In a New Era of Bonds

Do I need Bonds in my portfolio?

Bonds were a big loser during 2022 and ZIRP (zero interest rate period). We are in a new bond era with a non-zero interest rate, so I thought it was time to ask whether I need bonds in my portfolio.

Bonds, not Cash

Here we are in Q4 of 2024, and money market accounts and CDs pay about 4%. They paid almost zero for the last decade or more, so cash is back, baby!

I suggest you buy bonds, not cash. Let’s talk about it.

Why Bonds are Better than Cash in a Retirement Portfolio

Of course, you need cash in retirement. I suggest you have 1-3 years’ worth of expenses in cash. Spend this pot down and refill it once a year with another year’s expenses.

But the rest of your “safer money” should be in bonds, not cash. Bonds are better than cash over the long run because they pay higher interest rates than cash.

When rates drop, the price of your bonds goes up. What happens to money market accounts? The interest they pay you goes down along with the interest rate!

Why Are People in So Much Cash Right Now?

So, why are people invested in cash right now? Bonds hurt us in 2022! Remember, that was when interest rates were taken from zero to 5% in the shortest period in history. Inflation has (mostly) been reined in (though, of course, it can come back as inflation is as difficult as interest rates to predict).

Nothing but recency bias makes people think that cash is safe and bonds are not. Recently, that has been the case. Historically, the opposite is true. Which do you believe, the recent past or all of the past?

Is it something more than recency bias? Why do investors want cash right now rather than bonds?

Now that we are in a New Era of Bonds let’s see if I need bonds in my portfolio.

Do I Need Bonds in My Portfolio?

So, do I need bonds in my portfolio?

What a great question to ask! Of course, the Financial Independence Retire Early crowd says, “VTSAX and forget it,” but is that right for everyone?

Probably not. Everyone needs bonds, at least initially. Let me tell you why.

Recency Bias

We have been hurt by bonds recently, and they didn’t live up to their “safe” reputation. That happens now and again, and funds are flowing away from bonds, hopefully into cash, since cash is paying something again. And to me, the ten-year T bill looks pointless: if interest rates rise, you should have gone short-term, and if they fall, you should have been in a bond fund.

But don’t forget that bonds protect you from a large loss in your portfolio’s value. As long as you are a common-sense investor, you might be down 15-20%, not the 30-40% decrease we might need to see before bonds show their true value in a diversified portfolio.

The essential part of investing (aside from just doing it) is not to sell low. When the market tanks and you panic, you lose the game of investing.

The Game of Investing

Who me? I won’t panic.

Remember, investing is a game of one. It is you against you. But, if history is a guide, you win if you don’t sell out at the worst time.

Investing is not a zero-sum game; everyone can win if you play by the rules. When investing, you participate in the growth of the economy in general. More people, more products, more consumption, and that growth is why stocks increase over time.

Paper losses aren’t real; panic selling locks in the loss.

Don’t Sell Low

So, how can you not sell low?

One way: lose the password to your investment account. Seriously. If you have a 401k, set it up how you want it. Then, lose your password. Don’t check it for another 1-2 years. There is nothing you want to do in there anyway.

Or cancel the cable. Remember, TV’s job is to sell eyeballs advertising, and literally, there is nothing meaningful you might learn about investing or the stock market on TV.

Or stop talking to other people about hot stock tips. For example, change the subject if a friend mentions Bitcoin, blockchain (or Blockbuster). Your friend is going to lose money.

You are going to lose your password.

Why Invest in Bonds?

Bonds are volatility dampeners. That’s it; that’s the secret. They reduce the downside of investing. They are not for providing income. Later, in de-accumulation, they can provide cash when the market is down, but for accumulation, you have bonds because they dampen volatility.

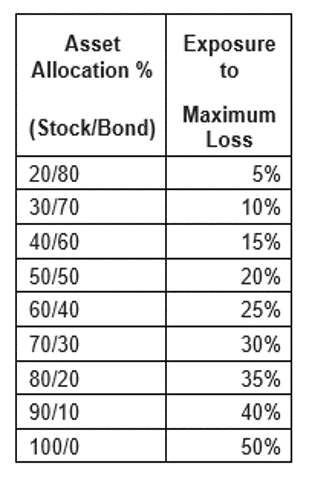

Figure 1 (Asset Allocation and Maximal Loss)

Figure 1 above shows how asset allocation (bond percentage) affects maximum loss. If you are in 100% stocks, you can lose 50%. If you are in a 60/40 portfolio, you lose much less than 25%.

Next, let’s discuss which bonds you should have in your portfolio.

Which Bonds Should I Have in My Portfolio?

Total bond indexes are often suggested as a part of the three-fund portfolio. Use a total bond index if you want some increased return during the good years, but if you’re going to have proper downside protection, US treasuries are the way to go.

There is a flight to safety (mostly) when the stock market tanks, so US treasuries are the place to be if you genuinely want to dampen volatility. In addition, you can use long-duration bonds for the most (theoretically) negative correlation.

However, the main competitor with a total bond index is in an intermediate-duration treasury ETF. So, let’s look closely at the two best kinds of bonds.

Basics of Bond Funds

Individual Bonds vs. Bond Funds

Most folks don’t want to bother with individual bonds. You can go to Treasury Direct or buy bonds from many custodians. But honestly, why bother? Instead, you should use bond ETFs or bond mutual funds.

Bond ETFs vs. Bond Mutual Funds

It doesn’t matter if you use Bond ETFs or Bond Mutual funds. Before 2020, there was a concern that Bond ETFs might have problems if there was a large amount of selling pressure, but they came through relatively well. So you can use either bond ETFs or Mutual Funds, depending on cost.

