Merton, SeLFIES, and Target Retirement Solutions

Merton is a smart guy. He started publishing on lifecycle investing in 1969. He won a Nobel for valuing derivatives. Like most academics, he looks at the retirement problem differently than us in the real world. I read his Designing the Best Solution for Retirement and have a few thoughts.

Merton’s goal is immunization or a liability-driven investment strategy. It is how pensions and insurance companies hedge future expenses, so Merton suggests that individuals do the same with their portfolios.

Fundamentally, he reminds us that income is the goal, not net worth. You can’t spend your net worth! We have no idea what it means to have a one-million-dollar net worth, but we know we can live on 4k a month!

This solution is admittedly for the middle class stuck with a 401k. The wealthy have other issues in retirement (like actually spending enough money!), and the less wealthy will have social security.

Dynamic Asset Allocation

Let’s start with his ideas of dynamic asset allocation.

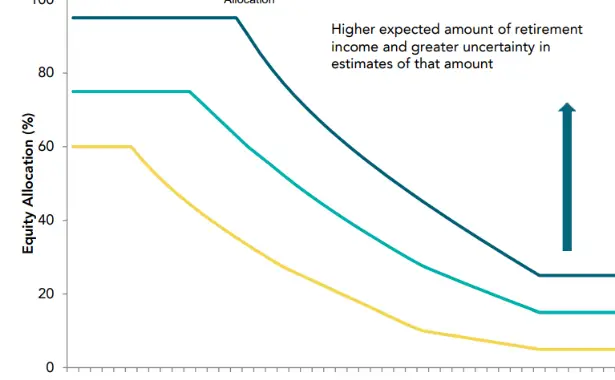

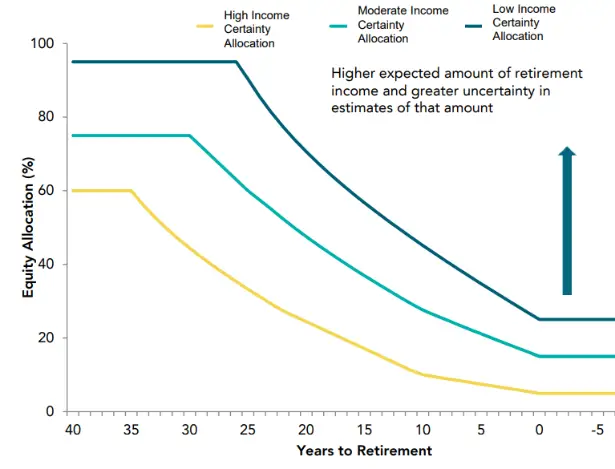

Here is the theory behind the accumulation phase. Knowing only three things about you (your income, your desired retirement income, and the number of years you plan to work, he can determine how certain you are to reach your goals. This is like a fundedness ratio. Say you are 90% certain to meet your income goals (yellow line above), your asset allocation is low in equities, and you buy more slices of annuities to pay you in the future. The dark line on top (low income certainty), you have a higher asset allocation (because you have to take more risk), and you buy fewer slices of annuities every year.

Dynamic asset allocation allows ratcheting up of hedged retirement income. You buy slices of annuity as you go.

He wants you to buy SeLFIES. I didn’t dig into them, but they are slices or a real deferred income annuity you buy over time.

It looks like this has been tried in real life at Dimensional Advisors via their Target Retirement Solution. I have no idea if you can actually buy this product.

Retirement Income Solution per Merton

Merton Suggests that returns and asset allocation information is not important (meaningful) for the client to know. What is needed is desired retirement income, current savings, and years until retirement. With that information, you can be given a probability of success. If you have a low probability of success, you can either save more, work longer, or take more risk. This is income-focused dialogue.

He suggests using income needs into three categories:

Minimum Guaranteed Income – this income is inflation-protected and guaranteed for life. It includes social security, pensions with cost-of-life increases, and annuities with inflation protection. He says “Some people are uncomfortable using all of their assets to purchase a risk-free annuity.” Oh brother, are they! The goal is to reduce inflation, longevity, and interest rate risk. This is similar to the minimum dignity floor used by the Retirement and IRA guys.

Conservatively Flexible Income – this is money for unexpected expenses or bequests. He suggests TIPS for this. Interestingly enough, it also seems like DIAs (and QLACs) also fit this bill for him.

Desired Additional Income – if it looks like you aren’t going to have enough to retire, then you may want to use risky assets like equities. I just vomited in my mouth a little, but let’s remember this is not for DIYers; this is for people who want to know what their chance of getting the income they desire in retirement.

Merton’s Retirement Income Plan

Merton’s retirement income plan is a safety-first, very low-risk low-reward investment plan requiring a hands-off approach from savers.

Necessities are covered by guaranteed income; periodic needs are covered by TIPS. And risky assets? I don’t think he will let you use them because you cannot be trusted with risk.

How do you know how much you want to spend in the future? They use a replacement rate (say, 80% of your current salary), which we know is inferior to savings rate. If the real problem is that people don’t know what it means to spend a nest egg, is using replacement rate an improvement?

He suggests using an inflation-linked deferred annuity, a product that is, of course, not available. Or maybe they are. Check out his SeLFIES (Standard-of-living indexed, Forward Looking, Income-only Securities).

Unfortunately, we are forced to use a 401k to plan for retirement. More people should buy income annuities. Merton doesn’t have the answer.