Should I buy short-term TIPS or just a regular TIPS fund?

TIPS, like other governmental bonds, have duration. Duration reflects the investment’s sensitivity to changes in interest rates.

Should you buy short-term TIPS or, perhaps, an intermediate-duration TIPS ETF?

How does interest rate sensitivity affect TIPS? Do you want Short-Term TIPS?

Duration measures the sensitivity of Treasury bonds to nominal (before tax) interest rate changes. With TIPS, it measures the sensitivity to changes in real (after inflation) interest rates. One doesn’t account for inflation expectations, and the other does!

Let’s dig into TIPS duration to decide if you should buy short-duration TIPS or just a regular TIPS ETF.

Short Duration and TIPS

Duration can be complicated. It is a bond’s price sensitivity to interest rate changes.

Bond prices and interest rates are like a teeter-totter; as one goes up, the other goes down. If the duration is short (the bond will pay out soon), there is not much price change when interest rates change. On the other hand, if the duration is longer, minor changes in interest rates affect the prices more.

The longer the duration, the more the effect!

Suppose you own a TIPS fund (typically a mutual fund or an ETF). When interest rates increase, the fund’s price decreases. Short duration: small change; large duration: larger change.

So, should you own short-term TIPS or intermediate-term TIPS?

Why Intermediate-Term TIPS?

Intermediate-term TIPS, on average, pay more than short-term TIPS. This is true with other treasuries, as the longer you “give” your money to the government, the more you require in return.

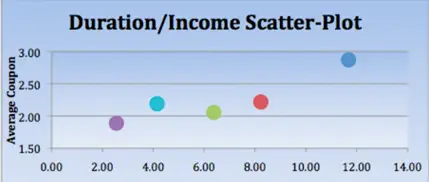

TIPS Duration and Yield

Above, the yield (average coupon rate) depends on the TIPS duration for several ETFs. In general, as TIPS duration increases, so does yield.

You should own intermediate-term (or longer) TIPS because they pay higher (yield higher) than short-term TIPS.

Why Short-Term TIPS?

Short-term TIPS yield less than longer-term bonds. So why bother?

Vanguard seems to think that short-term TIPS correlate better with inflation. This is mentioned in a 2012 White Paper that no longer appears online in the USA.

The long and the short: short-term TIPS hedge against inflation. Short-duration TIPS track CPI well, whereas their longer-duration counterparts don’t because of volatility. Unfortunately, intermediate-term and long-term tips are too sensitive to real interest rate changes to provide a short-term hedge.

I note that 2012 was when Vanguard added short-term TIPS to their pre-retirement glidepath, so this paper was their “just so” manifesto.

From their paper:

We found that the return on a short-term TIPS benchmark (of 0-to-5-year

maturities) has been more highly correlated to actual monthly and yearly

CPI (Consumer Price Index) inflation than other segments of the U.S. TIPS

market over the past decade. Although, in practice, all TIPS securities

receive the same CPI principal adjustment, short-term TIPS returns tend to most

closely track actual CPI inflation because of their lower duration and greater

responsiveness to temporary, unexpected inflation spikes.

While they note that short-term TIPS are more appropriate for risk-averse investors who want to track the CPI, there is no free lunch.

Further from the paper:

Of course, the higher inflation correlation of short-term TIPS comes at a cost—

a lower expected income return versus that of the

broad TIPS market. In this sense, the risk−return trade-offs of investing in a

short-maturity versus a longer-maturity TIPS portfolio parallel those involved

when selecting the interest rate exposure of any other bond portfolio.

They conclude that investors should decide whether they care about short-term inflation or long-term purchasing power, positive inflation-adjusted (real) long-run returns. And, of course, the answer is “both” to Vanguard.

So, Which “Hedge” Inflation Better: Short or Longer Duration TIPS?

So, which is a better hedge for inflation?

