A Less Expensive Variable Annuity Option: IOVA

IOVA Annuities can be less expensive than other Variable Annuities and can be considered if you want to repurpose other expensive insurance products.

Regular variable annuities are expensive, complex, and can be full of riders that benefit the insurance company more than the investor.

There are a few good reasons to own Variable (VAs). Though not many!

Some well-to-do investors may be maxing out tax-deferred accounts and looking for another way to tuck away after-tax money in a tax-advantaged way.

Others are sold annuities or unnecessary permanent life insurance policies and may want to consider a 1035 exchange. If you have a poorly performing life insurance policy or an expensive variable annuity, consider a tax-free 1035 exchange to an investment-only variable annuity (IOVA).

IOVA Annuity

OVAs are relatively new, and although there are a handful of companies out there selling them.

First, let’s look at the good, bad, and ugly of IOVAs.

The Good, Bad, and Ugly of IOVA Annuities

This advice is NOT for Variable Annuities SOLD or PITCHED to you. It is only for IOVA annuities that you want to buy. Generally, Variable Annuities sold by insurance salespeople should be avoided at all costs.

The Good: Advantages

-low cost (see below)

-no surrender charges

-no commissions

-include tax-inefficient assets such as REITs, bond funds, and actively managed funds

-1035 exchange into IOVA from a crappy product

The Bad: Drawbacks

-must be 59.5 years old, or a 10% penalty applies to withdrawals

-no commissions for the salesman, so no one will pitch them to you!

-limited or expensive selection of side accounts (mutual funds) to select from

-riders are difficult to understand without expert guidance (and salesman are not experts due to conflicts of interest)

-low minimum investments

The Ugly: Pitfalls

-misinformation about the products

-it feels sleazy to use one

-confusing death benefits, if any

-kickbacks (up to 0.6% of aggregate fees)

I’m not sure if the taxation of annuities is good, bad, or ugly!

Taxation of the IOVA Annuity

Taxation of IOVA Annuities is a critical consideration. Of course, a selling point of annuities, in general, is that growth happens tax-deferred. Beyond that, it gets complicated and depends on whether you have annuitized the annuity. Annuitized means you have given up the principal and turned on the cash payments that last your lifetime.

You can withdraw before you have annuitized the product, which is considered LIFO (last in, first out). So, you get earnings first (taxed as ordinary income), followed by a return of principal (tax-free).

Once annuitized, the payment is a combination of principal and earnings. It depends on whether you own the product in a non-qualified (after-tax) or qualified (pre-tax) account.

Ok, I agree taxation is ugly with annuities.

The death benefit, if there is one, is always fully taxable. Ugly as well.

Let’s talk about the main advantage of IVOA’s next 1035s.

1035 a Bad Product into an IOVA

As I mentioned, expensive “advisor” sold Variable Annuities or poorly performing permanent life insurance policies can be 1035 tax-free exchanged into Investment Only Variable Annuities. You get to keep your basis without tax implications. That is—if you have lost money—you can gain it back tax-free. And if you have made money in a crappy product, you need not pay taxes on the gain with a 1035 exchange.

In either case—win or lose—it makes sense to get into something that suits you better. An IOVA may be just the ticket with much lower costs.

Costs of Investment Only Variable Annuity

This is where IOVAs should shine compared to VAs that are sold. Fidelity states the VA average expense is 1.11%.

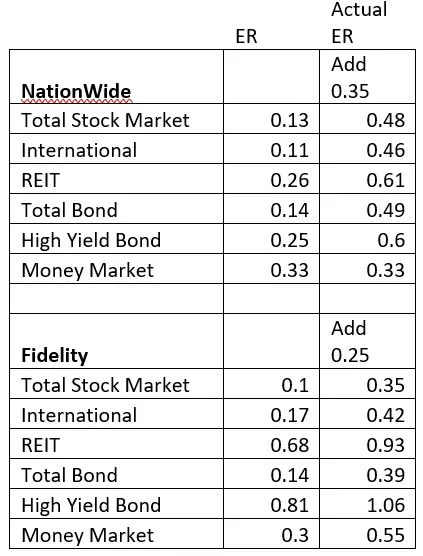

See the table below for the actual cost if you want low cost.

Investment options inside IOVAs

Transamerica took over from Vanguard in 2021. It was difficult to find the cost of these annuities; this is from the brochure:

Transamerica variable annuities’ range of fees and charges include

0.20%–1.50% M&E&A, 0%–8% surrender charges, current $35

and maximum $50 annual service charge, and investment option

management fees. A fund facilitation fee of up to 0.60% annually may

apply for certain investment options.

Expense Ratios (ER) are difficult to find on their webpage for the 35 funds offered. This is a negative change from when Vanguard offered IOVAs.

Jackson has an IOVA, but most ERs are between 0.5 and 1% after a $20 monthly charge.

Nationwide has 350+ side accounts (funds)! Talk about complexity. Expense Ratios are 0.49 (but see below for additional costs) up to >2% (in at least four funds).

Fidelity has 67 funds and calls their product a Personal Retirement Annuity. Six funds have ERs >1.0%, and twelve funds cost less than 0.5%. Target date and blended funds are about 0.44% to 0.68%. With the 0.25% fee added, many funds are above 1%.

Investment Only Variable Annuity Fees

Transamerica and Jackson are not fee transparent, and thus difficult to compare.

Nationwide is less transparent about fees. They advertise $20 monthly fees but have “ low-cost fund platform” fees. This is an additional 0.35% fee ON TOP OF the expense ratios they provide. They offer DFA, BNY Melon, and Vanguard funds, with this additional 0.35% fee hidden. Other funds have a .10% hidden fee.

Fidelity costs 0.25%, though fund fees apply.

Bottom Line: IOVA Annuity

This is important. Cost matters for index funds, and cost matters for an IOVA Annuity.

Conclusion: IOVA Annuity

If you must use a variable annuity, consider an Investment-Only Variable Annuity.

Cost and complexity are the main downsides to variable annuities. At least IOVAs cost less, though certainly, they are still complex!

For the DIY, no one will sell you an IOVA. There are times when tax-deferral is indicated, especially when you need to 1035 tax-free exchange out of expensive VAs that you bought before you knew better.

There aren’t a lot of great options out there.

How would you compare IOVA .vs the VA option of moving all funds to their GIA option? I believe VAs have to provide (general interest account) options with minimal guaranteed interest. I’ve seen old contracts with both 3% & 4% GIA rates. Given todays fixed income rates, that’s appears to be a potential option?

Thanks for the IOVA info.

great summary! I actually 1035 exchanged a Northwestern mutual whole life policy into a low cost VA, or as you call the a IOVA, at Fidelity. seems for my asset allocation of 75% total US stock market and 25% total international, Fidelity has the lowest cost. Definitely have to keep in mind your asset allocation when determining which IOVA to choose 🙂