Calculate MAGI for IRMAA and ACA Tax Credits

The MAGI calculation for IRMAA and ACA Tax Credits is vital but usually glossed over. When faced with a difficult calculation, it is easy to wave one’s hand.

MAGI is used twice by the IRS to help you afford health care.

Before Medicare, healthcare insurance is a considerable concern. Premium ACA Tax Credits can lower your health insurance bill. To get these credits, you need to understand MAGI.

Or, if you are on Medicare and don’t want to pay surcharges (hidden taxes), you want to avoid IRMAA. You need to understand MAGI!

Let’s learn how to calculate MAGI for IRMAA and ACA Credits!

Cliff Penalty Warning!

Both Premium ACA Tax Credits and IRMAA are cliffs penalties.

A single dollar over the cliff, and you have to pay IRMAA surcharges for an entire year. Similarly, misestimate your MAGI by one dollar with Premium ACA Tax Credits, and you owe the IRS (the cliff for ACA tax credits is expected to be back in 2026 but was put on hold in the COVID era).

Understanding MAGI and the Cliff

With the ACA, the IRS pays Premium Tax Credits to your insurance company every month to lower the cost of your insurance. You must estimate this year’s MAGI to get credits.

For IRMAA, you use your MAGI from two years before calculating the surcharge.

MAGI is important, but it is calculated differently depending on the use. There are five different MAGIs depending on what you are trying to accomplish! For example, MAGI for IRA deductibility uses modifications other than MAGI for health care. MAGI for IRMAA and the ACA are slightly different as well! What a headache. CPAs plug the numbers in, and the result comes out.

A quick way to estimate your MAGI for IRMAA is to look at your Adjusted Gross Income from the prior year and then add back (or modify) it. We will learn what we have to add back below. Then, let’s discuss ways to control your income so you don’t go over the cliff.

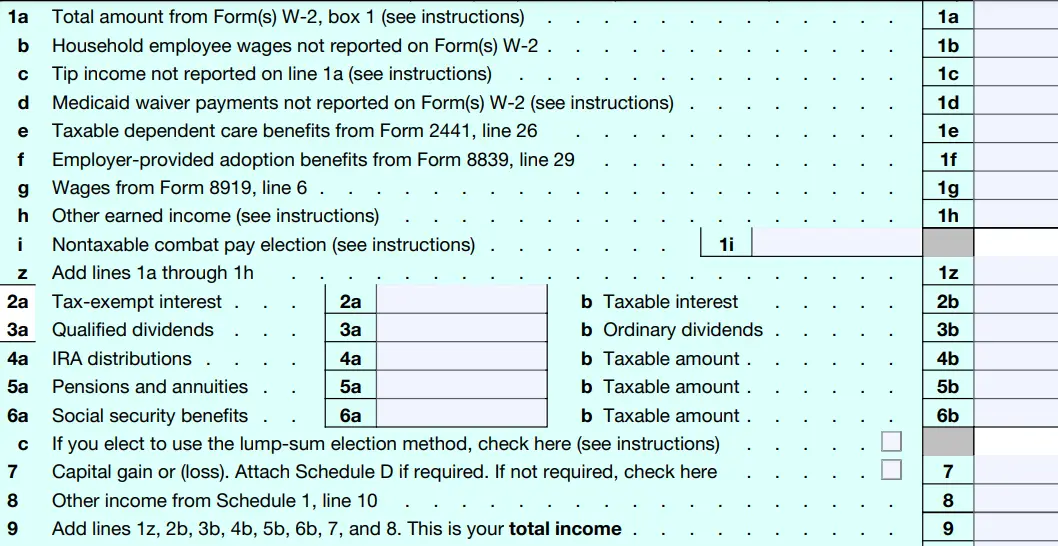

First, look closely at how AGI is calculated. We start with IRS Form 1040.

IRS Form 1040

MAGI calculation starts with form 1040. Above is the top portion of Form 1040 to calculate your Total Income (Line 9) and Adjusted Gross Income (AGI). But first, let’s see what goes into this calculation.

Line 1a through line 1i is gross income. Some W-2 pre-tax deductions include retirement plans and the (few) other perks of working for the man.

2b includes all your taxable interest (such as savings and money market accounts). Notice that tax-exempt interest in line 2a is not included in your AGI. Don’t worry, though; for the ACA, it will be added back later when we modify your adjusted gross income and make AGI into MAGI.

