The 10-Year Rule Increases Taxes

What is the 10-year rule, and why is it important? After 2020, most non-spousal beneficiaries pay attention. The 10-year rule will cost you more in taxes passing on your pre-tax retirement accounts.

Do You Have a Pre-Tax Retirement Account?

If you have a pre-tax retirement account, such as an IRA or a 401k/403b, you need to know about the 10-year rule.

Folks who read this blog are supersavers and likely need to leave some (or a lot) of their money behind. If you leave your pre-tax money to charities (or to a CRUT), you don’t need to worry about the 10-year rule.

On the other hand, if you leave your pre-tax money behind to your spouse, you don’t need to worry about the 10-year rule. Spouses are eligible designated beneficiaries, which I’ll discuss below. But remember, if you have a large IRA or 401k, you may want to do a cascading beneficiary plan via disclaimer planning.

But if you have a sizeable pre-tax retirement account not for your spouse or charity, the Secure Act changed how you leave your pre-tax accounts to your kids.

More in taxes, less for your heirs.

Secure Act Killed the Stretch IRA

The Secure Act killed the “stretch IRA.”

There is no such thing as a stretch IRA. It’s just a concept. Here is the idea: leave your IRA behind for your kids, and they can “stretch” it over their remaining life expectancy. So, say, for instance, they were 40 and had a forty-year life expectancy when they inherited your IRA. In the first year, they would take 1/40th, then 1/39th in the second year, then 1/38th, 1/37th, etc. So, you can see that the IRA will grow tax-deferred over time and will be worth quite a bit even 30 or 35 years later when you are taking 1/5th, 1/4th, 1/3rd, half, then, on the final year of the original life expectancy, they finally drain the account.

That’s quite a mouthful, but most people may not understand how the stretch used to work. If you read the above, now you do! You get the life expectancy one time from an IRS table, and then you subtract one from the denominator year after year.

Now, after the Secure Act, it is the 10-year rule. RIP Stretch IRA (at least to your kids).

The 10-year rule means the entire account needs to be drained by the 10th year after the death of the pre-tax owner. So, you could take out 1/10th every year or drain it all the last year. (Note there are yearly RMDs if the retirement account owner took RMDs at death.)

Eligible Designated Beneficiaries and the 10-Year Rule

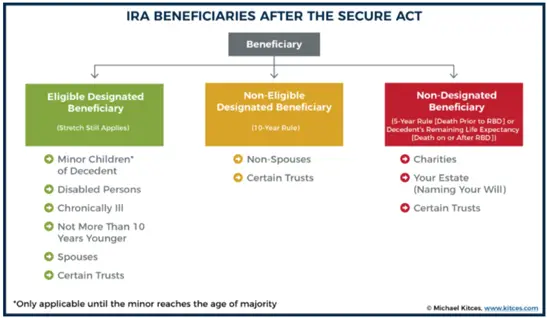

Let’s change gears here and discuss who can still use the Stretch IRA. The Secure Act didn’t eliminate the stretch so much as it added another concept: eligible designated beneficiaries.

A few designated beneficiaries are determined to be “eligible” not to be forced to use the 10-year rule.

First, a beneficiary is someone (or something like a charity or a trust, or—if you are uninformed—your estate) you list on the beneficiary form of your pre-tax retirement account. Next, a designated beneficiary is someone with a pulse.

Charities and trusts will use the 5-year rule because while they may be beneficiaries, they don’t have a pulse and thus are not designated beneficiaries.

Above, you can see from Kitces that beneficiaries can be non-designated (because they don’t have a pulse) and non-eligible (because they don’t meet the eligibility criteria).

Who Is Eligible Designated Beneficiary?

To be eligible not to use the 10-year rule, you must fall into one of the following four eligible exceptions:

- Spouses. Spouses keep their broad ability to do just about anything they want with IRAs. As a result, they have always had the most flexibility to take it as their own, stretch it as an inherited IRA, or other features depending on if RMDs have begun.

- The beneficiary is less than ten years younger than the owner.

- Chronically ill (2 of 6 ADLs) or Disabled (note disability uses strict IRS criteria but leaves open the possibility of stretch IRA trusts for disabled folks, which is a must).

- Less than the Age of Majority (or still in school until 26). You can stretch it until you hit the magic age when the 10-year rule starts. So this is just a deferral of the 10-year rule. And it is only for the account owner’s children, not grandchildren or other non-child youths.

The Death of the Stretch IRA

So, what are the options to get around the 10-year rule and the death of the Stretch IRA?

A Charitable Remainder Uni-Trust (CRUT) is a fascinating idea. If you have charitable intent and want to leave a yearly income behind for your heirs, this might be just the thing for your large IRA. And guess what? You can name a Donor Advised Fund as your charity, which means the remainder goes to your grandkids for gifting.

Taking money out for life insurance is also a consideration, especially if you are bumping against estate taxes and your heirs are in high tax brackets. So, the plan is to pay taxes now to pull out money to put into a second-to-die GUL in a Life-Insurance Trust. This gets money from your estate into a tax-free benefit for your heirs. After Roth conversions, believe it or not, this is an amazingly effective use of Permanent Life Insurance and one of the appropriate uses for high-income earners.

