Choosing between Premium ACA Tax Credits and Roth Conversions in Early Retirement

Health care is perhaps the most challenging decision in early retirement. Healthcare insurance is expensive, yet the risk of inadequate coverage is potentially devastating.

For an early retiree with a healthy Tax Planning Window, it is not “Death and Taxes” that must be considered. Instead, it is: “Healthcare and Taxes.” And then death.

One interesting option for healthcare in early retirement is an ACA plan with Premium Tax Credits to offset the cost.

Let’s consider who should consider Premium ACA Tax Credits and who should pay full price for Healthcare Insurance and instead do Roth conversions.

Save or Spend on Health Insurance in Early Retirement

Case #1 – Go for Premium ACA Credits

Let’s think about a couple retiring at 60. Call them Mr. and Mrs. Credit.

- $3M in assets: $1M in each brokerage, IRA, and Roth IRA

- Live a frugal life

- Goal: Actively donate to charity

Case #2 – Go for Roth Conversions

Another couple, Mr. and Mrs. Conversion, also plan to retire at 60.

- $5M in assets, $1.5M brokerage, $3.5M IRA

- Downsizing

- Goal: Maximize legacy to children, including one with special needs

What do you think the Credits and the Conversions should do for their healthcare in early retirement? Both couples have five years until Medicare.

Let’s examine the options and discuss which type of healthcare insurance would be a good fit.

Considerations for Healthcare in Early Retirement – Premium ACA Credits

Both couples look very closely at ACA plans and Premium Tax Credits.

If you keep your income less than 400% of the poverty limit in your state, you may be eligible for Premium ACA Tax Credits. The IRS pays part of your premiums directly to the insurance company with these tax credits. However, you have better stay below the magical MAGI number at the end of the year because it is a cliff penalty! If you are a single dollar above the cliff, you might owe the IRS all the money paid on your behalf to the insurance company. (Note some significant changes made in 2021 that have been extended to 2025. Check your state’s website as well.)

The Credits think it will be a good fit for them! They have lots of money in their Roth accounts due to near continuous Roth IRAs and some Roth conversions while working. In addition, they have access to high-basis index funds in their brokerage accounts. Therefore, they can live off the brokerage account without Capital Gain implications and utilize Roth money for living expenses.

Think about this for a second. They have no legacy concerns, so why do they need all that Roth money at the end of their lives? Of course, keeping Roth accounts in a tax-deferred status is good, but they also have an IRA that will continue to grow tax-deferred. If your goal is charity, use your Roth money to donate more taxable money later.

They plan to take out enough pre-tax money to fill up their standard deduction and 10% tax bracket and then live on the Roth. Then, when they are 62, they will get a reverse mortgage (Yes, reverse mortgages are for the wealthy too). This way, they keep MAGI low enough to get Premium ACA Tax Credits, pay less in taxes, and leave more behind to charity.

What about the Conversions? They could also keep their income low. However, they don’t have the option to use Roth money and have a massive amount of money in a traditional IRA. Tick, Tick, Tick, taxes will be enormous when RMDs start.

Does a Roth conversion count as income for Obamacare?

Does a Roth Conversion Count as income for Obamacare? ACA vs. Roth Conversions

The Conversions have other priorities. They live modestly and want to leave behind as much money as possible for their four children.

While they have plenty of resources, they consider Premium ACA Tax Credits because healthcare insurance is expected to cost them $26,000 a year in premiums. Plus, a $12,000 deductible!

They see their Magic MAGI number and can easily get there. They can pull out just enough from the IRA to fill up the standard deduction and the 10% tax bracket and still do about $20k a year in Roth conversions. Will that help them save in taxes over their lives and leave a legacy to their children?

Before we look at Roth conversions more closely, let’s look at MAGI.

How to Calculate Your MAGI for IRMAA: Healthcare in Early Retirement

What is the magic MAGI number? MAGI is important to consider when looking at IRMAA and Premium ACA Tax Credits.

How to calculate your MAGI for IRMAA? In essence, it is your Adjusted Gross Income plus modifications.

To modify your AGI (for the ACA), add back 1) Non-taxable social security benefits, 2) Tax-exempt interest, and 3) non-investment Foreign income.

So, to get under the MAGI: control your AGI, don’t take social security, limit municipal bonds, don’t earn wages in a foreign country. Sounds pretty easy!

Does a Roth conversion count as income for Obamacare? Yes!

Back to the Conversions. Consider their future tax liability and discuss Roth conversions in their Tax Planning Window.

The Tax Planning Window and Health Care in Early Retirement

Let’s take a look at each couple’s Tax Planning Window. As a reminder, the Tax Planning window opens up when you retire and no longer have income. It allows you to access your lower tax brackets to do tax planning for the future. The Tax Planning window starts to close when you are forced to take social security at 70 and RMDs at 72.

Let’s start with the Credits.

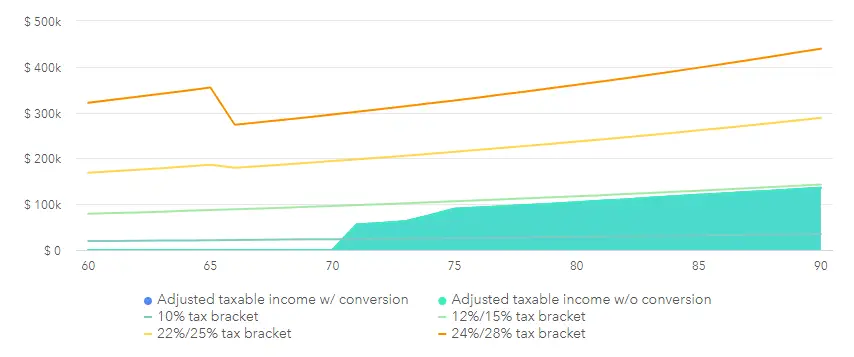

Credit’s Tax Planning Window

Figure 1 (The Credit’s Tax Planning Window)

Above, you can see the tax brackets and the required minimum distribution from the pre-tax money for the Credits.

