What is a RILA?

What is a RILA, and should you buy one?

These annuities are taking off from a sales perspective, so I’m not surprised that you are being sold a RILA. Should you buy one?

Let’s find out!

What is a RILA?

A RILA (registered index-linked annuity) is similar to a FIA (fixed indexed annuity). Both use options on stock market indexes to provide a return and limit loss of principle.

Further, both are types of deferred annuities aimed at accumulation. FIAs have principle protection—there is no risk of principal loss, though likely they won’t return nearly as much as advertised over the next few years.

With a RILA, you can dial up and down the risk you will tolerate.

RILAs are like buffered ETFs, with a downside buffer. Before becoming registered index-linked (who knows what that means???), they were often called buffered annuities.

RILAs must be sold by folks who have a security license (the registered part of the name), so they may be pitched as an alternative to VAs (variable annuities) rather than FIAs (you don’t need a security license to sell FIAs, just an insurance license). So, in effect, you might see your bank or broker dealer pitching you a RILA (or a variable annuity). In contrast, your insurance salesman will continue to pitch you a FIA (unless they also have a securities license).

Let’s look at how RILAs compare to FIAs and VAs.

How Do RILAs Compare to FIAs and VAs?

RILA vs FIA

As mentioned above, you need a security license to sell a RILA. You don’t with FIAs. FIAs don’t lose money (there is true principle protection), but there is only a downside buffer or floor for a RILA. You might make more with a RILA than a FIA because you have more risk, or specifically, less downside protection.

RILA vs VAs

VAs are chock full of fees (with the general exception of IOVAs) and invest in the stock market via subaccounts. RILAs use options rather than actual investments in stocks and bonds. VAs seldom are indicated, yet they remain the bestselling annuity year after year.

RILA vs MYGA

MYGAs are also accumulation products, but the interest is fixed. MYGAs are similar to CDs. There is no downside risk with MYGAs, whereas you may earn more (and lose some) with a RILA annuity.

Next, how do RILAs work?

How Do RILAs Work?

RILAs use a rather complicated series of options. The downside (floor or buffer) is pretty much locked in for the duration of the contract, but the insurance company can change the cap. They make their money on the spread between what they earn and what they give you with the cap. The salesperson earns a commission because of the surrender charges, which lock you up with surrender fees.

So, how do RILA annuities work?

On the upside is a cap, where you participate in the upside of a market index via options (you don’t actually own the stocks, just options to purchase the stocks if they go up). It is important to remember that you do not get dividends when you only own options on stocks.

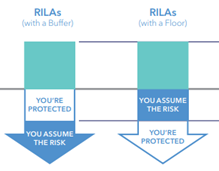

The downside is a bit more complicated. There is either a buffer or a floor.

Above, with a buffer, you are protected from the downside for a while, and then you are fully exposed to any further losses. Since the downside is unlimited, you often have higher caps with buffer RILAs. For example, if the buffer was 10% and the market went down 30%, you would lose 20% (30 minus the buffer).

With a floor, you assume the initial risk of a down market, and then you have protection below the floor. Since the insurance company assumes the largest downside risk, you usually have lower caps with floors than with buffers. For example, if the floor was 10% and the market went down 30%, you would lose only the floor (10%) and no more.

So, the floor is the absolute most you can lose, and a buffer absorbs part of your losses before you start taking them again.

I’m not going to get into how options are specifically used for these products, but if you want to understand them, read my blog on Buffered ETFs.

What might you want to use a RILA?

Use Cases for a RILA Annuity

There are few actual use cases for a RILA annuity, which is why you are being sold one. There are annuities (good annuities) that you actually have to seek out and buy. This is not one of them, as most of the time, you will be better off investing in a diversified portfolio.

That said, there are use cases for RILAs, similar to the use cases for buffered ETFs. ETFs are generally superior to annuities in almost every way unless you actually plan to annuitize the contract.

With RILAs, there are surrender charges. This provides you an illiquidity premium, and, on average, you see higher caps with RILAs than you do with similar ETFs.

Given the complexity of these annuities, you should avoid them unless you understand what you are getting yourself into.

So, when might you consider a RILA rather than a buffered ETF?

When might you want a RILA rather than a buffered ETF?

If you are considering annuitizing the annuity for income, you might consider a RILA.

If you are a “safety-first” kind of person, a RILA might be in your plan if you are not ready for a SPIA or QLAC.

In general, RILAs and Buffered ETFs are there if you have behavioral problems with investing you are trying to address. See my blog on buffered ETFs for a full discussion and examples of the behavioral problems RILAs attempt to address.

Behave!

Ranking the Risk of RILAs

Let’s look at the risk of deferred annuities, force rank them, and also see what “usual” investment they are similar to.

MYGA >> FIA >> RILA (Floor >> Buffer) >> VA

(CDs) (structured investments) Buffered ETFs Mutual funds

MYGAS are the least risky, about as risky as CDs. Both are principle-protected and have fixed growth rates.

FIAs are similar to structured investments. The goal is to be a bond-alternative and grow more than bonds, but also principle protection.

Next, RILAs can be compared to buffered ETFs. Floors are more conservative, and buffers are more aggressive. However, buffered ETFs also offer the same options for buffers and floors.

Finally, VAs might be compared to mutual funds. With both, you have the usual market risk.

Summary: Are you Being Sold a RILA Annuity?

In summary, annuities are mostly oversold. They are complicated, and you must understand the details before considering purchasing one.

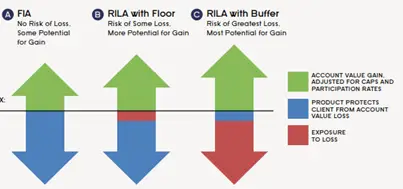

Above, you can see a FIA compared to a RILA with a floor and buffer.

If you use a buffer, you might have a higher cap because, as you can see, you are exposed to more risk.

As is usually the case with these products, you are better off being in a diversified portfolio of stocks and bonds.

You might consider a FIA if you tend to panic, sell low, and want bond-like returns. FIAs are true bond-alternatives.

With RILAs, you can dial up and down the risk by selecting a product with the risk characteristics you want. RILAs with floors are more like bonds than those with buffers, but the specific details of the products are important.

If you are being sold a RILA, remember to always think about the purpose of the money. There will be folks who understand and want to purchase RILAs, but not many. Many more will be sold.