Next, line 3b includes ordinary dividends. Qualified dividends are not explicitly included in the MAGI calculation. They are considered a part of ordinary dividends and thus already included. Qualified dividends stack on top of your ordinary income when you pay Long Term Capital Gains Tax.

Lines 4b, 5b, and 6b are complicated! They are the taxable amount of your IRAs, pensions, annuities, and social security. You only include the amount on which you pay taxes. For social security, this could be between 0-85%. Pensions are usually fully taxable! Taxation of annuities is complicated, but there is an exclusion rate on your after-tax annuities. For tax-deferred accounts, include the entire distribution amount (There are some exceptions such as QCD or a QHFD).

This can get a bit complicated. Look at last year’s 1040 to understand what lines 4 and 5 are included.

In line 7 of Form 1040, you add any income from Schedule D.

Line 8 adds the Additional Income from Schedule 1 (but not the Adjustments to Income)

We are ready to calculate your adjusted gross income.

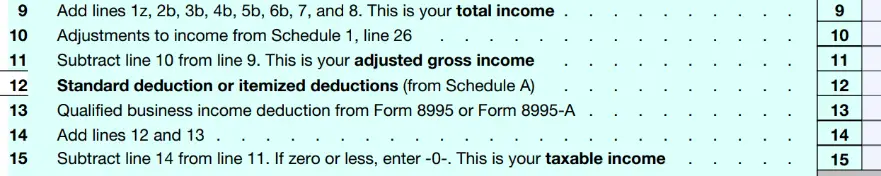

Adjusted Gross Income

Back on form 1040, let’s go on from line 9.

Line 10 finishes the bottom part of Schedule 1 (Adjustments to Income). And now you have adjusted gross income.

Now, we don’t care about your taxable income (which you get after the Qualified small business income deduction and either the standard or itemized deductions) but to get “MAGI” from AGI we have to MODIFY it.

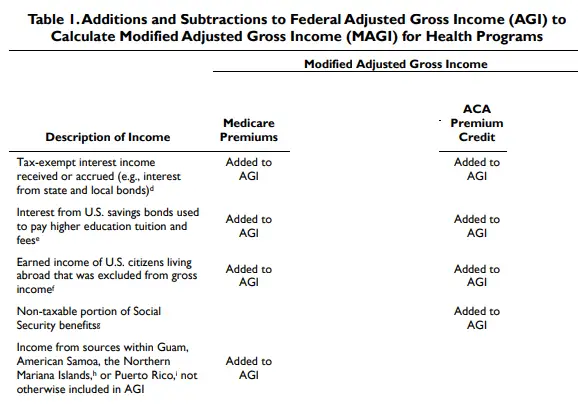

Now Modify your Adjusted Gross Income to Calculate MAGI

Now that we have your adjusted gross income, we have to add back some items to call it modified. This is how you calculate MAGI! Add back (or modify) to your AGI.

You add back tax-exempt interest (usually from Municipal bonds).

The taxable portion of your social security is already in your AGI; what about the non-taxable portion of your social security?

For IRMAA purposes, you don’t include the non-taxable portion of social security for IRMAA.

However, for Premium ACA tax Credits, you add back the non-taxable portion of Social Security! This means you probably don’t want to claim Social Security between 62 and 65 if you get Premium ACA tax Credits.

Above, find the differences between IRMAA and ACA Premium Tax Credits.

Note that you add both tax-exempt interest and interest from US savings bonds for higher education.

In addition, foreign-earned income is also added to both. Please note this is income from wages, not investment income. You can still deduct your Foreign Income Credit from your international investments.

The non-taxable social security portion is added back for ACA Premium Tax Credits but not IRMAA.

Strategies to keep MAGI Low

Let’s talk about the ways you can keep your MAGI low:

- Don’t make any income

- Remember, tax-exempt income is pulled back in, so interest paid by municipal bonds will count against you

- All brokerage income from cash and bonds is included

- Ordinary dividends are pulled back. If you buy and sell stocks, mutual funds, or ETFs frequently (or have actively managed funds), this can hurt

- Pension income, pre-tax account distributions, and social security are complicated. If you want ACA Premium Tax Credits, delay taking pensions and social security until age 65. In addition, watch out accessing pre-tax accounts for income and be careful with Roth Conversions

- Schedule 1 – Avoid the sources of income on Schedule 1