Velocity Banking Calculator

Does mortgage acceleration work? How can you more efficiently use your paycheck to accelerate your mortgage payoff?

Use “offset accounting” to make interest while offsetting or reducing the balance of another account.

So, for instance, you have a bank account where your paychecks are deposited, earning no interest. If you also have loans accruing daily interest, wouldn’t it be nice if your paycheck offset the loan, decreasing the amount of interest owed?

Let’s look at how offset accounting is used in mortgage acceleration and calculate the savings!

Principals of Offset Accounting as Applied to Mortgage Acceleration

Your bank makes profits by taking your money and lending it at higher rates than it gives you (and at 10 to 1 leverage since it is fractional reserve banking). This is interest rate arbitrage.

When you deposit your paycheck into your checking account, they pay you 0% interest (or close to it). Meanwhile, banks take your money and loan it out. Say they loan it back to you as a mortgage. They win on both sides. They have your liquid cash, and you pay them interest on the mortgage.

The bank makes money on both sides of interest rate arbitrage. What if you could interrupt the cycle and immediately have your paycheck pay off your debt rather than earn nothing? That’s mortgage acceleration.

Warning

Frequently called Equity Optimization, Velocity Banking, or one of many other names, these are often remakes of old MLM (pyramid scheme) products. Mortgage acceleration works, but not if you buy a product that isn’t right for you.

How to Get Your Paycheck Working for You

Offset accounting aims to put your paycheck to work immediately; this is the acceleration of mortgage payoff.

Normally, a check from your employer drops into your bank account every two weeks. It then sits there, earning nothing until you pay bills.

Meanwhile, the mortgage you pay monthly is sitting there, accruing interest charges on the principal owed.

How can you optimize this? Get your paycheck working for you.

What is Mortgage Acceleration?

Mortgage acceleration is a programmatic method to pay your mortgage off early using your cash rather than having it sit idle.

Mortgage acceleration works because a home mortgage is an amortizing loan. This is a fancy way to say you pay the same amount over the term, but the amount applied to your principal (vs. interest payments) increases over time.

Mortgages are Amortizing Loans

Figure 1 (Amortizing Loans- Interest and Principal payments on a 30-year mortgage)

Above, you can see the amount of interest you pay in blue over thirty years. Note that most of the early payments go to interest payments, and there is a slow slope down over time.

After about 14 years, you pay as much into equity (principal) as interest. The principal payments in green have a flat slope.

There are a couple of lessons from the above. First, the average homeowner sells or refinances after about 7-8 years, so their payments are almost always mostly going to interest.

Next, a pre-payment early in the mortgage has a more significant effect as it compounds over time! You save the interest on your pre-payment not only the first month but also every month after that. The effects are magnified over time, but especially so early on.

Let’s look at this last point a little more closely.

Early Pre-Payment’s Compounding Effect on Acceleration of the Mortgage

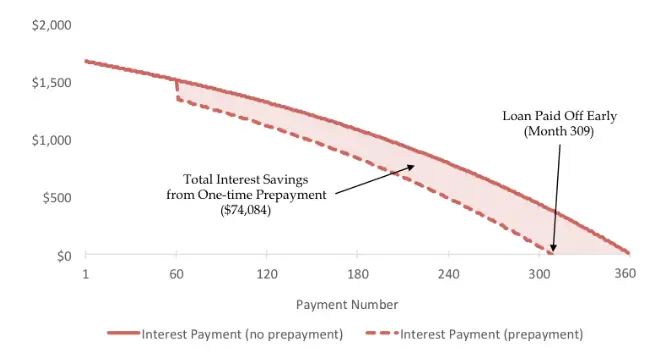

Figure 2 (Compounding Effect of a Pre-Payment)

Note above how a single pre-payment compound over time. The solid red line demonstrates the payoff of the 30-year mortgage. The dotted red line shows the ongoing result from a single pre-payment.

You get compounding growth on your pre-payment! Note how the slope of the pre-payment line drops faster than the original line over time.

How much do you save? It depends on when you make the pre-payment.

