Estate Planning for Doctors

While often neglected, an optimized estate plan is vital to your legacy.

The need to protect your assets never goes away, though you often don’t have much initially. As you age, assets increase; legacy and the tax-efficient gifts of money become important.

First, why is it important for doctors to optimize their estate plan?

What is the Goal of an Optimized Estate Plan?

The primary goal of the optimized estate plan is to meet your desires. Usually, that means the right person gets the right assets. So, while wills and trusts are important, those are table stakes.

And the purpose of estate planning?

Well, you want to ensure that your assets (and your minor children!) go where they are supposed to when we die. Next, you want to minimize your death’s pain-in-the-ass factor for your family, including limiting the assets that go through probate (which is public and sometimes expensive and time-consuming).

Finally, some have estate taxes to consider. Federal or State.

What are the Elements of an Estate Plan Specific to Doctors?

The basic elements of an estate plan are the same for doctors and other DIY investors, but what is different about a doctor’s estate plan?

- Private Practice (Usually set up as a professional corporation to limit the liability between the individual doctors, and may have an LLC to limit the liability of the business)

- Unlimited Personal Liability for Medical Malpractice (though judgments seldom reach individuals). Protecting your assets against such liability is huge but usually an insurable risk.

- Incapacitation (Especially if you own a practice, what will happen to your patients if you are mentally incapable of working?)

Well, that’s a lot, and it is only going to get worse. Let’s start with asset protection.

Asset Protection for Doctors

What do you need to know now to protect your assets?

Well, that depends on your age and your stage in wealth creation.

Let’s look at Asset Protection Strategies and determine which suits you best.

Once you start working, your major asset is human capital—your ability to work. Protect human capital like the gold mine it is (disability and life insurance).

Later in life, as you convert human capital to assets, additional considerations pile on top. What type of accounts or investments should you fund? How can you keep those various assets Safe? What are the perils, and how can you mitigate them?

Still later, in retirement, tag on aging, estate, and legacy considerations. Prior asset protection strategies evolve over time as your goals change, but they don’t disappear.

Let’s look at asset protection early, mid-career, and in retirement to see what perils or land minds to consider.

Protecting Assets Through the Life Stages

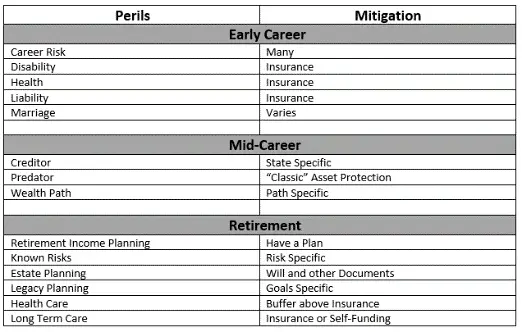

Above, you can see the different perils you face during your career. Then, some thoughts about mitigation.

Let’s walk through the stages and see what steps you must consider.

Asset Protection Strategies for Early Career

Perils abound for the newly minted professional. As human capital is the engine that drives asset accumulation, career risk—that is, you might lose your job—is a huge consideration. Maintaining income is the primary concern early in your career.

Beyond that are many insurable risks, such as life, disability, health, and liability. These are discussed below.

Finally, divorce is common and usually devastating to finances.

Human Capital

Your greatest asset initially is human capital. Turn human capital into assets by saving more than you earn.

If other people depend on you, then life insurance is a must. Stick with term life insurance unless you have an appropriate indication for permanent life insurance.

Disability insurance, too.

Nothing can drain your bank account faster than our broken healthcare system, so get health insurance through work or buy it.

As far as personal liability insurance, yes, please! “Max out” your home and auto policies and get $2M of umbrella insurance. Medical malpractice insurance is the standard of care.

Asset Protection in Mid-Career

In mid-career, consider predators. You have saved money. The longer you accumulate assets, the higher your chances of becoming a target. Families, houses, and young drivers are also sources of risk.

In your middle ages, start to understand Exclusion Planning.

Exclusion Planning

Predator protection (lawsuits) differs from creditor protection (bankruptcy).

That said, some assets are protected from bankruptcy (creditors). This is State-dependent, so know what your State-specific statutes say. This is the first stop in property protection. Which assets do you own that are automatically protected by State Law?

Homestead-

Some states are more generous than others. For instance, Montana protects homesteads up to $250,000, whereas other states are more or less generous. Texas and Florida have unlimited homestead protections!

Retirement Accounts-

This is a big one. Remember ERISA plans (401k and defined benefit pensions) have federal protection, whereas other requirement accounts are State-specific. 403b and governmental 457 plans are technically not protected by ERISA but have equivalent significant protection. IRAs are usually covered up to $1M plus, however, inherited IRAs are not considered retirement accounts and treatment is State-specific. Finally, remember non-governmental 457s are not even your asset (they are an asset of your employer and subject to their creditors).

Insurance products-

Again, this is very State-specific. Look up and see if annuity payments are protected from bankruptcy and how much of the cash value of permanent life insurance policies is covered. Disability payments and medical and group payments are also state-specific but less frequently considered.

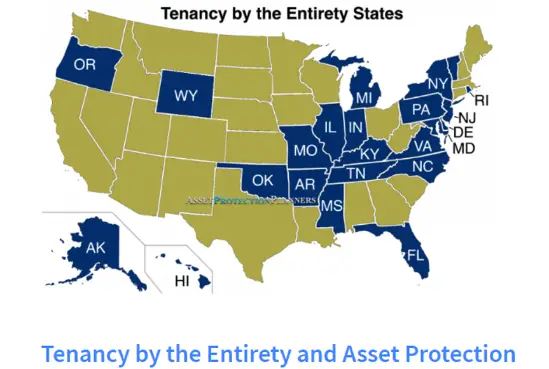

TBE

Tenants by the Entirety is important to understand. This is also State-specific, so see below. Tenants by the Entirety is a way to title assets so that you don’t fully control them, so the asset can’t be taken away from you if you are individually named. This is a powerful asset protection trick, so find out if your State allows TBE titling.