Disclaimer Estate Planning

Partial Roth Conversions

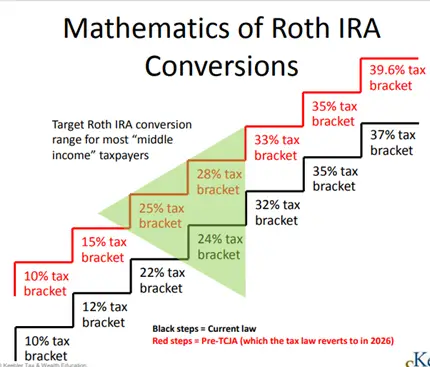

But the clear winner is the partial Roth conversions. Consider at least debulking your Roth IRA if you have a lot of pre-tax retirement money, or consider a series of full-on partial Roth conversions during your Tax Planning Window.

Above, you can see the current tax law (in black) and the tax law in 2026 when the Tax Cut and Jobs Act expires. Between 12 and 24%, there is a clear spot for partial Roth Conversions. So, if you do nothing but wait for a couple of years, it will save you 3-4%. But there is a deeper, more important reason to do them.

Alternatives to the 10-Year Rule

- Roth Conversions

- Gifting

- CRUT

- 529 Plans

- QCDs

- Life Insurance

- Accumulation trusts

Let’s review these stretch IRA alternatives and talk about the benefits of each.

Roth Conversions as an Alternative to Stretch IRAs

A series of partial Roth conversions is a powerful alternative to the Stretch IRA. If you have a high tax bracket heir, you can use your lower tax brackets to pre-pay the taxes.

The idea is to look at your and your heir’s tax brackets (over your remaining life span and the 10 years they get to remove the IRA and Roth IRA) and determine the optimal tax brackets to pay taxes.

This is true tax bracket arbitrage, and it takes understanding both effective and marginal tax brackets.

Roth conversions (for some) are the optimal alternative to the Stretch IRA. Who will pay the taxes on retirement accounts?

Yearly Gifting

Don’t forget to use your yearly $16k per person gift tax exclusion to give while you are living.

This gifting can be upstream if you want a tax-efficient way to give money, or it can be downstream gifting.

If you have to take out RMDs you cannot spend, getting them out of your estate early (as an estate freeze) makes sense, so the growth happens outside of your estate.

CRUT as an Alternative to Stretch IRAs

Charitable remainder trusts are a more complicated idea, and I will discuss them here. However, if you have charitable intent, a CRUT is an exciting idea and worth considering if you need a Stretch IRA alternative.

Remember, they are Charitable Remainder trusts, so promise at least 10% to the charity of your choice. That is fine if you want the charity to be your own DAF (donor-advised fund). (The Grandkids can give the money away!) The payment rate is determined based on the beneficiary’s age, interest rates, and IRS tables. Usually, 5-8% is taken out each year, and at the end of the term—usually 20 years—at least 10% remains for charity.

What Goes in a Charitable Remainder Trust?

Often, appreciated property (such as real property or stocks with a low basis) is donated. Since they donated to charity, you get the total amount deposited into a trust, which can be sold without capital gains. In addition, you also get a current tax write-off on the present value of the future charitable donation.

In the end, CRUTs can pass on a steady income stream and, in the right situation (especially if you have charitable intent), can be a compelling way to dispose of large IRAs efficiently.

529 Plans as Stretch IRA Alternatives

This idea is a bit off the beaten path, but you can donate large sums of money to 529 plans. You can leave a legacy of education to your family or consider using the 529 Retirement Plan.

QCDs

Next, consider QCDs to lower your taxable income, which allows you to do more Roth conversions. Of course, in the end, you won’t leave more after-tax money to your children, but QCDs are one of the optimal ways to balance out your taxes during your lifetime, which is an excellent alternative to the Stretch IRA.

Permanent Life Insurance as a Stretch IRA Alternative

Permanent Life Insurance has a bad reputation, but there are indications for permanent life insurance.

Leveraging your Required Minimum Distributions is a great way to leave a non-taxable lump sum to your heirs.

Guaranteed Universal Life Insurance (GUL) is the cheapest, most effective way to build a death benefit. You can use second-to-die policies to increase the death benefit or lower the premiums. This option is reasonable if you have extra RMDs and are not averse to using permanent life insurance.

Accumulation Trusts

Finally, you could leave your IRA to an accumulation trust and have the trust dictate the distribution of assets. But, of course, this is a horrific idea from a tax perspective, as all the income to the trust is fully taxable at trust tax rates.

But if you must replicate the Stretch IRA to protect the money from creditors or control the money for the heir, accumulation trust is a consideration.

Summary: The 10-Year Rule and Your Retirement Accounts

If you were considering leaving a Stretch IRA behind as a legacy, think again!

Most beneficiaries of inherited IRAs will now be forced to withdraw the money over ten years using the 10-Year Rule. You now must drain the account by the end of the 10th year.

Congress does not intend retirement plans to be vehicles for generational wealth. Before the Stretch IRA, the 5-Year Rule was the law of the land. The Supreme Court determined that inherited retirement accounts are, in fact, not retirement accounts and are subject to loss by creditors. Many intelligent folks predicted it was only a matter of time before the Stretch IRA would be repealed. Now, these same folks are saying it is only a matter of time before the 10-year rule goes away and is replaced by the 5-year rule.

Fundamentally, these changes are happening because Congress wants to get the money out of tax-deferred accounts so they can get paid taxes. Also, the money forced out is spent or forced into a taxable account with ongoing tax drag—a Win-Win for the government.

But the 10-year rule is why you must pay attention to your retirement accounts. The goal: minimize your and your heir’s taxes. Every dollar you don’t pay the government is one you get to spend or give away.