Volatility and Correlation to Inflation

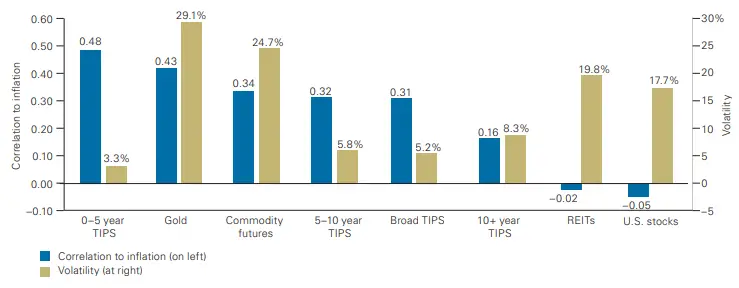

Above, you can see a graph from the same white paper.

Note that blue is the correlation to inflation, and tan is volatility.

Short-term TIPS correlate best to inflation with the lowest volatility. Gold has a reasonable hedging capacity but at the cost of massive volatility.

Note that you decrease correlation and increase volatility with the intermediate and the long-term tips.

Thus, changing to short-duration TIPS means a higher correlation with inflation, lower volatility, AND a decrease in yields.

The Key: What WILL Inflation Be?

When considering TIPS, it is important to remember that inflation expectations are already baked into the price.

Only UNEXPECTED inflation allows higher returns with TIPS. If the market only expects inflation, TIPS will be priced the same as their other governmental bond cousins.

Deflation was quite common before the 1940s (but not since). Remember that the truth about inflation is that we tolerate it modestly because it is better than deflation. Deflation is to be avoided at all costs because it devastates the economy.

What will inflation be? Who knows! However, the expectation of inflation sets TIPS prices, and short-duration TIPS are a short-term Hedge against unexpected inflation.

Short-term TIPS are a Short-Term Hedge Against Unexpected Inflation

Let’s look at expected inflation vs. unexpected inflation for a second.

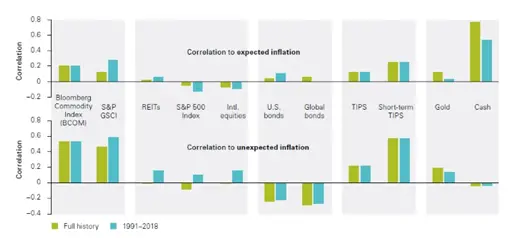

Correlation of Asset Classes with Expected and Unexpected Inflation

On the top, you can see a correlation with expected inflation, and on the bottom, a correlation with unexpected inflation. These are from two different periods, but the main focus here is on the second-to-last box on the left.

Look at TIPS and Short-term TIPS with expected (top) and unexpected (bottom) inflation. Short-duration TIPS are more correlated with expected and unexpected inflation over the long term and in recent history. Of course, it is interesting to know that TIPS haven’t been around for more than a couple of decades, so make what you will of the data!

Summary—Should I buy the short-term TIPS?

In summary, short-duration TIPS funds have a lower yield. There may be a higher correlation to unexpected short-term inflation than with longer-duration TIPS funds. Longer-term TIPS funds suffer from too much volatility to allow short-term inflation hedging.

It is interesting to think why this may be the case. After all, the price of TIPS depends on the expected inflation. So, if people believe there will be inflation, all TIPS become more expensive.

Perhaps the difference in the duration and correlation with inflation is, in fact, an investor’s sentiments about inflation. Only investors’ concerns about inflation drive up the prices of TIPS. Over the long term, sentiment changes cause volatility due to sentiment alone.

Further, short-duration TIPS are less affected by increases in interest rates than all bonds.

What this means to me is that you probably need to liability-match your TIPS.

If you have a short-term need for inflation-protected cash, consider short-term TIPS to better hedge that liability.

If, on the other hand, you are sinking part of your “safe money” into TIPS, perhaps for inflation, in the long run, the extra yield (albeit not much!) of the longer duration TIPS is worth the volatility.

After all, investors should care more about the correlation to unexpected inflation – expected inflation is already baked into current market prices.

Let me know when you expect unexpected inflation; I’ll tell you what sort of TIPS fund to buy.