If You Have Won the Game Quite Playing with Money You Really Need

A smart doctor once said, “when you’ve won the game quit playing.”

I convinced him to add “with the money you need,” but that is a long story. And probably apocryphal.

We will get to that, but let’s talk about how to actually quit playing with the money you need in retirement. What is your personal glildepath? That is, how do you shepherd the money you need from accumulation to income? How do you quit playing the game?

Quit Playing the Game

Fundamentally, retirement planning is about turning assets into income.

If those assets are only “risk” assets, the market might be down when you need the money and force you to sell low. Now, while volatility (market risk) is fine when you are young, at some point, take some chips off the table. At least enough to pay the bills for a couple of years. This is called de-risking. If you know what is “enough,” you do it when your time horizon shrinks. Another way to think about this is when you don’t want to rely on your human capital to pay the bills, be sure to have other assets there to provide for you. And the other important lesson: never sell low.

What does a personalized glidepath look like for you? One that takes your assets from accumulation through pre-retirement and into retirement.

How do you quit playing the game?

With the Money You Need

Since we know that market volatility transfers money from the impatient to the patient and provides the equity risk premium, it is a feature rather than a bug.

You will always own equities. How much depends on the return you need to reach your investing goals.

Once you have reached your investment goals, you still need equities, but at some point, the decision becomes: how well do I sleep at night vs. how rich do I want the kids to be?

Since you have oversaved for retirement, you can take on as much risk (in the form of market volatility) as you want.

But for sure, put some money into safer assets.

After all, why would you play with the money you need?

”Safer Assets” depends on what type of investor you are.

What Type of Investor Are You?

So, what type of investor are you? Are you interested in total returns, a bucket plan, or safety first?

Total Return (Bogleheads, for example)

Suppose you are comfortable with a total return approach. You understand that stock market volatility at the wrong time (sequence of returns risk) is your most significant risk and needs mitigating (usually by having some “safer money.”) Of course, some folks might have other ways to mitigate sequence of returns risk (buffer assets), but the primary way people who believe in total returns do so is with bonds, bond-alternatives, and cash.

So, if you are a total return investor (as a good Boglehead investor), you have some safer assets so you don’t have to sell low to meet your income needs.

Bucket Plan (Christine Benz, for example)

Some like a bucket plan approach if they want to time segment their assets depending on when they need them. This, essentially, is asset liability matching, at least from a big-picture perspective.

Actually it is deciding how much cash and safer money you need.

That is, matching your assets with future liabilities (I will need X amount for the next three years, Y amount for years 3-10, etc.). In effect, this just collapses down into an overall asset allocation, but mental accounting is promoted by Christine Benz as a practical behavioral finance intervention for some.

Safety First (Wade Pfau, for example)

Others (often called “safety-first”) prefer insurance contracts and risk pooling to turn assets into a guaranteed lifelong income stream.

Wafe Pfau calls this concept safety first, though he admits this is not the best moniker. What they actually want is a fountain of youth. Those who are safety first give up the largest legacy to have mailbox money and they understand guaranteed income sources make you live longer, spend more money, and have a happier retirement.

So, happier retirement or more legacy?

Sounds like a false dichotomy to me. You can have both!

So what should your asset allocation be when you’ve won the game?

Asset Allocation 5 Years from Retirement

When you’ve won the game, about five years before retirement, you need to consider de-risking. Take some risk off the table because stocks are riskier the longer you own them.

While there are many ways to skin the retirement cat, five years from retirement, you take your asset allocation from accumulation to retirement allocation over five years.

Take less risk with the money you will need soon.

How Much do I Need?

To know how much money you will need soon, you need to know how much you will need to retire.

If you have oversaved, it is pretty simple to back into the amount of money you need to retire. How much do you plan to spend a year times 25.

Above and beyond that, what do you plan on doing with that money? That’s the money you are taking off the table.

Withdrawal Rate

Beyond that, it is helpful to consider how much money you need every year as a withdrawal rate. Since you have more than you need, this withdrawal rate will be well below 3.5% a year. This gives you a little room for error, or wiggle room, but that is why you oversaved in the first place.

How Do You Figure Out How Much Safer Money You Need?

How do you figure out how much you need in safer money rather than the total amount you “need.”

Calculating a withdrawal rate is pretty easy: take your yearly desired before-tax income, and subtract out sources of income such as social security, annuities, and other incomes like rentals. The amount leftover is funded from portfolio withdrawals.

The trick is doing this with before-tax money, but no one bothers doing it because it is too hard. After all, that’s why you oversaved, right?

Next, how many years do you need to support those withdrawals?

How Many Years?

This question is critical. How many years of safer money do you need to avoid the bulk of sequence of returns risk? How many years’ worth of withdrawals should you have in non-equity investments? This is money that you can tap if the market misbehaves.

To address the question “how much safer money do I need,” you need to understand two ideas: 1) how bad will sequence of returns risk be this year if it happens, and 2) how long do downturns last?

How Bad is Sequence Risk the Year I Retire?

No one knows how bad sequence risk will be the year you retire.

You need 5-10 years of safer money both before and after retirement. This is the time of maximal risk for a poor sequence of stock market returns.