From age 60 to 70, they have their standard deduction and 10 and 12% tax brackets to fill with ordinary income. This means they can pull money from the IRA and pay no or minimal taxes. In addition, they might consider Capital Gain Harvesting up to the limit of the 0% Capital Gain Bracket. They can also use their Roth accounts for tax-free income or a reverse mortgage.

Due to their IRA’s conservative returns, required minimum distributions stay under the 12% (which becomes 15% in 2026) tax bracket throughout.

Special bonus for premium ACA tax credit planning when you are 63 and 64: you minimize IRMAA when you are 65 and 66! If you haven’t looked into IRMAA, the hidden Tax, please do so!

Conversion’s Tax Planning Window

What about the Conversions?

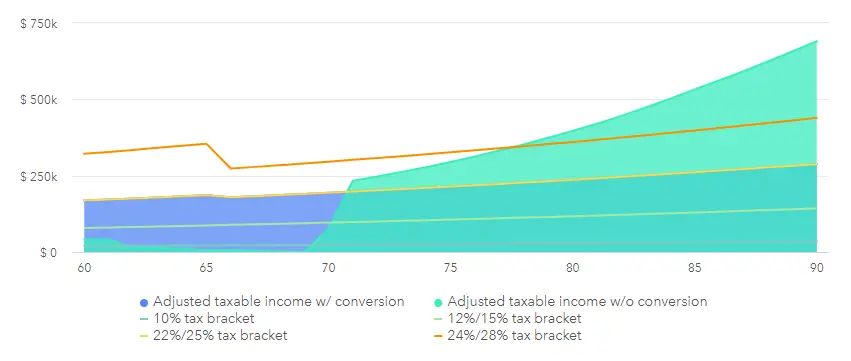

Figure 2 (The Conversion’s Tax Planning Window)

The Conversions have different issues. First, they have a substantial Required Minimum Distribution problem starting at 72 (used to be 70, as reflected above).

Above, we have a baseline in green and Roth conversions in blue (the blue is a little hard to see as it sticks right to the top of the 22%/25% tax bracket the whole time).

Let’s start with the baseline scenario (no Roth conversions). Look at the green in the figure above. Without Roth conversions, their IRAs grow massively over time. They don’t think they will need most of the money, so the IRA is invested aggressively for their children. After de-risking to prevent sequence of return risk, they pick an asset allocation of 60/40 with a Rising Equity Glidepath.

Note that when required minimum distributions start without Roth Conversions (again, in green), they shoot up into the 28% tax bracket. This increases over time. Soon, counting state income taxes, they pay 40% taxes on their last dollars as they fill all the other brackets.

What about doing some Roth conversions? How do Roth conversions interact with the ACA subsidy?

They do aggressive Roth Conversions up to the 22% tax bracket in blue. Note that these conversions keep the Conversions just under the 22/25% tax bracket for the foreseeable future.

If they live to be 90, Roth conversions are expected to save them almost $1M in tax payments. That’s not too bad!

The back-of-the-envelope math: spend 12-20k extra a year for health insurance to save $1M over your lifetime in taxes. Since you get to spend (or give to your children) every dollar you save in taxes, it is an easy decision when you have a large IRA!

When it is not an easy decision, what factors should you consider when deciding on premium ACA tax credits or Roth conversions?

Factors to Determine if you Go for Premium ACA Tax Credits or do Roth Conversions

Income Sources

Remember, to qualify for Premium ACA Tax Credits, you need to keep your income low. This may not be easy if you take Social Security early or have pensions or other ordinary income sources. Also, capital gains and qualified dividends count against you in the MAGI calculation.

Tax Diversification in Retirement Accounts

If you have good tax diversification (i.e., money in all three types of accounts) by having lots of Roth and no legacy goals for your Roth money, you can use this money for your living expenses. Conversely, if you have massive pre-tax accounts, you will likely need to do Roth conversions to control your required minimum distributions in the future.

Other Tax-Free Sources of Income

Roth money is tax-free. Other sources of tax-free income include reverse mortgages or HELOCs, the cash value of permanent life insurance, high basis assets in your brokerage account, and loans on your brokerage assets. These can be used as buffer assets for sequence of return risk, or when you need to limit your taxable income to get tax credits.

Goals

If you want to leave a legacy to your heirs, Roth conversions are indicated. If you are leaving money for charities, you might as well give away your pre-tax money. See this excellent piece on leaving your money to heirs or consider maximizing your gifts to charity.

Does a Roth Conversion Count as Income for Obamacare?

So, does a Roth conversion count as income for Obamacare? Yes, it does! You need to decide if the future tax savings from Roth conversions make up for the loss of Obamacare tax credits.

Conclusion Premium ACA Tax Credits or Roth Conversions

Should you go for Premium ACA Tax Credits or do Roth conversions?

For the Conversions, they could now save thousands of dollars a year on ACA Premium Tax Credits or $1M in taxes throughout their lifetimes. Their main goal is to leave a legacy to their heirs; the decision is easy!

For the Credits, they have access to Roth accounts and, later, a reverse mortgage. They easily keep their income low and receive maximum Premium ACA tax credits. As a result, they save $20k a year in health care premiums and sail into traditional retirement with plenty of resources to last their lifetime.

Healthcare decisions are difficult in early retirement. Healthcare insurance costs are outrageous and only likely to worsen.

Understanding how to control your ordinary income and planning for taxes now and for the rest of your life can help you decide what type of healthcare is right for you in early retirement.