Additional Mid-Career Considerations

In reality, there are three paths to wealth.

The first, paper assets, focuses on retirement and brokerage accounts. Secondly, real assets (owning a business and real estate) require professional guidance with titling, incorporation, and other protection issues.

Finally, the entrepreneur who builds businesses also seeks professional assistance.

Protecting your assets depends on the chosen path.

The high-income earner should consider tax-deferred retirement accounts as a primary savings vehicle for all three paths.

Let’s transition now to estate and legacy issues.

Safeguarding Assets in Retirement

You must address the known risks in retirement. There are many known risks, but health care and Long-Term Care are front and center for most folks and will be specifically mentioned below.

Estate and Legacy planning are also times to think about safeguarding assets. You have amassed much. How it is spent when you are gone is an important consideration.

Sure, you should have an estate plan in place. This includes a will, but a will is not enough! Ensure you have your designated beneficiaries for accounts that transfer outside of trusts and/or probate. This is an important yet neglected consideration.

Predators, Creditors, and Long-Term Care

At this life stage, you should be concerned about three monsters: predators, creditors, and Long-Term Care.

I have discussed Long-Term Care Insurance, which is a difficult decision. The current pitch to doctors is hybrid life insurance / Long-Term Care Insurance products. If you are considering one of these hybrid policies, understand the Tax Implications of Long-Term Care Insurance because the person selling you one surely won’t mention this massive downside.

Traditional Long-Term Care Insurance, while providing more comprehensive coverage, is expensive and likely to continue increasing premiums. Self-funding is a third option. Again, Long-Term Care insurance is a difficult subject, and there are truly no good options currently.

What about healthcare costs? Medicare is important. Expect (and plan for) healthcare costs to increase faster than inflation during retirement. This may include a buffer account for future expenses or build your floor income with especially high healthcare inflation in mind. Keep IRMAA in mind!

Let’s focus on trusts for a second, as they are also misunderstood.

Trusts for Safeguarding Assets

If you are a lumper, there are two types of trusts: Revocable and Irrevocable.

Revocable (or living) trusts are NOT for protecting assets. They may make your assets more difficult to discover, but there is no property protection as you control and benefit from a revocable trust. Remember, these trusts are for passing assets outside of probate and to protect you if you become incapacitated.

Irrevocable trusts remove the asset from your control, thus providing property protection.

Initial irrevocable trusts are intended for estate TAX planning. The estate tax exclusion is over $13.6M ($27M with spousal portability), so we are usually not concerned with estate TAX planning.

An irrevocable trust has three parties: the grantor (who provides the assets), the trustee (who manages the assets), and the beneficiary (who benefits from the assets).

Generally, the grantor cannot be the beneficiary (as irrevocable implies you give away the assets and cannot benefit from them).

So, in summary, we have revocable trusts, which are used for estate planning, and irrevocable trusts, which are used for estate tax planning. In the middle is property protection.

What is the Point of Asset Protection Strategies?

A brief word about the goal or the point of asset protection.

Asset protection seeks to separate control and ownership of assets. That is, you still control the asset, but if someone has a judgment against you, you don’t own the asset, so there is nothing to take!

Specifically, asset protection does not protect you from lawsuits; it just makes you a less appealing target. If you don’t own many assets, or it is not easy for lawyers to see through your assets and decide you are a fat target, you are less attractive to sue.

So, when protecting assets, you place a legal barrier between you and your assets. This does not make you judgment-proof but does provide you with leverage to settle claims rather than pay them out.

Given fraudulent transfer concerns, protect your assets preemptively before you are sued.

Asset Protection Structure

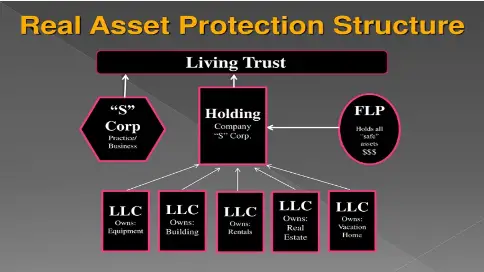

Above, you can see a schema of a complicated strategy. This has many different versions, but let’s focus on some basic elements.

LLCs own separate assets. Keeping assets in separate LLCs prevents a judgment against one asset from affecting others.

Above that, a holding company may be in a state that provides anonymity for your assets. In addition, this holding company has discretion, so it does not have to distribute assets to creditors even if there is a judgment.

As an aside, having your brokerage account assets in an FLP or TBE is often better.

On top of that, all assets are owned by your living trust. This does not provide protection for you but does avoid probate upon your death and is a source of protection for your heirs.

A full discussion of this type of protection scheme is beyond the scope of this little ditty. It shows you what you might be in for if you truly want a comprehensive strategy…

Conclusion- Asset Protection for Doctors

Asset protection for doctors is not a one-and-done game. It is a process that depends on where you are in your life cycle. Continued learning and assessment of your current strategy is important to your overall financial health.

There are no magic bullets. Understand what perils are common and do your best to mitigate known risks.

Protect your human capital when you are young. As human capital becomes assets, optimally utilize State-specific exclusion planning.

Designated beneficiary forms and asset-specific planning are important. Wills and sometimes trusts are early components of a comprehensive estate plan. Moving on to retirement, complexity grows as you access your assets for income and mitigate known risks.

With the growth of assets, safeguarding them becomes more complicated. It is worthy consideration, however, to protect you, your family, and your legacy.