-deductible. Instead of using tax-free money, take extra distributions out of a pre-tax retirement account to a specified tax bracket. Utilize extra deductions via tax bracket arbitrage.

Summary: Inherited HSA

Are inherited HSAs taxable? YES!

Have a plan for your HSA, especially if you have a large one. Don’t die with your HSA!

Leave it to your spouse, or spend it before death. Remember, Inherited HSAs are fully taxable to a non-spouse beneficiary. Why not give your HSA to charity instead?

If you are inheriting an HSA after the death of a loved one, see if the HSA owner has a file of health care receipts. If so, pull some money from the HSA to reimburse those expenses in the year of death. The HSA deathbed drawdown.

HSAs are quadruple-advantaged tax accounts that can be great for retirement. But don’t die with one!