One of the ways we mitigate sequence of returns risk is with a more conservative portfolio. If the stock market crashes, we expect our bonds to dampen the volatility and perhaps even increase value due to flight-to-safety. You have never to sell your equities when they are down and give them time to recover.

Even if sequence risk happens, how long might it last?

How Long Does a Downturn Last?

As it turns out, the length of a downturn depends on your asset allocation!

If you are 100% equities, you can have a “lost decade” like the 2000s, where equity returns are negative. However, a more balanced portfolio should have a shorter period of rebound.

More likely, at least with historical rolling returns, with a 50/50 asset allocation, you might be down 6.8% at three years and 2.1% at five years.

If you have to avoid a negative five-year period (for whatever reason), then (historically at least) you should be 30/70.

The point here isn’t to die by decimal places; it is to understand the length and depth of your portfolio’s decline are tied to the asset allocation.

At least as determined by how long your portfolio might be down during a bad sequence, risk is defined by your asset allocation.

Now that we know how many years of safer money you want, let’s calculate your asset allocation.

How Much “Safer Money” Do You Need?

Let’s just cut to the chase. You need 5-10 years of safer money, or even more if you want. Remember, after all, that the upside is that the kids get rich.

You lose some sleep in years 3 or 4 (or more!) of depression and stock market crash. This can be heart-wrenching; it may feel like the world is ending, but remember, you still have plenty of money to retire.

To figure out how much safer money you need, multiply your withdrawal rate times how many years you want to be safe for.

Actual Asset Allocation of Safer Money

Ok, so let’s get into some nuts and bolts of safer money.

Say you want ten years of “safer money.” If we want ten years x 2% = 20% of the money in safer assets, then our goal asset allocation depends on portfolio size. If you have oversaved, your asset allocation is 80/20 or 90/10.

Remember, 80/20 sounds risky (compared to a “traditional” retirement portfolio), but you have ten years of safer money. And this doesn’t even include the dividends. Of course, you spend dividends rather then invest them. You pay 15% tax to have them, but it keeps up the cash reserves.

Why 80/20 is the New 60/40

Think about the “traditional” 60/40 portfolio for a “traditional” retiree. Assume a 4% withdrawal rate and ten years of safer money, which is 4 x 10 = 40%. So the traditional 60/40 has ten years of safer money, just like your 80/20 has because of a lower withdrawal rate.

How Long do you Keep your “Safer Money” Once Retired

How long to keep safer money after sequence risk has passed is a sexy question responsible for bond tents and rising equity gluidepaths. The actual answer depends, obviously, on how much risk you want to take.

What is the major risk in a retirement portfolio after investment risk has passed? It depends on how you define risk. If you are worried about usual risks in the late slow-go to now-go, it is not running out of money.

How much money you keep in bonds after sequence risk passes depends on who you have around you and your goals.

When You’ve Won the Game Quite Playing with Money You Need

Sequence of returns risk increases slowly before retirement, so it is time to take money off the table when you have money to take off the table.

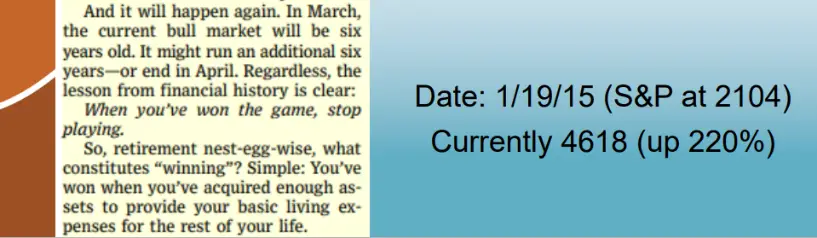

Mathematically it is optimal to stay fully invested until the day before a stock market crash. Since you cannot time the market, stop taking risk with the money you need.

Seems like a contradiction which is how you know it is true. You need to be just conservative enough to tolerate a market crash tomorrow. Since eventually tomorrow will come, now is the time to take risk.

That means quit playing with the money you need.

I met both Bill Bernstein and Paul Merriman at the White Coat Investor Conference.

Paul Merriman says, “there is no risk in the past.” You can only plan for today. Now is the time to understand actual risk. It is only for now that you can plan. Set your asset allocation for the bad times, not excellent ones. But programmatically change your asset allocation afterward via a personalized glidepath.

You have more control over the bad times than you think. That is the benefit of oversaving.

Finnalle—Bill Bernstein

This is a safe space to talk about first-world problems like oversaving for retirement.

If you have oversaved, all you need to know is this quote by William Bernstein, MD:

When you have won the game, stop taking risk with the money you need.

His original quote did not include “with the money you need.” The story I’m telling myself is that I talked him into adding it after I sent him an email talking about the purpose of money.

If part of your money is not for you or your retirement (because you oversaved—what will you do with the money when you are done with it?), you may be investing with a longer time horizon than just your retirement. Maybe for your kids or charity. Different goals, different asset allocations! But one retirement.

I say: how well do you want to sleep at night vs. how rich do you want your kids to be?

Bill says figure out what you need, and then you can win the game by taking risk off the table.

Same thing.