Bonds: Active vs. Passive

Active management may play a role in bonds. Pay attention to costs, however! Since returns are muted with all bonds, costs are even a more significant consideration than usual. Also, active management may lead to more tax considerations, making ETFs and tax-deferred accounts a consideration if you want active funds.

What is the Best Kind of Bond to Own: Easy Version

Let’s start with the easy version. What is the best kind of bond to own if you need bonds in your portfolio:

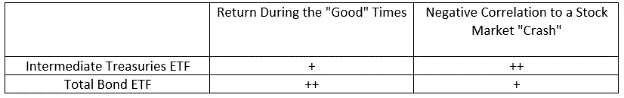

Above, you can compare the two primary considerations for the kind of bonds to own and what makes them better than the other.

First off, we have intermediate treasuries (which can be an ETF or mutual fund). Next, you have total bond funds (ETFs or mutual funds).

You expect slightly higher returns during the “good” times between market crashes with a total bond fund. In addition to about 30% intermediate treasuries, they have corporate and other governmental bonds. You, of course, need to do a deep dive into the total bond fund you are exploring, but the whole point is to own a more representative sample of total US bonds with the total bond fund.

On the other hand, Intermediate treasuries are US treasuries with a duration of around 6-7 years. These are considered as high quality as bonds get. Even though they may not pay as much during the good years because of “flight to safety,” they retain their value well during a market crash.

The two best bond funds are intermediate treasuries and total bond funds.

What is the Best Kind of Bond to Buy? Complete Version

Next, let’s get complicated.

As I mentioned, there are a lot of different kinds of bonds.

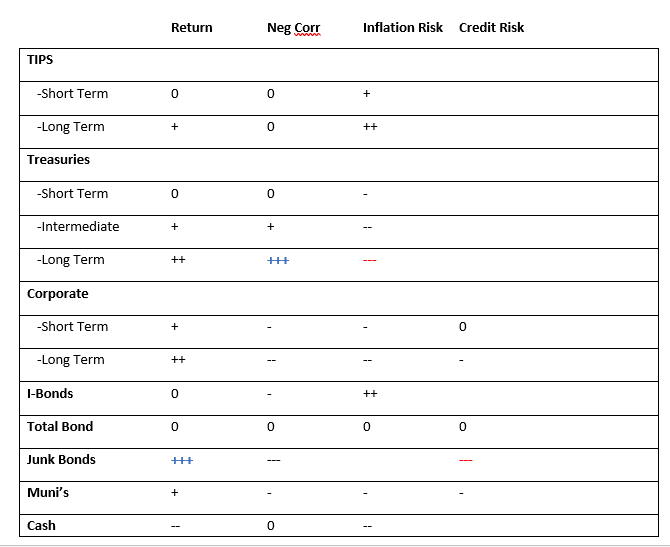

Above, you can see the different kinds of bonds on the left; some even have duration. See my blog for a discussion on TIPS (especially TIPS Duration).

Let’s look at returns first. Above, under Return, you can see Junk Bonds have the highest yield of the bonds listed. Cash has the lowest yield. In general, the shorter the duration, the less the return. Corporate bonds pay better than treasuries primarily due to credit risk.

But say you are interested in a negative correlation with the stock market. What will keep its price the best (or even increase) when the stock market crashes? Under “Neg Corr” above, you can see the most negatively correlated with stock market crashes. Again, long-term treasuries are the best here, and Junk Bonds are highly positively correlated with stock crashes. As you can see, most of the other bonds don’t have as consistent correlations, but you can see trends reflected above.

Next, we can see what might be expected to do well with increasing inflation. I-Bonds were sexy, but now people are trying to figure out what to do with the ones they bought in the last two years.

The final category is credit risk. Products from the US government are considered to have no credit risk as the full faith of the US government backs them.

So, how do intermediate treasuries and total bond funds do in the above comparison? First, total bond funds aren’t too great (or bad!) in any of the above categories. The idea is that they are pretty good for most. On the other hand, Intermediate treasuries might return a little less but keep their value a bit better during a correction.

What is the best bond fund if I decide I need bonds?

So, in summary, for most, a total bond fund or an intermediate treasury fund is all you need. Of course, you can choose from many other bonds (or, more accurately, fixed-income products), but start simple!

Next, consider your asset allocation and decide on asset location. Bonds go into your tax-deferred account. It is okay to use a target-date fund, but remember, it is not good in retirement!

Many should consider bond alternatives. But, again, the idea is not to replace all your bonds, but once you understand why you have bonds, you might be able to (at least in some circumstances) do better with other options.

Summary: Do I need Bonds in my Portfolio?

Bonds are not sexy, but something must be said about the stabilizing effect on your portfolio, at least in the long term. Last year, there was insufficient evidence of why you need bonds in your portfolio. But remember, history rhymes. Knowing your asset allocation- essentially your stock-to-bond ratio- is the first decision to make when investing right after you decide to start investing.

Bonds hedge against making panic decisions.

If you are new to investing and have never experienced a significant market drop, have bonds in your portfolio.

If your response to a market crash is to buy stocks when they are on sale, maybe that is the time to sell your bonds and go all-in on stocks. You will be buying low!

Remember, in the beginning, savings rate is all that matters. Returns on your investment don’t matter until later. So, to learn how to use bonds when you are young, you will need to use them later! And, of course, why take downside risk until you can tolerate it?

Bonds are complicated. Duration and convexity, default and interest rate risk, coupon, etc. Who cares about that stuff? As long as you understand, do I need bonds in my portfolio?