IRA Legacy Planning

Let’s look at IRA Legacy Planning. IRAs are tax timebombs, and someone will pay the taxes. Who? You, Your Spouse, or Your Kids?

Do you and your spouse want to pay the taxes or leave them for the kids to pay? What about if one of you dies prematurely? Should you optimize your IRA for life as a widow?

What about if your goal is to leave money to charity?

IRA Legacy Planning is important once you have determined you have enough to retire safely. After all, paying more than you have to in taxes is no fun, so why not optimize your IRA?

IRA Legacy Planning and Goals

What are some common goals for the IRA?

Optimization includes considering leaving money to your children and/or charity if there is enough to go around. Qualified Disclaimer Estate Planning is important (and easy!) to consider first.

Let’s look at the goals of your IRA when we consider IRA Legacy Planning.

Charitable Intent and IRA Legacy Planning

Planning becomes fun and easy if you have charity as your legacy goal! Spend what you want and leave the rest to charity.

Or, with some IRA Legacy Planning, pay less in taxes during your lifetime to leave more to charity.

Once you have a future tax projection, see what your Required Minimum Distributions will be. Now, mitigate your RMDs and keep you in an optimal tax bracket during your lifetime via Tax Bracket Arbitrage.

Options are:

QCDs –

Instead of recognizing your RMDs as income, once you are 70 ½ (the SECURE Act didn’t change the age at which you can start QCDs), you can give your pre-tax money directly to a qualified charity. If you do, you don’t need to recognize this money as income. This can keep you in a lower tax bracket, and it has many positive downstream effects, like decreasing the taxation of social security, reducing IRMAA surcharges, keeping tax credits that would otherwise phase out, etc.

Partial Roth Conversions –

If you will have a much higher tax rate in the future but plan to earn some extra tax-free income later in life, consider partial Roth conversions. However, remember your “heir’s” income tax bracket is ZERO (charities don’t pay tax on pre-tax money!), so be careful not to overdo Roth conversions.

Charitable Remainder Trusts –

CRTs are an important tool! If you give your nest egg to a large institution, they retain estate lawyers who would happily help you set up a Gift Annuity or Charitable Remainder Trust. These can be effective ways to generate (taxable) income during your life while getting a present-day tax deduction based on your future expected gift.

Basis in Brokerage Account –

Remember that charities also don’t pay capital gains taxes, so gift them equities with high basis (significant embedded capital gains) while living or in your will.

Giving your nest egg to charity is fun but hard work if you want to optimize it. So, let’s move on to a more difficult discussion: nest egg optimization for a couple or a single spouse.

IRA Legacy Planning for Couples

Who will pay the taxes, a couple or a widow? There can be massive tax implications.

Let’s consider a couple for the time being. They don’t have significant goals to give money to their children or charities but want a comfortable retirement.

Here, it makes sense to optimize taxes for three different scenarios: Both have long lives, or one or the other passes on early in retirement.

IRA Legacy Planning for the Children

If you want to leave the most possible behind for your children, consider permanent life insurance for the death benefit. Not infrequently, this would be a second-to-die guaranteed universal life insurance policy with no cash value.

If you want to avoid life insurance, consider partial Roth conversions. Of course, you must be concerned with your children’s future tax rate here. Due to the death of the stretch IRA via the SECURE Act, they can no longer stretch out their inherited IRAs, so consideration for Roth conversions becomes even more critical. Review this important concept in the 10-year rule and your Retirement Accounts.

However, you don’t want to convert at a high tax bracket for a low-income heir. Why pay taxes now when they can pay fewer taxes in the future?

If you have high-income and low-income children, consider leaving your pre-tax account for the low-income children and your Roth and brokerage accounts for high-income children.

Leaving money to your heirs is a complicated topic that will require some IRA legacy planning.

Pre-Tax Accounts and IRA Legacy Planning

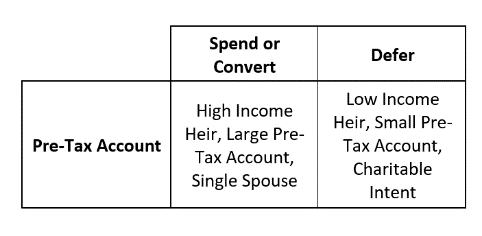

Figure 1 (IRA Legacy Planning)

Much of the consideration for IRA Legacy Planning comes from the pre-tax account. As this money will always be taxable unless left to charity, it is important to consider what to do with your IRAs and 401k/403b plans.

In addition, Required Minimum Distributions force this money out. Initially, there are only small minimums, but over time, these distributions can force you into the highest tax brackets if you have large pre-tax accounts.

You want to spend down or convert your pre-tax money if the accounts are large or if you may be a single spouse subject to higher tax brackets. In addition, if your heir will be in a higher tax bracket than you currently are, Roth Conversions make sense.

On the other hand, you might consider deferring spending from these accounts if your heir is in a low tax bracket or if you have charitable intent. If nothing else, consider de-bulking your IRA via Partial Roth Conversions.

So, who will pay the taxes?

Who Will Pay the Taxes? IRA Legacy Planning

First, understand that this question is only for those with plenty of money. If you can comfortably spend from your nest egg and will have leftovers, then you can worry about the taxation.

But understand this: Taxes will be paid. Doesn’t it make sense to think about the lifetime taxation of both you and your spouse AND your future heirs?

So, when you plan for death and who will pay the taxes, you need to decide who to focus on. Your goals and priorities determine who will pay the taxes now and in the future.