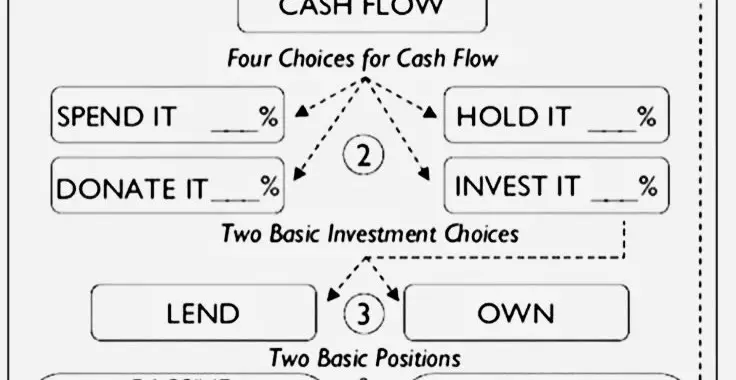

The Path of Human Vs Financial Capital

Your total wealth increases over time as you work for money and your money works for you.

Source: Some book I read. Please email me if you know.

Financial capital is low during the early stages of your career, while you possess nearly unlimited human capital. Total wealth is the sum of these two factors and only increases as your capital assets begin to work for you.

Source @growthhub_

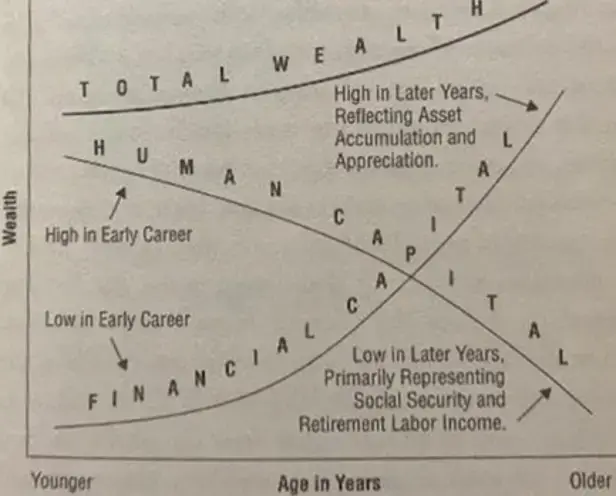

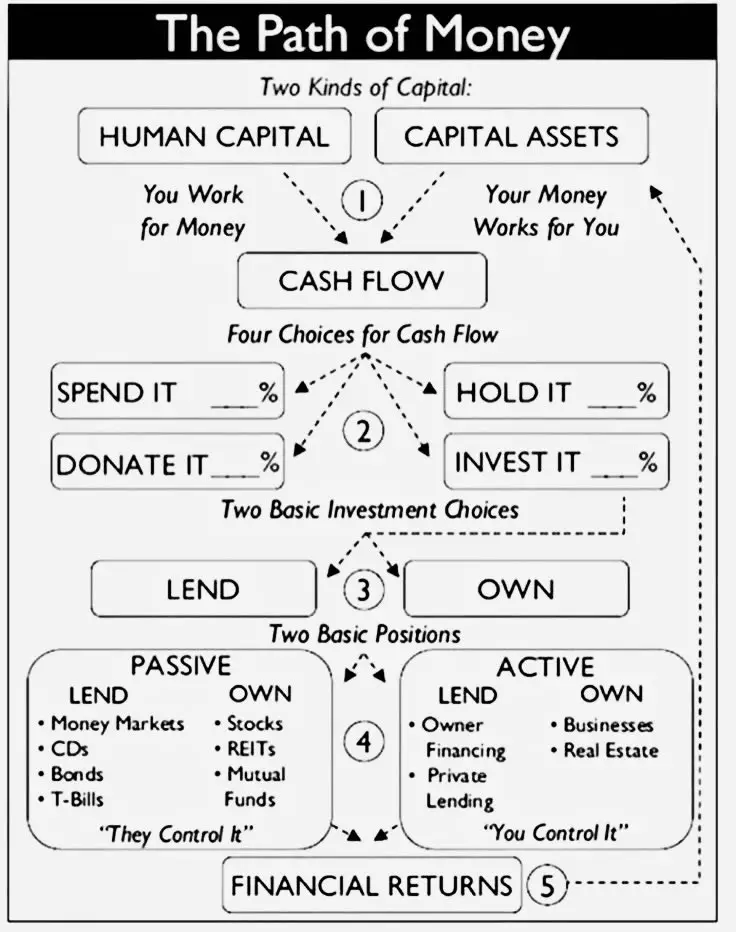

The Path of Money

While I love the picture I took while reading a book, the above is everything you need to know about the path of money. Start with your sources of capital, and you get Cash Flow.

You can only do four things with money: spend it, keep it in cash, donate it, or invest it. What percentage do you allocate to each? These are expenses, emergency fund, tithing, and savings rate.

Above, “invest it” is your savings rate. To reach Financial Independence, you need to know your net worth, savings rate, and asset allocation. That’s it.

Next, do you lend or own when you invest? And is it passive or active?

Lend Passive

This is HYSA, US Treasuries, and other bond alternatives.

Lend Active

Equities. Stocks for the long run.

Own Passive

Private lending; something most should avoid.

Own Active

Business and Real Estate. This is where you can grow your wealth.

The Path of Money

When you save money, those savings turn into productive assets that generate financial returns. These financial returns become your capital assets—the money that works for you. Over time, your financial assets can provide more income than your human capital, leading you to financial independence.

The path of money is one graph to rule them all.