How Much You Accelerate the Mortgage Depends on the Timing

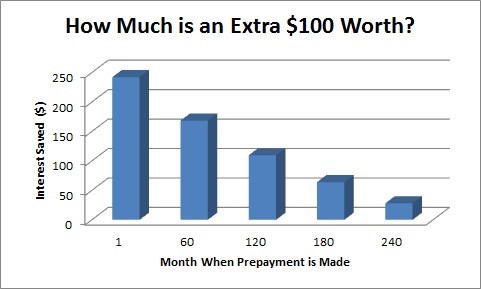

Figure 3 (How much you save depends on how early you pre-pay)

See above: the amount of interest you save depends on when you make the prepayment. A velocity banking calculator demonstrates the savings.

The interest saved on each $100 prepayment depends on when the prepayment is made. When you prepay early (at month 1), you save over $200 of interest on your $100 investment. You save less in interest as you prepay later in the loan cycle.

So, now that we know you save more the earlier you pre-pay and that mortgages are amortizing loans, we can understand mortgage acceleration.

Mortgage Acceleration with a HELOC

Mortgage Acceleration works even if your HELOC’s interest rate is higher than your mortgage’s. This is where most people get lost, so listen closely.

For example, take $10,000 out of your HELOC and use it to pay the mortgage.

You get compounding interest savings in your amortizing mortgage from that point forward.

In the HELOC, you start with the same amount of debt at a simple daily interest rate.

Direct deposit your paycheck into the HELOC. This means you owe less the day it hits your account.

You pay less in interest rather than having it sit in your checking account, earning nothing. It is tax-free savings for pre-paying your debt.

As you pay down your debt, your average debt being exposed to simple interest is less than the debt otherwise exposed to amortizing interest, saving you money via interest rate arbitrage.

This works even if your HELOC has a higher stated interest rate than your mortgage for two reasons. One is that the average debt is lower, and two, it is simple interest vs. amortizing interest.

How can you make mortgage acceleration even more effective? Using credit cards.

Use a Credit Card to Pay Bills with Velocity Banking

It works even better if you use a credit card.

If you put your expenses on a credit card, you get a 30- to 50-day float. Then, you pay off the credit card with your HELOC, allowing you to use the money to decrease your interest charges before it is needed to pay bills.

How Long Should the Payment Cycles Be with Mortgage Acceleration?

If you use a credit card to do mortgage acceleration, you can use one paycheck to pre-pay your mortgage and then catch up with your positive cash flow. However, be careful to understand that you must pay your credit card off monthly; otherwise, this will not work.

You can pre-pay for 2-4 cycles a year using a HELOC.

Eventually, mortgage acceleration doesn’t make sense as you pay off your amortizing mortgage debt. After a few years on a 15-year mortgage or 14 years on a 30-year mortgage, more of your monthly payments go to principal than interest, and pre-payment stops being effective.

Does Velocity Banking Work?

Yes, of course, it does! If you have positive cash flow and plan on paying off your home early, you will increase your net worth more rapidly with mortgage acceleration.

Find a Mortgage accelerator calculator online.

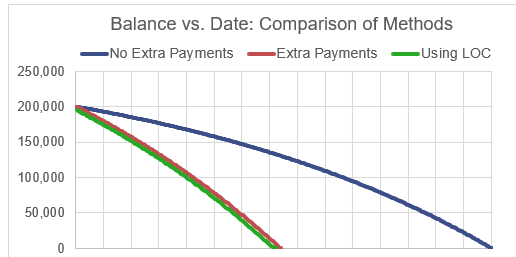

Figure 4 (Amount saved with Mortgage Acceleration. Source Spreadsheet)Above, you can see the payoff of a 15-year $200,000 mortgage. Blue is without any additional payments.

The red line represents an early payoff using extra principal payments alone. In green, extra principal payments are made with mortgage acceleration. You can see that instead of 15 years, you pay off the mortgage in just over seven years with either method.

According to our velocity banking mortgage calculator, mortgage acceleration pays off debt three months earlier and saves $3,000.

It won’t rock your world, but a small change—or even one or two early pre-payments—can compound over time.

Does Mortgage Accelerate Work?

When you deposit your paycheck into your HELOC, you offset your debt. You use money that might pay the electric bill in two weeks now rather than in two weeks. Money has another purpose: you use it to pay down your debt while lowering the overall interest paid.

You trade an amortizing debt with a simple compounding debt. Your previously incompetent paycheck pays off your debt before you pay off your other debt.

Instead of earning zero on your paycheck, you offset the simple interest in your HELOC.