Three Accounts and the 3-Fund Portfolio

Simplicity is a 3-fund portfolio. Total US and International equity funds and a bond fund are baked together in a set asset allocation. There is much more to consider when you have different account types and tax treatments.

How can we optimize the 3-fund portfolio across the different accounts?

When we add asset location (also known as tax optimization), you need to consider the different taxation of the accounts and tax efficiency.

What is the Three Fund Portfolio?

Bogleheads suggest the 3-fund portfolio, a simple mix of total US and International equity mutual funds or ETFs and some fixed-income (usually a total bond fund). These three funds comprise your overall asset allocation (equities + bonds = 100%). For example, here is a 3-fund portfolio exploring a 50/50 Asset Allocation Portfolio.

Once you know which mutual funds or ETFs you want, where do you own them?

What are the Three Accounts?

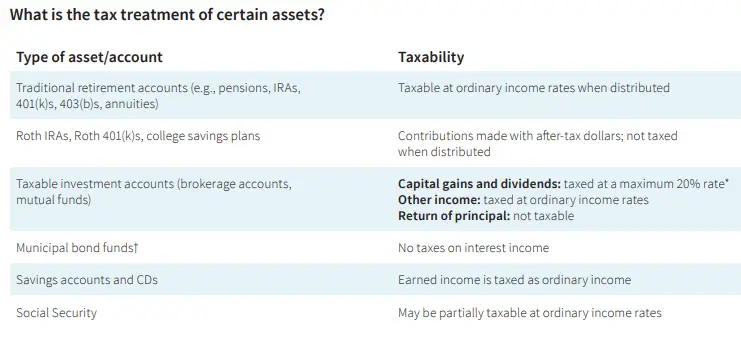

There is brokerage, pre-tax, and Roth. Of course, it’s a little more complicated than that, as you see in the table below. But why do you want some of the three taxable account types?

Tax diversification!

Tax diversification helps you use your tax planning window to control your income during retirement, which controls the amount of taxes you pay over your lifetime.

Attention is needed as different types of investments are taxed differently, and account types vary in their tax treatment.

Figure 1 (Tax treatment of account types)

As shown in Figure 1, many different types of assets or accounts exist, and they are taxed differently.

To simplify, there are only three account types to consider when considering tax diversification.

Roth

Roth is the TAX-FREE bucket. Tax-free means you paid taxes, and all future growth and withdrawals are tax-free. Roth money is precious; gather it whenever you can.

How can higher-income folks get money in Roth accounts? The most common are Partial Roth Conversions, Backdoor Roth IRA Contributions, and Mega Backdoor 401k to Roth IRA Rollovers.

Brokerage

Often called a taxable investment account, a brokerage account invests after-tax money.

When you pay 1) capital gains tax on qualified dividends and 2) ordinary income on interest, you suffer from tax drag.

Pre-Tax

Pre-tax or retirement accounts get a tax break when you put money in. Growth is tax-deferred. Eventually, when you withdraw from these accounts, you pay ordinary taxes.

Tax Arbitrage (deferring income tax during peak income years and recognizing it later when you have low income) helps you decide whether to defer or accept income.

There are different taxes for different assets in different accounts. Let’s look at that.

