Get the Last Doubling – The Portfolio Size Effect

The portfolio size effect leads to a tough decision: a tradeoff.

All investment decisions are tradeoffs.

You want to get what you can from the market before you retire while not risking too much just at the end of the race. Yet, you have the most to lose because your portfolio is as large as it will get.

You want the last doubling but beware of the portfolio size effect.

The Lasts Doubling vs. the Portfolio Size Effect

Let’s start with risk just before retirement.

As all decisions are tradeoffs, you must decide whether it is the right time to de-risk your retirement portfolio.

Why de-risk? It is because of the portfolio size effect.

When you are most at risk, you also have the most significant chance to participate in market growth (because your portfolio is the largest). This tradeoff is the last doubling vs. the portfolio size effect.

Portfolio Size Effect

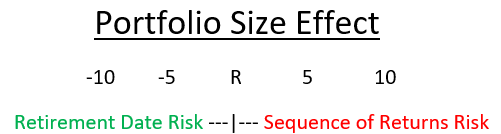

The Portfolio Size Effect has two periods: one before retirement and one after.

Above, in the years before retirement, there is retirement date risk. If the market crashes and you haven’t gone conservative with your portfolio, there is a risk you could suffer massive market losses and not be able to retire the day you desire to do so. This is a risk because many people don’t control the day they retire. Perhaps half of folks older than 50 are prematurely forced to retire. Physicians are less at risk than the general population of forced retirement, but if it were going to happen, it would happen during a recession and a market crash.

Retirement date risk is when the market is down, clinics and hospitals are firing people, housing prices crash, and banks stop lending. But, as they say, “volatility clusters,” and so does lousy news during terrible sins.

If you have retirement date risk, a market crash forces you to work longer, which you may not be able to.

After you pull the trigger and retire, you have sequence of returns risk. I have discussed sequence of returns risk in previous pieces, so I’m not going to go further on the topic now.

Regardless, the period of maximal portfolio size effect is also when your last doubling occurs. So you need your last doubling!

The Last Doubling

Compound growth means that time is your friend. You expect your investments to double for you every 5-15 years.

Say, for instance, you have a 7.2% yearly return. Given the rule of 72, your money will double every ten years. If you have 1M, you will have 2M, then 4M, then 8M. That last doubling gives you four times more than your first doubling! That is the power of compound growth.

The rule of 72 describes the effect of compound growth. How does it work? Take your yearly interest rate and divide it by 72, telling you which years it takes for your money to double.

Or, divide the number of years by 72, and you know what IRR you need to double your money. [Note, the IRR or internal rate of return is also known as the geometric average. This is a more accurate representation of the hurdle rate than you need, rather than the arithmetic average. For example, if you gain 50% and then lose 50%, your arithmetic mean is zero (50-50/2=0), whereas your actual return is the geometric mean, a loss of 25% (100*0.5*1.5=75, which is a -25% return). Ignore this part if you want to, but you need to understand it at some point.]

The point is that you may need that last doubling to provide a quality of life worthy of your goals in retirement. But this is right at the maximal time of the portfolio size effect!

Time in the market is more important than timing the market, yet the risk is vast in “the retirement RedZone.” This, of course, is a trademarked phrase used to simulate the difficulty of scoring a touchdown in football when you are close to the endzone. But, of course, the closer you are to the endgame, the more difficult it becomes. Because then you have the most to lose!

The Portfolio Size Effect and the Last Doubling

Right before you retire, you have the most to lose!

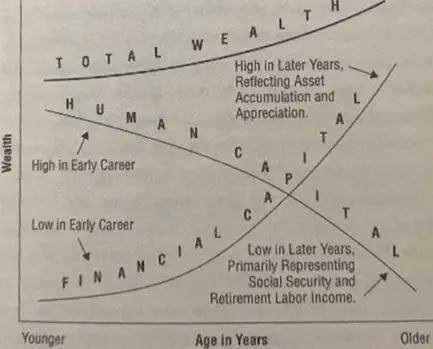

Think about it… early on in your investing career, you have only a small amount of money at risk and a considerable amount of human capital.

Above, your total wealth is measured along the top and increases slowly with time. Total wealth is the addition of financial capital and human capital. Your human capital starts very high and is most of your wealth early in your career. Then your financial capital starts to take off and eventually becomes your total wealth—compound growth at work.

The implications here are huge, as you can take many risks when you are young but not many risks when you have little human capital left. You no longer have time to make it up as your human capital fades.

This brings us back to the idea of the fallacy of time diversification. Most think that stocks are safer the longer that you own them. This is true if you look at your average return over time. But that’s not true if you look at the geometric return.

Think about it: if the year before you need a pile of money is the year it gets cut in half, then the actual return you get in your pocket is half what it otherwise might have been. When you get close to needing it, the risk of a market crash to your nest egg is enormous.

That’s why you de-risk: to mitigate the portfolio size effect.

Risk of Not Meeting Your Goals is Highest the day Before you De-Risk

The tradeoff of the last doubling vs. the portfolio size effect is about the risk of not meeting your goals vs. the highest risk the day before you de-risk.

This may seem obvious, but let’s discover that risk differs on each side of the equation.

Risk of not meeting your goals means the risk of leaving life unlived. If you can get that last doubling, you will have a much larger nest egg to participate in your experiences and life during your retirement. Again, you might have 4x more if you participate in equity growth for a few more years.

Retirement is not the end of the world if you are constrained in retirement. But it is nice to have the ability to fly first class (so that your kids don’t after you pass!). Unfortunately, many folks need that last doubling, which leads to increased risk in the last few years before retirement as they reach for yield.

Because the risk to your portfolio is most significant the day before you de-risk, yes, the risk of a market crash is always higher tomorrow than today, but if you de-risk today, that changes everything.

Summary: The Portfolio Size Effect

In summary, the risk is highest the day before you de-risk. The reason is the portfolio size effect, which means that you will have to keep working (if you can) or suffer sequence of returns risk.

But the real risk is not meeting your goals in retirement.

The basic idea: Get the Last Doubling, but don’t be thrown out at home plate.

As your human capital decreases, it is time to take some chips off the table. When it comes to the last doubling vs. the portfolio size effect, understand when enough is enough.