The 3-Fund Portfolio in the 3 Accounts

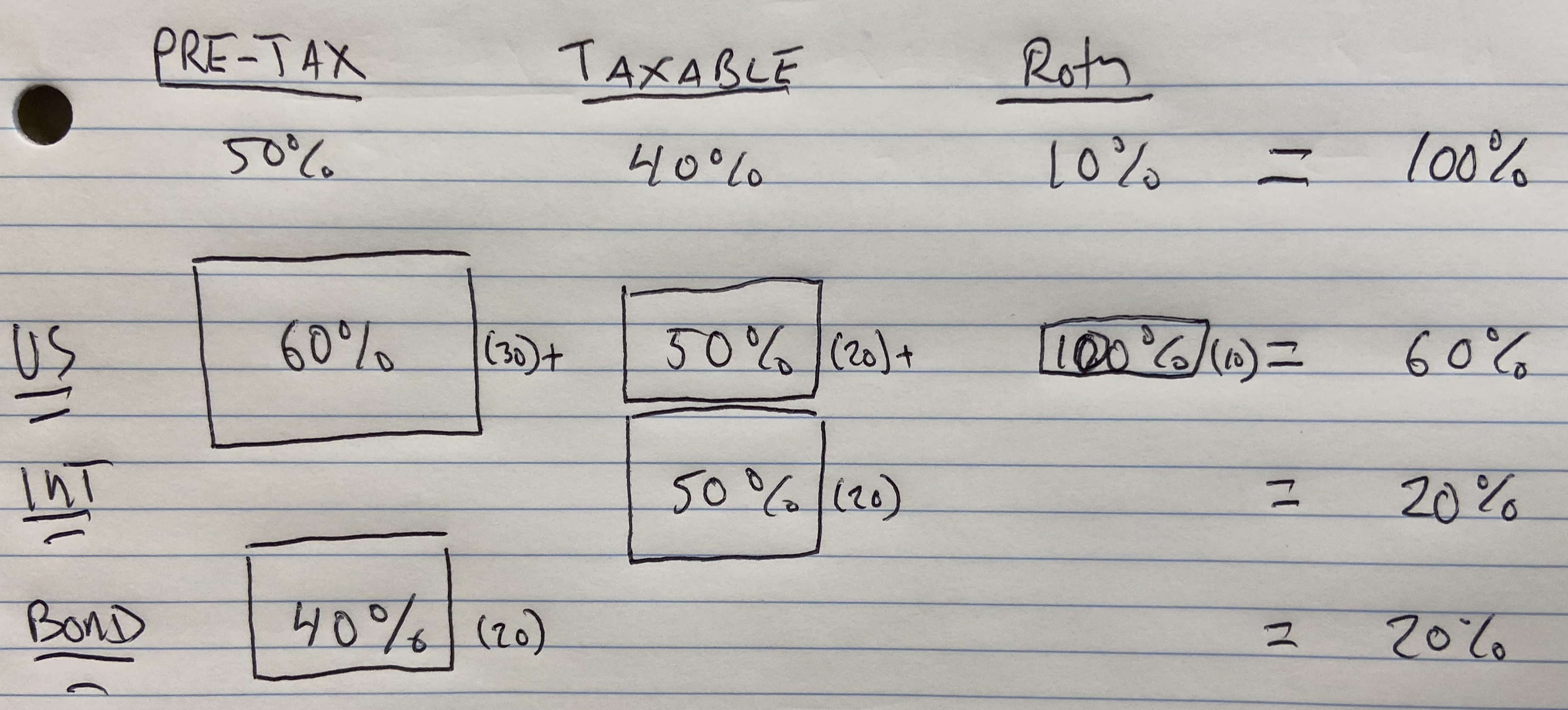

This is my 3rd-grade drawing of the 3-fund portfolio in the different account types.

Figure 2 (How a 3-Fund Portfolio fits Across the different types of accounts)

In Figure 2, you can see the three account types: pre-tax, taxable, and Roth. Note that 50% of the portfolio is Pre-tax, 40% is Taxable, and 10% is Roth. This distribution is typical for high-income folks who sock away lots of money pre-tax and have little opportunity to fund Roths.

On the left are the three funds: US Equity, International Equity, and Bonds.

In the Pre-tax account, you have 60% invested in the US and 40% in Bonds. The little numbers in parentheses are the percentage times the 50% (which is the size of your pre-tax compared to your whole portfolio).

In taxable, you are 50/50 US and international (which, in parentheses, is 20% of your total).

Finally, in the Roth, you have 100% in the US (10% of your portfolio).

Add them up on the right, and you have 60% in the US (which is a part of all three account types), 20% in international (which is just in your brokerage account to take advantage of the foreign tax credit), and 20% in bonds (held only in pre-tax to be tax-efficient).

Asset Allocation and the 3-Fund Portfolio.

So, what is your asset allocation? You are 80/20! US (60) plus International (20) equals 80%; the rest are bonds.

Asset allocation is the second most important decision you make after investing.

The 3-Fund Portfolio

There you have it. You have an efficient asset allocation located among the different accounts.

Believe it or not, that is what you need to know. If you can tax-optimize the 3-fund portfolio, you will beat 95% of investors.